USD/JPY ANALYSIS Early this morning, the Japanese Yen (JPY) appreciated considerably in opposition to the US Greenback as stimulu

USD/JPY ANALYSIS

Early this morning, the Japanese Yen (JPY) appreciated considerably in opposition to the US Greenback as stimulus hopes pale as soon as extra. The essential aid bundle that has been the middle of worldwide markets of current has diminished its pre-election potential on November 3. This comes after delayed negotiations over stimulus specifics.

The consequence has been a worldwide risk-off temper as mirrored within the shift in direction of the standard safe-haven currencies (JPY and CHF). Upcoming elections will doubtless favour the Yen as volatility is predicted to extend together with the rise in COVID-19 instances in Europe and the US. This being stated, the uncertainty current across the aforementioned elements might restrict Yen energy.

Go to the DailyFX Instructional Heart to find why information occasions are Key to Foreign exchange Elementary Evaluation

USD/JPY TECHNICAL ANALYSIS

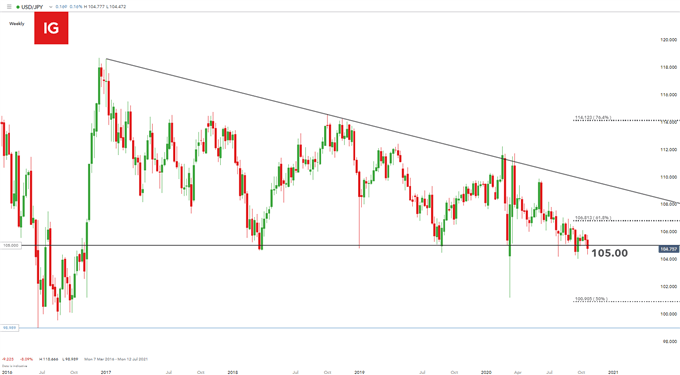

USD/JPY weekly chart:

Chart ready by Warren Venketas, IG

The multi-year descending triangle (black) above reveals value motion testing decrease help on the 105.00 psychological degree. With basic tailwinds behind the Yen, additional draw back for the pair might happen over the subsequent few weeks which is able to help the bearish continuation principle of the descending triangle sample.

Begins in:

Stay now:

Oct 26

( 11:10 GMT )

Hold updated with value motion setups!

FX Week Forward: Technique for Main Occasion Threat

USD/JPY every day chart:

Chart ready by Warren Venketas, IG

The every day chart suggests USD/JPY approaching oversold territory (represented by the Relative Energy Index (RSI)) which might present brief time period aid for bulls with 105.00 the near-term resistance goal.

The 104.00 September swing low might doubtless see the subsequent space of help for bears and consequently the 100.90 50% Fibonacci degree ought to 104.00 not maintain.

IMMINENT JAPANESE INFLATION FIGURES COULD INCITE BOJ INVOLVEMENT

The Financial institution of Japan (BOJ) has said that they’re maintaining a detailed eye on the strengthening Yen and its potential impression on inflation. Financial institution of Japan Deputy Governor Masazumi Wakatabe has not taken additional price cuts off the desk. The reasoning from the central financial institution is solely cost-benefit evaluation whereby the advantages of additional easing (if required) exceeds the associated fee.

Later at the moment, the Japanese inflation price for September (YoY) will likely be launched at 23:30GMT. Inflation expectations by analysts are sustained strain which might immediate BOJ intervention and measures relating to the appreciating Yen.

DailyFX Financial Calendar:

Beneficial by Warren Venketas

Buying and selling Foreign exchange Information: The Technique

USD/JPY: KEY POINTS TO CONSIDER MOVING FORWARD

The USD/JPY is basically on the mercy of worldwide elements – primarily impending US elections. Readability on the election ought to present market members with some directional bias going ahead. The coronavirus continues to be a driving power behind Yen energy and can proceed to take action till such time as a vaccine silver lining presents itself.

Key factors to contemplate:

- 105.00 and 104.00 key horizontal ranges

- Descending wedge sample

- Anticipated rise in volatility

— Written by Warren Venketas for DailyFX.com

Contact and observe Warren on Twitter: @WVenketas