Because the onset of the COVID-19 pandemic, most within the monetary group puzzled if lagging inflation was quickly to grow to be a factor of the

Because the onset of the COVID-19 pandemic, most within the monetary group puzzled if lagging inflation was quickly to grow to be a factor of the previous. Unprecedented capital injections from the U.S. FED and authorities shortly swelled the availability of Bucks ― was this the catalyst for USD devaluation? At this level, indicators are starting to level to sure. As we speak’s Producer Value Index (PPI) report means that the costs of commodities are on the rise.

Right here’s a fast have a look at this morning’s PPI figures:

Occasion Precise Projected Earlier

Producer Value Index (MoM, July) 0.6% 0.3% -0.2%

Producer Value Index (YoY, July) -0.4% -0.7% -0.8%

Core PPI (MoM, July) 0.5% 0.1% -0.3%

The spotlight of this group are the Core PPI numbers from July. Costs of products unique of meals and power moved greater by almost 1% month over month. Whereas not an amazing market mover, it seems to be like inflation is poised to develop within the coming months.

PPI Up, USD Down

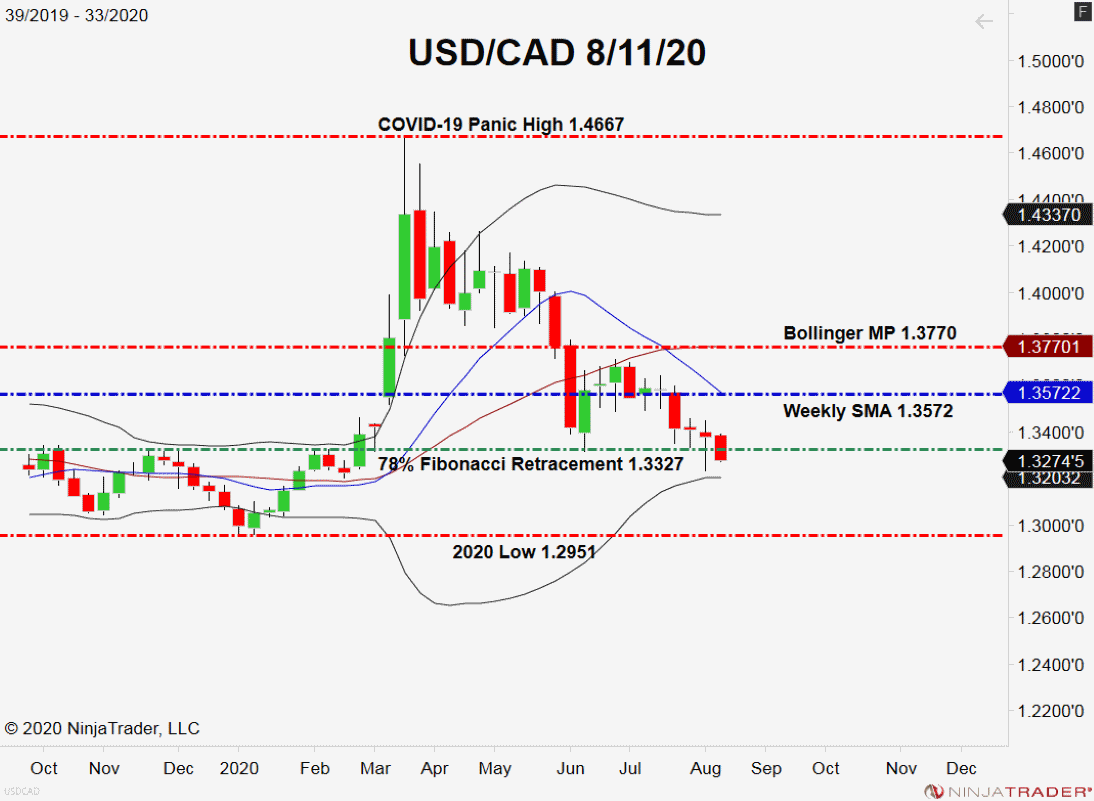

As has been the theme all yr lengthy, the USD is struggling to take care of market share. Charges are down throughout the majors, with the USD/CAD difficult a key Fibonacci help degree.

+2020_33+(10_40_09+AM).png)

For the rest of the week, there are two ranges on my radar for the USD/CAD:

- Resistance(1): 78% Fibonacci Retracement, 1.3327

- Assist(1): 2020 Low, 1.2951

Backside Line: As we transfer into mid-August, it seems to be just like the USD/CAD goes to make a run at yearly lows. Till elected, I’ll have purchase orders within the queue from 1.2956. With an preliminary cease at 1.2919, this commerce produces 35 pips on a sub-1:1 threat vs reward ratio.

On the financial information entrance, at the moment’s PPI figures are a preview of tomorrow’s CPI numbers. In the event you’re holding lively positions into the Wednesday session, be prepared for the CPI report at 8:30 AM EST.