We’re only some hours forward of the weekend break and U.S. shares are buying and selling combined. And, for as soon as, the NASDAQ is lagging eac

We’re only some hours forward of the weekend break and U.S. shares are buying and selling combined. And, for as soon as, the NASDAQ is lagging each the DOW and SPX. Going into the late-session, the DJIA (+215), S&P 500 (+15), and NASDAQ (+5) are all within the inexperienced. At the least in the intervening time, buyers are selecting conventional U.S. equities as an alternative of huge tech and growth-oriented firms.

For the previous a number of weeks, foreign exchange merchants have tried to price-in an upcoming inflationary cycle for the USD. Nevertheless, the dreaded inflation monster has but to slam American markets. At the moment’s financial studies have bolstered this truth:

Occasion Precise Projected Earlier

Producer Value Index (MoM, June) -0.2% 0.4% 0.4%

Producer Value Index (YoY, June) -0.8% -0.2% -0.8%

Core PPI (MoM, June) -0.3% 0.1% -0.1%

Many analysts, together with this one, have gone on document calling for inflation to hit the USD sooner reasonably than later. In line with right this moment’s PPI numbers, this assertion stays a projection; the FED’s two-plus 12 months struggle in opposition to lagging inflation continues to show acceptable.

Both approach, a majority of U.S. shares are liking the present surroundings. On the foreign exchange, merchants are favoring worldwide majors over the Dollar ― for now, the “inflation narrative” isn’t performed out.

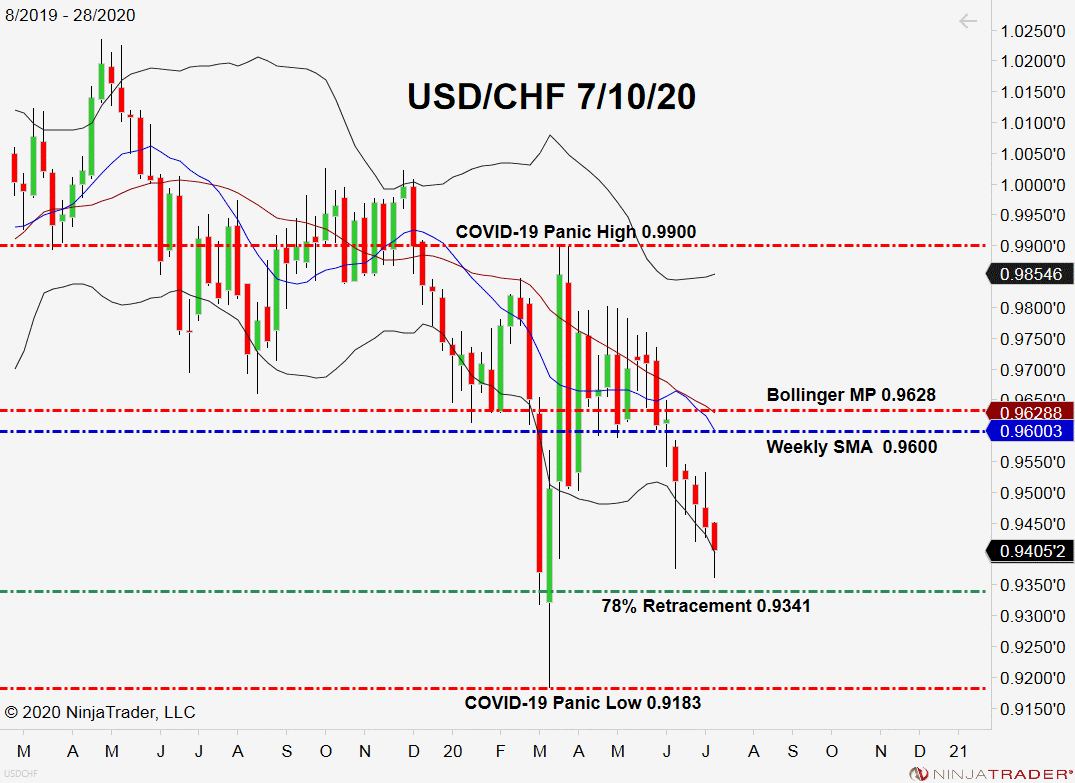

U.S. Massive-Cap Shares Rally, USD/CHF Stalls

As of this writing, the USD/CHF is in place to shut the week on a optimistic notice. Nevertheless, values have fallen beneath the 0.9500 deal with and are in bearish territory.

+2020_28+(10_48_04+AM).png)

Going into subsequent week’s commerce, there’s one stage on my radar for the Swissy:

- Assist(1): 78% Retracement, 0.9341

Overview: It’s been a modest shock that amid rising COVID-19 circumstances within the U.S. shares have put in a powerful week. Nonetheless, safe-havens have additionally drawn bids, as evidenced by the bearish USD/CHF. Barring any hawkish dialogue from the FED, one other crimson candle within the Swissy is prone to arrange by subsequent week at the moment.