The dollar is mildly weaker on the day after a light retreat to start the week yesterday. Yields tracked lower then but are moving back up now, though

The dollar is mildly weaker on the day after a light retreat to start the week yesterday. Yields tracked lower then but are moving back up now, though the greenback is not really budging all too much.

Equities were more mixed with tech the laggard again, though US futures are pointing to a slightly better tone for now. S&P 500 futures are up 0.4% and Nasdaq futures up 0.6%, while Dow futures are up 0.3%.

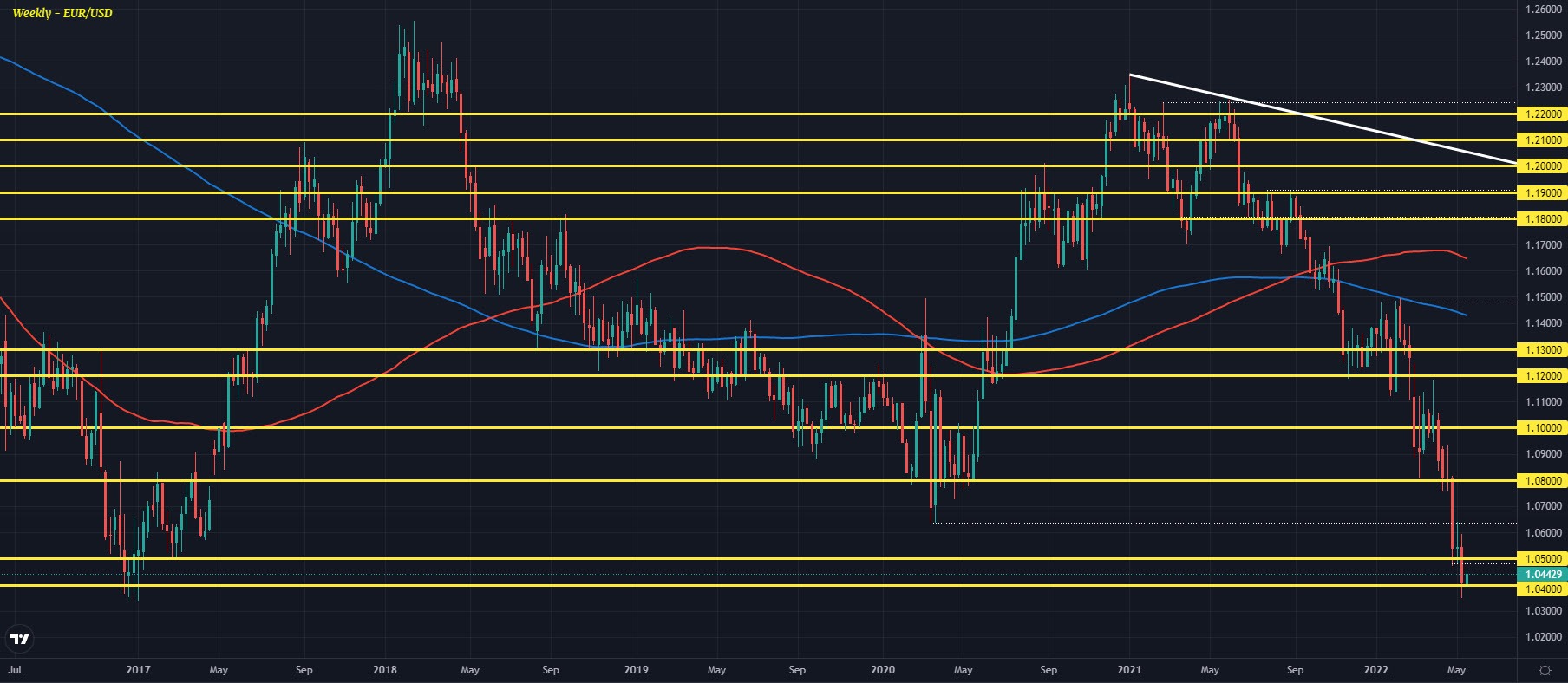

The technicals are still a key part of the story in my view and for now, EUR/USD is at least keeping a weekly break below the 1.0400 mark:

Meanwhile, AUD/USD is aiming to get back above 0.7000 with buyers also pushing past its 200-hour moving average @ 0.6989. The figure level will be a major pivot point for sentiment in trading this week.

Elsewhere, things are getting interesting for oil as price seeks a technical breakout from the wedge pattern I highlighted at the end of last week here. Price is knocking on the door of $114 to $115 region with the March highs around the region of $115.37 to $116.61 being the next key focus.

Looking ahead, the usual push and pull in the market flows will continue to dictate trading sentiment with the risk mood being a key driver in that sense. There won’t be much in Europe to distract from that before we get to US retail sales data and Fed chair Powell’s speech on inflation later in the day.

0600 GMT – UK April claimant count change

0600 GMT – UK March ILO unemployment rate, employment change

0600 GMT – UK March average weekly earnings

0900 GMT – Eurozone Q1 GDP second estimate

That’s all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.

www.forexlive.com