The US consumers have been keeping the US economy resilient during this rough period of the last four years, but elevated FED rates are dragging them

The US consumers have been keeping the US economy resilient during this rough period of the last four years, but elevated FED rates are dragging them down. Most consumer sentiment indicators, such as the UoM Consumer Sentiment on Friday which confirmed the softening trend, as well as Home Sales. have been showing weakness. However, some other indicators such as retail sales have shown stability.

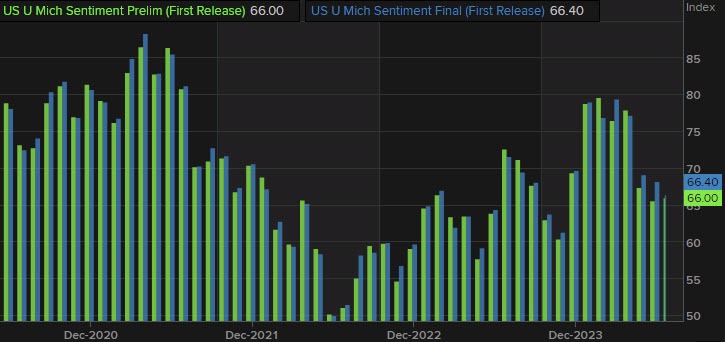

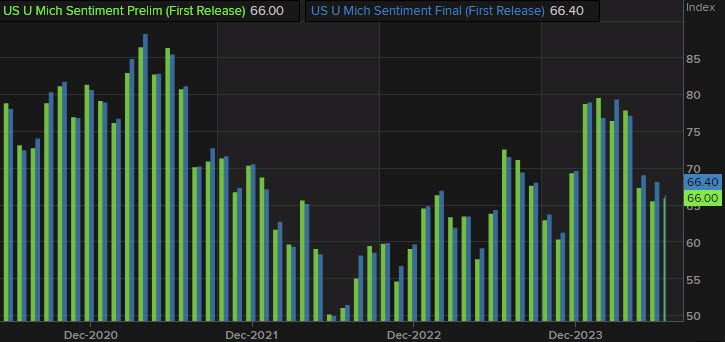

The detailed data for the University of Michigan Consumer Sentiment shows a negative picture: consumer sentiment came slightly better than in the first reading, primarily due to lower expectations, but compared to the previous month, both the Consumer Sentiment and the Current Conditions showed a decline in July, which further reinforcing the downward trend of the last several months. Inflation expectations remained stable, suggesting consistent consumer outlook on price trends.

University of Michigan Consumer Sentiment and Inflation Sentiment for July

- University of Michigan Consumer Sentiment for July 2024: 66.4 points vs. 66.0 points estimate (and prelim); prior 68.2 points

- Current Conditions: 62.7 points vs. 64.1 points prelim; prior 65.9 points

- Expectations: 68.8 points vs. 67.2 points prelim; prior 69.6 points

- 1-Year Inflation Expectations: 2.9% vs. 2.9% prelim; prior 3.0%

- 5-Year Inflation Expectations: 3.0% vs. 2.9% prelim; unchanged from prior

- Key Observations:

- Sentiment slightly higher than prelim

- Current conditions lower than prelim

- Expectations higher than prelim

The University of Michigan’s consumer sentiment for July 2024 was reported at 66.4 points, slightly above the estimated 66.0 and the preliminary figure. However, this is a decrease from the previous month’s 68.2 points. Current conditions were recorded at 62.7 points, which is lower than the preliminary 64.1 points and also lower than the 65.9 points reading seen last month.

Expectations came in at 68.8 points, which also is below June’s 69.6 points. Inflation expectations for the next year remained steady at 2.9%, matching the preliminary figure and slightly down from 3.0% in the previous month. The five-year inflation expectations were at 3.0%, unchanged from last month, though slightly above the preliminary estimate of 2.9%.

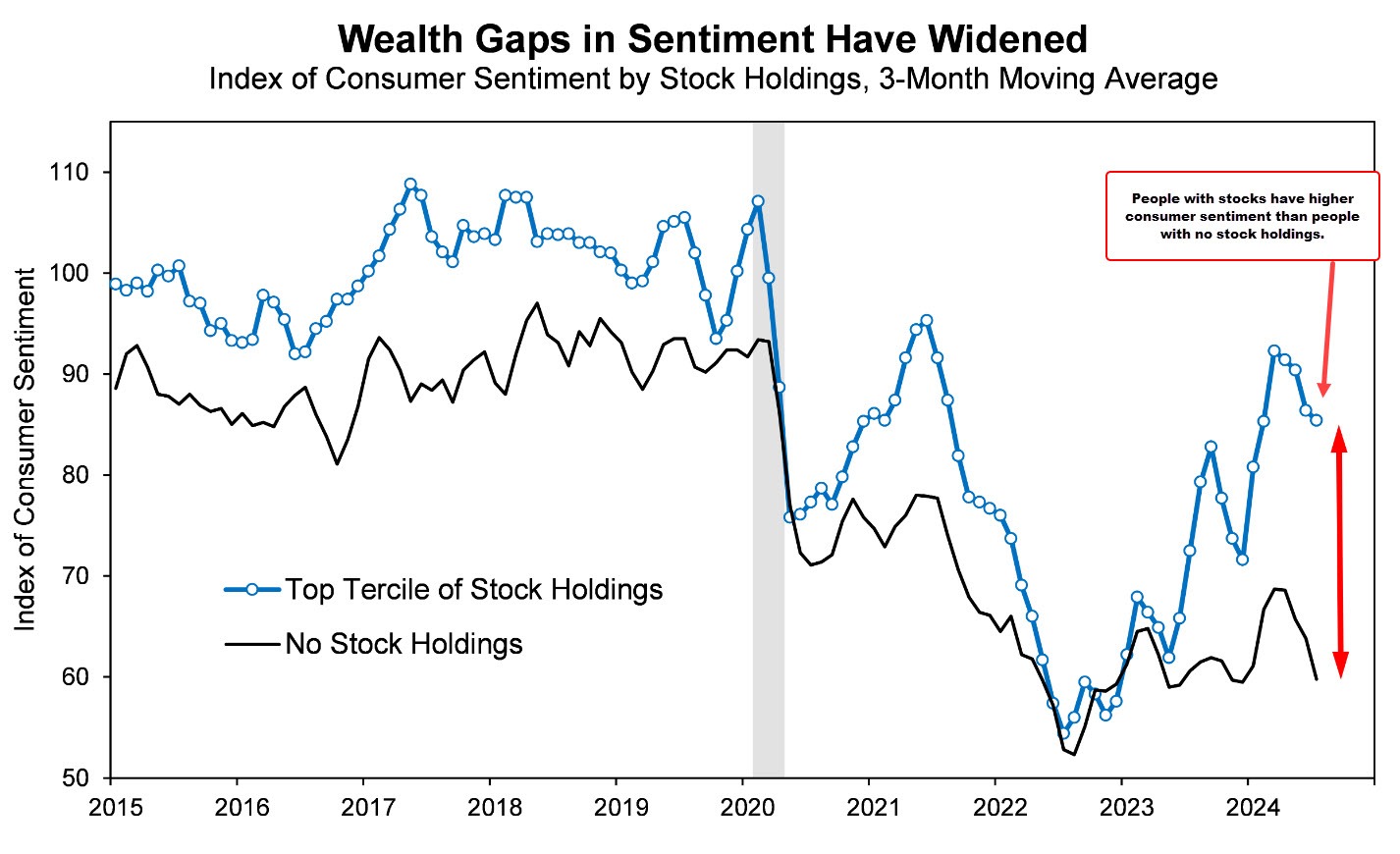

The survey’s consumer sentiment data reveals that individuals with equities in the top third showed higher confidence, while those without stock holdings had a notably more pessimistic view of consumer sentiment. This disparity aligns with the recent rise in US stock markets over the past year and a half.

www.fxleaders.com