Oil Value Forecast: WTI Crude Oil has continued to consolidate as bullish momentum seems to have stalled at a key space of resist

Oil Value Forecast:

WTI Crude Oil has continued to consolidate as bullish momentum seems to have stalled at a key space of resistance, marked by the 76.4% Fibonacci retracement degree of the 2020 main transfer. Though OPEC seems to be on monitor concerning pledged oil output provide, the delay in each the US Fiscal Stimulus package deal and the Covid-19 vaccine rollout proceed to hinder additional progress on the lengthy aspect.

Go to the DailyFX Instructional Middle to find why information occasions are Key to Foreign exchange Elementary Evaluation

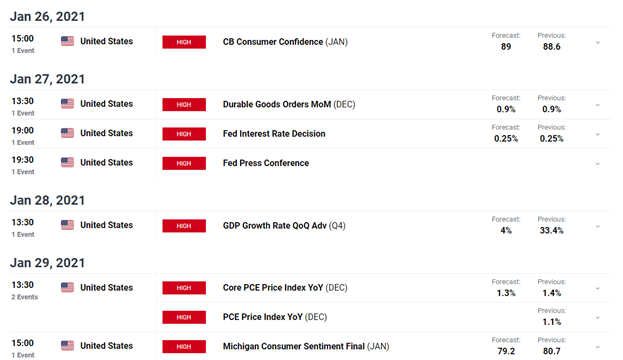

In the meantime, this week’s main danger occasions embrace an array of knowledge that will present a catalyst for value motion. With Shopper Confidence (reported earlier at present) falling in-line with expectations, the Federal Reserve coverage assembly (tomorrow), This fall Adv GDP knowledge (Thursday) and Core PCE outcomes (Friday) will possible be the principle drivers of the USD for the rest of the week.

Beneficial by Tammy Da Costa

Get Your Free Oil Forecast

DailyFX Financial Calendar

With world lockdowns additional weighing on Oil demand, prospects of extra US Fiscal stimulus mixed with optimism concerning a vaccine rollout have weighed on the dollar, serving to to maintain US Crude Oil afloat.

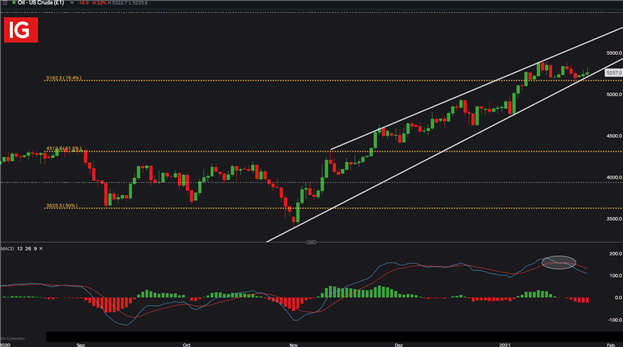

WTI Technical Evaluation

At present WTI value motion stays encapsulated by the channel formation that has supplied help and resistance for themain commodity since November. Concurrently, the 76.4% Fibonacci retracement talked about above offers help at 5162.Three whereas the Transferring Common Convergence Divergence (MACD)stays effectively above the zero line, indicating that the upward development continues to be holding in the intervening time.

Beneficial by Tammy Da Costa

Be taught the Core Fundamentals of Oil Buying and selling

WTI – US Crude Oil Day by day Chart

Chart ready by Tammy Da Costa, IG

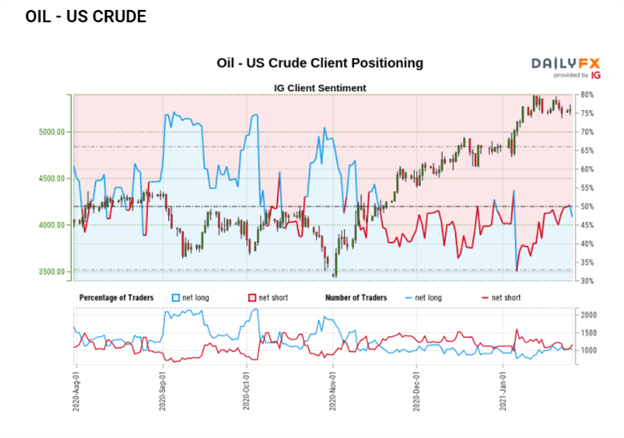

WTI – US Crude Oil Consumer Sentiment

| Change in | Longs | Shorts | OI |

| Day by day | 5% | -2% | 1% |

| Weekly | 8% | -12% | -3% |

On the time of writing, Retail dealer knowledge exhibits 47.10% of merchants are net-long with the ratio of merchants quick to lengthy at 1.12 to 1. The variety of merchants net-long is 10.26% decrease than yesterday and seven.94% decrease from final week, whereas the variety of merchants net-short is 5.46% increased than yesterday and 1.28% decrease from final week.

We usually take a contrarian view to crowd sentiment, and the actual fact merchants are net-short suggests Oil – US Crude costs might proceed to rise.

Merchants are additional net-short than yesterday and final week, and the mixture of present sentiment and up to date modifications provides us a stronger Oil – US Crude-bullish contrarian buying and selling bias.

— Written by Tammy Da Costa, Market Author for DailyFX.com

Contact and observe Tammy on Twitter: @Tams707