US PCE Index, US Dollar, Russia, Oil, Euro, GBP – Talking PointsCore PCE YoY comes in at 5.4% vs. 5.5% forecastUS Jobless Claims come in at 202k, abo

US PCE Index, US Dollar, Russia, Oil, Euro, GBP – Talking Points

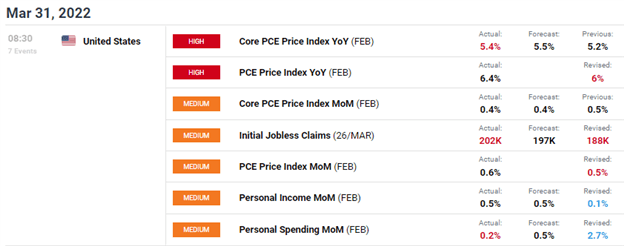

- Core PCE YoY comes in at 5.4% vs. 5.5% forecast

- US Jobless Claims come in at 202k, above 197k estimate

US PCE data came in mixed on Thursday, with Core PCE coming in slightly cooler than expected. Oa year-over-year basis Core PCE came in at 5.4%, just below the street consensus estimate of 5.5%. Higher energy prices and rising incomes continue to put upward pressure on inflation. The PCE Index is often referred to as the Fed’s favorite inflation gauge, and the February data may push the FOMC closer to a 50 basis point hike at the next policy meeting. The YoY increase of 5.4% represents the largest jump since 1983, something that will certainly be catching the Fed’s attention. Thursday’s premarket session also saw jobless claims crawl back above the 200k threshold.

US Economic Calendar

Courtesy of the DailyFX Economic Calendar

Following the data releases, US equity benchmarks were flat in the premarket session. Thursday’s trading session will bring a wild first quarter to a close, which could potentially prompt some volatile action. Oil remains on the backfoot as headlines surfaced overnight that President Biden may look to aggressively tap the Strategic Petroleum Reserve (SPR) in order to combat rising oil prices. Hopes of progress at peace talks between Russia and Ukraine have cooled, as the fighting continues all across Ukraine. Sentiment also continues to be hit by the ongoing Covid breakouts across China.

Across the FX markets, US Dollar strength was the dominant narrative throughout the European session. Heading into the New York open, the US Dollar Index was up roughly 0.75%. Euro was the noticeable underperformer, with mild softness seen in Sterling and the Oceanic currencies. After finding a bottom around the 97.72 level both yesterday and in the early hours of Thursday, the US Dollar Index may continue higher toward the 98.50 area. This area capped Tuesday’s brief rally, and may act as a first impediment to higher prices.

US Dollar Index 1 Hour Chart

Chart created with TradingView

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

— Written by Brendan Fagan, Intern

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com