US Greenback, EUR/USD Speaking Factors:It was an enormous week for US Greenback bears because the forex pushed right down to a contemporary low on

US Greenback, EUR/USD Speaking Factors:

It was an enormous week for US Greenback bears because the forex pushed right down to a contemporary low on the heels of a extremely disappointing NFP report. Shares rallied to associate with that transfer of USD-weakness, main many to level to the ‘good is unhealthy’ theme that seems to have re-emerged in markets. However, this fails to acknowledge the lagging efficiency in tech shares, which proceed to commerce on their again foot regardless of the S&P 500 pushing as much as one other contemporary all-time-high.

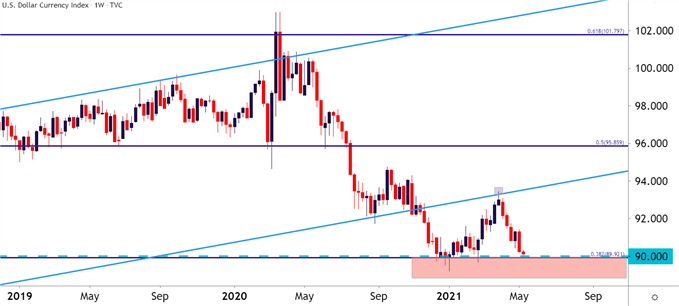

In FX-land, developments look like just a little extra clear. The US Greenback has continued to sell-off, furthering the Q2 theme of weak point that re-emerged on the primary buying and selling day of the brand new quarter. The forex is quick approaching an enormous spot on the chart, taken from across the 90.00 psychological stage, which is confluent with the 38.2% Fibonacci retracement of the 2001-2008 main transfer.

To study extra about psychological ranges or Fibonacci retracements, try DailyFX Training

This identical zone helped to arrest the nine-month sell-off across the New 12 months open, which led to that Q1 bounce. However, as checked out within the Q2 Technical Forecast for the US Greenback, that bounce appeared corrective in nature with the larger image development nonetheless carrying a bearish tonality, which has performed out to date within the first half of Q2.

To get the complete Q2 Technical Forecast for the US Greenback, the hyperlink under can prepare that:

US Greenback Weekly Value Chart

Chart ready by James Stanley; USD, DXY on Tradingview

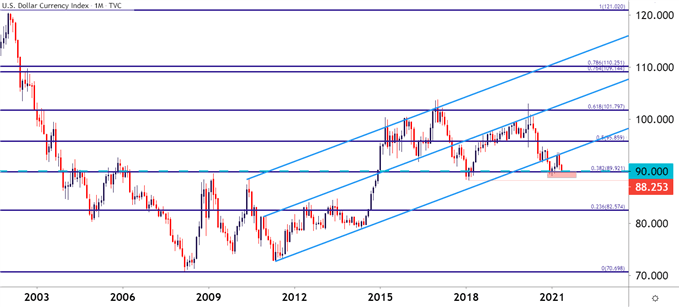

Taking a step again to take a look at the larger image, and the significance of this present help space turns into just a little extra clear.

That Q1 swing-high confirmed up proper on the underside of a development channel that’s been going for nearly a full decade. The help facet of that channel provided a bounce within the USD in August/September, however sellers had been capable of take it out on a recurrent try in November. Under this present zone of help – 89.20 is the 2021 low and the present six-year-low rests round 88.25, after which there’s no close by or latest help to work with.

US Greenback Month-to-month Value Chart

Chart ready by James Stanley; USD, DXY on Tradingview

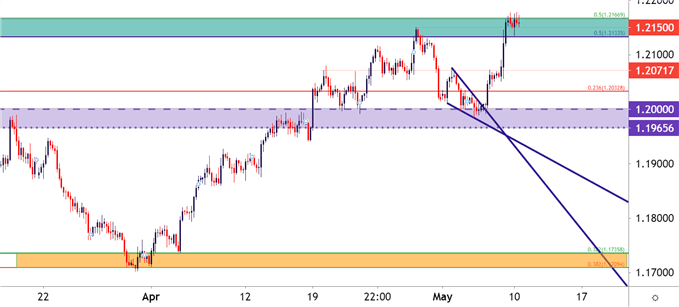

USD Weak spot Helps EUR/USD To Leap to Recent Two-Month-Highs

On the opposite facet of that USD transfer, EUR/USD has been very sturdy. Simply final week the pair was grinding round help on the 1.2000 deal with, permitting for the construct of a falling wedge sample to look. Such patterns are sometimes adopted with the intention of bullish reversals, and that’s what occurred within the latter portion of final week as patrons pushed EUR/USD as much as a contemporary two-month-high.

The pair presently finds itself buying and selling on the top-end of a key zone of resistance, working from 1.2134-1.2167, comprised of two completely different 50% markers from two separate main strikes. This identical zone caught the excessive in late-April as costs pulled again to the 1.2000 deal with; however patrons look pretty persistent on this iteration as EUR/USD jumped as much as this space after NFP final week, and hasn’t but backed down.

This may preserve the door open to near-term breakout potential, notably for these which can be in search of USD to drive deeper inside its present help construction. Alternatively, for these a short-term stall, short-term higher-low help might be sought out in EUR/USD round 1.2134 or 1.2072.

EUR/USD 4-Hour Value Chart

Chart ready by James Stanley; EURUSD on Tradingview

— Written by James Stanley, Senior Strategist for DailyFX.com

Contact and observe James on Twitter: @JStanleyFX

ingredient contained in the

ingredient. That is most likely not what you meant to do!nn Load your software’s JavaScript bundle contained in the ingredient as an alternative.www.dailyfx.com