US Greenback, Singapore Greenback, Thai Baht, Indonesian Rupiah, Indian Rupee, ASEAN, Basic Evaluation – Speaking FactorsUS Green

US Greenback, Singapore Greenback, Thai Baht, Indonesian Rupiah, Indian Rupee, ASEAN, Basic Evaluation – Speaking Factors

- US Greenback aimed principally greater in opposition to ASEAN currencies final week

- Weak point in Chinese language and Rising Market equities fueling volatility

- Key occasion threat: Chinese language PMI, Fed ending SLR exemptions and NFPs

Uncover what sort of foreign exchange dealer you’re

US Greenback ASEAN Weekly Recap

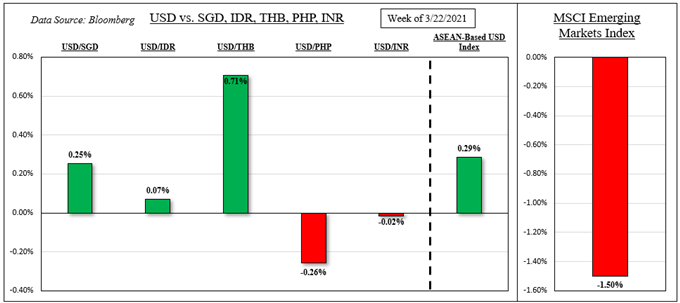

The haven-linked US Greenback aimed cautiously greater in opposition to its ASEAN counterparts this previous week, gaining 0.25% and 0.71% in opposition to the Singapore Greenback and Thai Baht respectively. The Indonesian Rupiah was pretty flat whereas the Philippine Peso managed to understand barely. That is whereas the MSCI Rising Markets Index (EEM) weakened about 1.50%.

Good points in USD/THB occurred regardless of the Financial institution of Thailand leaving benchmark lending charges unchanged at 0.50%. The central financial institution minimize the outlook for GDP as a result of Covid outbreak and a fragile vacationer business. The latter is a key contributor to progress. On the identical time, the Financial institution of Thailand left the doorways opened to additional financial assist. The native 10-year authorities bond yield weakened and stays underneath February peaks.

In the meantime, the PHP’s resilience could also be attributable to fading dovish expectations from the Philippine Central Financial institution. The BSP left benchmark lending charges unchanged, highlighting draw back financial dangers, but in addition reiterating that present settings stay applicable. The native inventory market index, the PSEI, gained this previous week as capital inflows doubtless supported the Philippine Peso.

US Greenback, MSCI Rising Markets Index– Final Week’s Efficiency

*ASEAN-Primarily based US Greenback Index averages USD/SGD, USD/IDR, USD/THB and USD/PHP

Exterior Occasion Danger – Chinese language Shares, Treasury Yields, Fed, NFPs

ASEAN currencies will be fairly delicate to capital flows, influenced by total market sentiment. Whereas US equities principally rose this previous week, Chinese language ones flirted with correction territory. China’s authorities has been making an attempt to handle what it thinks could also be a market bubble. That is because the PBOC has been slowly tightening coverage this 12 months to maintain inflation from taking off.

In the meantime, rising longer-term Treasury charges and a stronger US Greenback have been pressuring Rising Market equities. Albeit, the bond market appeared to stabilize this previous week, halting a 7-week profitable streak for the 10-year yield. This adopted lackluster demand at a collection of presidency debt auctions as Fed Chair Jerome Powell continued to spotlight the dangers to the financial system at an affidavit earlier than a Senate panel.

Treasuries additionally paid little discover to barely softer core PCE knowledge this previous Friday, which is the Fed’s most popular gauge of inflation. The central financial institution has been underscoring that it’ll doubtless view a near-term rise in inflation as transitory. So softer underlying costs can cool the bond market additional. For that, all eyes flip to the US non-farm payrolls report. Extra consideration could also be given to common hourly earnings.

The Fed can also be anticipated to not prolong emergency SLR exemptions within the coming week, opening the door to fewer demand for Treasuries from banks. Which will supply upside momentum to bond yields. As such, the US Greenback may stay elevated in opposition to its ASEAN counterparts because the latter are inclined to concentrate on exterior developments.

Advisable by Daniel Dubrovsky

How will you overcome frequent pitfalls in FX buying and selling?

ASEAN, South Asia Occasion Danger – Thailand, Indonesia, Chinese language Manufacturing PM

Specializing in the ASEAN financial calendar docket, Thailand and Indonesian Markit manufacturing PMI are due. Thailand can even launch the subsequent set of present account figures. Chinese language manufacturing PMI can also be value watching because the nation is a key buying and selling associate for ASEAN members. Rosy knowledge from the world’s second-largest financial system may create constructive spillovers to neighboring nations.

Try the DailyFX Financial Calendar for ASEAN and international knowledge updates!

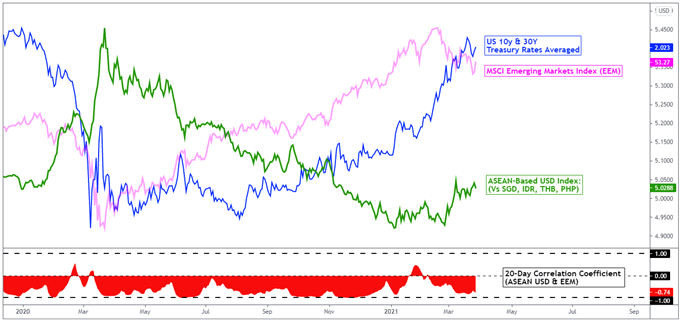

On March 26th, the 20-day rolling correlation coefficient between my ASEAN-based US Greenback index and the MSCI Rising Markets index modified to -0.74 from -0.82 one week in the past. Values nearer to –1 point out an more and more inverse relationship, although it is very important acknowledge that correlation doesn’t indicate causation.

ASEAN-Primarily based USD Index Versus EEM and Treasury Yields – Every day Chart

Chart Created Utilizing TradingView

*ASEAN-Primarily based US Greenback Index averages USD/SGD, USD/IDR, USD/THB and USD/PHP

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the feedback part under or @ddubrovskyFX on Twitter

aspect contained in the

aspect. That is most likely not what you meant to do!nn Load your software’s JavaScript bundle contained in the aspect as a substitute.www.dailyfx.com