US DOLLAR OUTLOOK: USD PRICE ACTION RIPE FOR VOLATILITY AMID FOMC COMMENTARY, STIMULUS NEGOTIATIONS, & UPDATES ON TRUMP’S HEA

US DOLLAR OUTLOOK: USD PRICE ACTION RIPE FOR VOLATILITY AMID FOMC COMMENTARY, STIMULUS NEGOTIATIONS, & UPDATES ON TRUMP’S HEALTH

- The US Greenback drops to begin the week owing to a restoration in market sentiment

- DXY Index has potential to rebound increased if US Greenback bulls can defend the 50-DMA

- USD seems to be primed for extra volatility with Trump, FOMC officers, and stimulus talks in focus

The situation of president trump bettering over the weekend has seemingly brought on a downshift in coronavirus issues, which seems to be boosting market sentiment in flip. This has corresponded with a lift to main inventory indices and deeper pullback by the anti-risk US Greenback. The broad-based US Greenback Index has declined 5 out of the final six buying and selling periods and now trades greater than 1% under its September swing excessive. Higher-than-expected US Providers PMI information launched shortly after the Wall Avenue open this morning has helped USD worth motion strengthen off intraday lows, nevertheless.

Really helpful by Wealthy Dvorak

Foreign exchange for Novices

DXY – US DOLLAR INDEX PRICE CHART: DAILY TIME FRAME (28 MAY TO 05 OCTOBER 2020)

Chart created by @RichDvorakFX with TradingView

A DXY chart reveals that US Greenback promoting stress has steered the safe-haven forex towards resistance-turned-support underscored by the 93.50-price stage. This potential space of buoyancy is roughly highlighted by its 50-day transferring common. A breakdown under this stage, nevertheless, may invalidate the bullish inverse head and shoulder bottoming sample developed over the past two months.

Really helpful by Wealthy Dvorak

Get Your Free USD Forecast

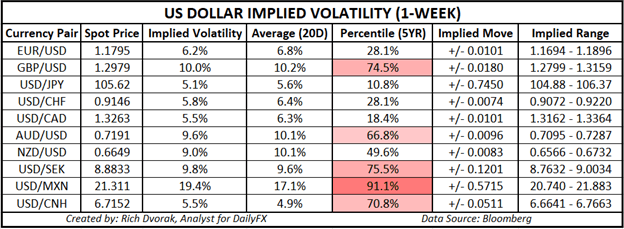

USD PRICE OUTLOOK – US DOLLAR IMPLIED VOLATILITY TRADING RANGES (1-WEEK)

That mentioned, there may be potential for USD worth motion to fluctuate inside a buying and selling vary as resurgent market volatility lingers. The path of the US Greenback hinges largely on dealer sentiment surrounding the prognosis of President Trump as he makes an attempt to get well from catching the coronavirus. Although current updates from POTUS suggests he stays in general good well being, there should still be potential for a worsening of signs as Trump battles the coronavirus. To not point out, fiscal stimulus negotiations may additionally weigh materially on the place USD worth motion heads subsequent.

Really helpful by Wealthy Dvorak

Buying and selling Foreign exchange Information: The Technique

Politicians have struggled to achieve one other coronavirus assist invoice, however markets have turned extra optimistic not too long ago as Treasury Secretary Mnuchin and Home Speaker Pelosi try and make progress towards reaching a deal. Moreover, a slew of speeches from Federal Reserve officers scheduled this week – detailed on the DailyFX Financial Calendar – may gasoline US Greenback volatility as nicely. Choices-implied buying and selling ranges are calculated utilizing 1-standard deviation (i.e. 68% statistical chance worth motion is contained throughout the implied buying and selling vary over the desired timeframe).

— Written by Wealthy Dvorak, Analyst for DailyFX.com

Join with @RichDvorakFX on Twitter for real-time market perception