Supply: Adobe/freshidea Serkan Arslanalp is Deputy Division Chief within the Stability of Funds Division of the Worldwide Financial Fund (IMF)

Serkan Arslanalp is Deputy Division Chief within the Stability of Funds Division of the Worldwide Financial Fund (IMF)’s Statistics Division. Chima Simpson-Bell is an Economist in the identical division.

____

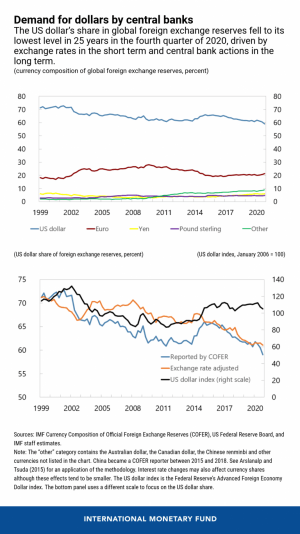

The share of US greenback reserves held by central banks fell to 59%—its lowest stage in 25 years—through the fourth quarter of 2020, based on the IMF’s Foreign money Composition of Official Overseas Alternate Reserves (COFER) survey. Some analysts say this partly displays the declining function of the US greenback within the international economic system, within the face of competitors from different currencies utilized by central banks for worldwide transactions. If the shifts in central financial institution reserves are giant sufficient, they will have an effect on foreign money and bond markets.

Our Chart of the Week seems on the current knowledge launch from a longer-term perspective. It exhibits that the share of US greenback property in central financial institution reserves dropped by 12 proportion factors—from 71% to 59%—for the reason that euro was launched in 1999 (high panel), though with notable fluctuations in between (blue line). In the meantime, the share of the euro has fluctuated round 20%, whereas the share of different currencies together with the Australian greenback, Canadian greenback, and Chinese language renminbi climbed to 9% within the fourth quarter (inexperienced line).

Alternate charge fluctuations can have a serious influence on the foreign money composition of central financial institution reserve portfolios. Adjustments within the relative values of various authorities securities can even have an effect, though this impact would are usually smaller since main foreign money bond yields normally transfer collectively. During times of US greenback weak spot in opposition to main currencies, the US greenback’s share of worldwide reserves typically declines for the reason that US greenback worth of reserves denominated in different currencies will increase (and vice versa in occasions of US greenback energy). In flip, US greenback trade charges could be influenced by a number of elements, together with diverging financial paths between the US and different economies, variations in financial and monetary insurance policies, in addition to overseas trade gross sales and purchases by central banks.

The underside panel exhibits that the worth of the US greenback in opposition to main currencies (black line) has remained broadly unchanged over the previous 20 years. Nonetheless, there have been vital fluctuations within the interim, which may clarify about 80% of the short-term (quarterly) variance within the US greenback’s share of worldwide reserves since 1999. The remaining 20% of the short-term variance could be defined primarily by lively shopping for and promoting choices of central banks to assist their very own currencies.

Turning to this previous yr, as soon as we account for the influence of trade charge actions (orange line), we see that the US greenback’s share in reserves held broadly regular. Nonetheless, taking an extended view, the truth that the worth of the US greenback has been broadly unchanged, whereas the US greenback’s share of worldwide reserves has declined, signifies that central banks have certainly been shifting steadily away from the US greenback.

Some anticipate that the US greenback’s share of worldwide reserves will proceed to fall as rising market and growing economic system central banks search additional diversification of the foreign money composition of their reserves. A number of nations, corresponding to Russia, have already introduced their intention to take action.

Regardless of main structural shifts within the worldwide financial system over the previous six a long time, the US greenback stays the dominant worldwide reserve foreign money. As our Chart of the Week exhibits, any adjustments to the US greenback’s standing are prone to emerge in the long term.

__

This text has been republished from blogs.imf.org.

___

Be taught extra:

– What May Change The Foreign money Composition of Central Banks’ Reserve Holdings?

– ECB Sends One other Affirmation of A ‘International Foreign money Struggle’

– Russia Needs to Use the Digital Ruble to Energy its USD Purge

– Bitcoin Is Extra ‘Public’ Cash than Central Financial institution-Issued Fiat Currencies

– Central Banks Will Want To Rethink Financial Insurance policies – PayPal CEO

– Put together For ‘Unsure Way forward for Cash’ – US Intelligence Middle

– The Nice Melancholy and Cash Printers of Right this moment