IMF GDP Forecast, US Greenback, COVID-19, Recession – Speaking Factors:IMF lowers world financial output forecast to -4.9% for 20

IMF GDP Forecast, US Greenback, COVID-19, Recession – Speaking Factors:

- IMF lowers world financial output forecast to -4.9% for 2020

- Restoration stays extremely unsure as COVID-19 unfold continues

- US Greenback pushes increased as threat urge for food pulls again

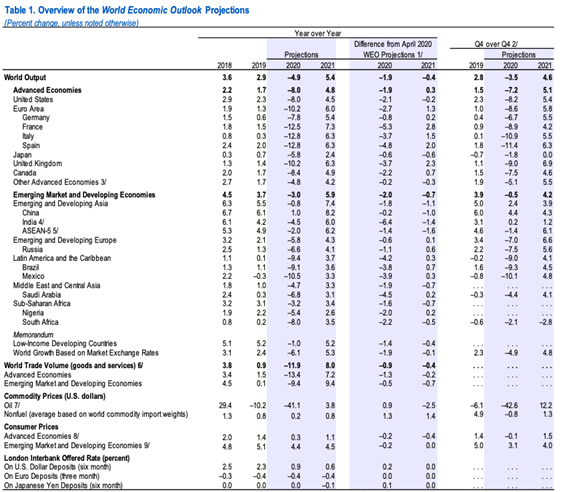

The Worldwide Financial Fund up to date its World Financial Outlook Progress Projections Wednesday morning, revealing a downgraded forecast for the world financial system than beforehand projected. World output is now forecasted to drop by 4.9% this 12 months, down 1.9% from the earlier April IMF forecast. The restoration forecasted for subsequent 12 months additionally took successful, now at 5.4%, down from 5.8%. This quantities to a cumulative output lack of 12.5 trillion USD all through 2020 and 2021 in accordance with the IMF report.

IMF World Financial Outlook Projections:

Supply: IMF World Financial Outlook Replace, June 2020

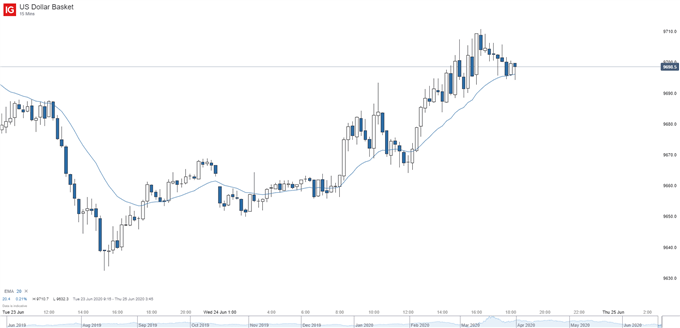

US Greenback value motion ticked increased following the report’s launch, bolstered by the general threat aversion rippling all through markets Wednesday. Whereas the downgraded IMF forecast is probably going answerable for a portion of the chance aversion seen at the moment, growing COVID-19 infections, notably in sure areas of the US, is worrying market individuals on second-wave fears. As an illustration, Florida recorded a record-breaking 5,500 confirmed new infections for Tuesday. The rise in circumstances is a testomony to the COVID-19 pandemic being removed from over.

US Greenback (15-Min Chart)

Supply: IG Charts

Beneficial by Thomas Westwater

Get Your Free USD Forecast

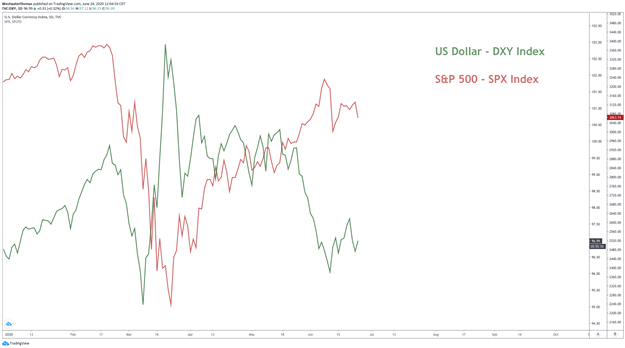

Moreover, US fairness markets are deep within the purple right this moment following the downgraded IMF forecast and troubling rise in infections seen throughout a number of US states. Each the Dow Jones Index and S&P 500 index are buying and selling over 2.5% decrease within the Wednesday afternoon buying and selling session. This value habits between the US Greenback and equities additional highlights the latest cross-asset correlation seen throughout the FX and equities area.

US Greenback Index versus S&P 500 Index (Each day Chart)

Chart created in TradingView by Thomas Westwater

Whereas the US Greenback stays nicely off its multi-year excessive from March, a major and extended bout of threat aversion would probably push USD value motion again close to that stage as buyers flee for safe-haven property. The latest energy in fairness markets being pushed on hopes for a ‘V-shaped’ restoration, together with unprecedented financial and financial assist might take successful going ahead ought to the IMF projections for a extra sluggish financial rebound develop into extra obvious to market individuals. For now, virus an infection charges, financial information, and efforts for additional financial and financial stimulus will stay forefront to buyers as market circumstances are frequently reassessed.