US inflation eyed forward of Biden’s stimulus proposal – Foreign exchange Information Preview Posted on Ja

US inflation eyed forward of Biden’s stimulus proposal – Foreign exchange Information Preview

Posted on January 12, 2021 at 11:44 am GMTMarios Hadjikyriacos, XM Funding Analysis Desk

The primary occasion for the greenback and fairness markets this week would be the particulars of incoming President Biden’s stimulus proposal, which will likely be unveiled Thursday. Earlier than that, the newest CPI information on Wednesday will inform us how inflationary pressures are evolving. This might show essential amid hypothesis round whether or not the Fed would possibly start tapering early subsequent yr. Total, markets appear to be transitioning from a ‘reflation’ to a ‘progress’ narrative, and if this shift persists, the newest rebound within the greenback should have some miles left.

Large stimulus packages to spice up US progress

The primary order of enterprise within the Biden administration will likely be to cross a brand new aid package deal price ‘trillions of {dollars}’ to revitalize the US financial system. That’s what the incoming US president promised final week, with the main points of his proposal set to be introduced on Thursday.

What’s placing is that each the inventory market and the greenback powered greater on the information. Guarantees of runaway authorities spending are normally a adverse sign for a foreign money, however deficit considerations have been unable to maintain the greenback down recently. What has modified?

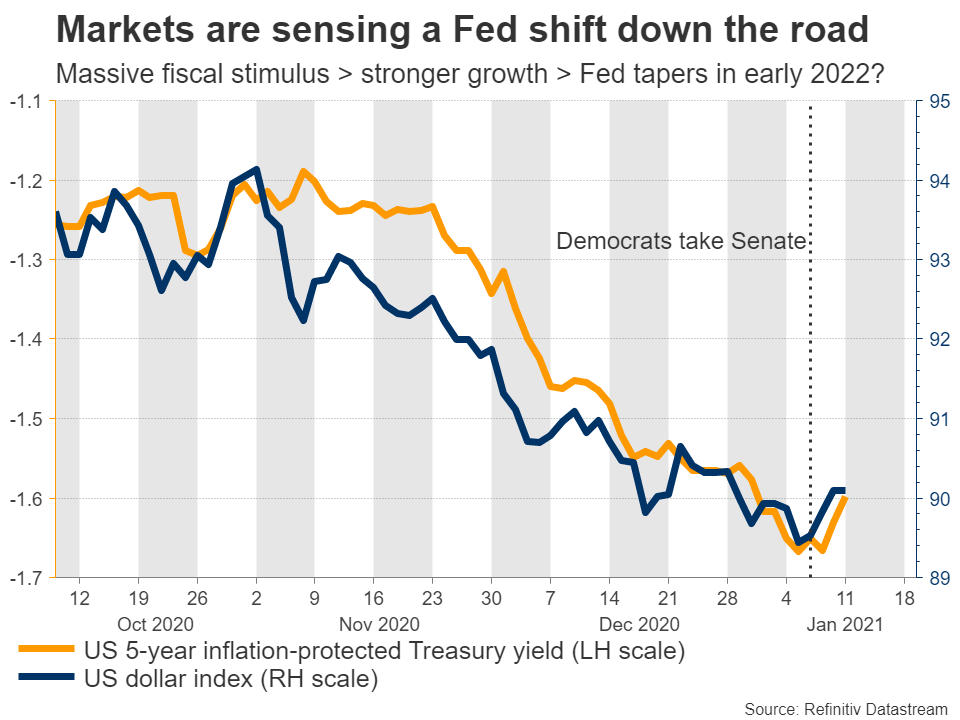

In a nutshell, markets are rising extra assured that each one this spending will turbocharge US progress. The narrative thus far was that each one the Trump-era stimulus would generate some inflation down the street, however with out spectacular progress. This stored actual US rates of interest depressed, alongside the greenback. However now that the Democrats are promising to ‘juice up’ the financial system even additional, buyers are bracing for a interval of blazing progress.

In flip, the rosier outlook for the financial system is main buyers to rethink how quickly the Fed would possibly reduce its gigantic QE program, pushing actual yields a contact greater and respiratory some life again into the greenback.

CPI inflation and Powell speech eyed

The main points of Biden’s stimulus proposal will likely be carefully watched. The extra he guarantees, the higher the US progress outlook. For instance, a package deal price $Three trillion – as has been instructed by some experiences – would probably reignite the ‘progress commerce’, whereas one thing nearer to $1 trillion could even be seen as a disappointment.

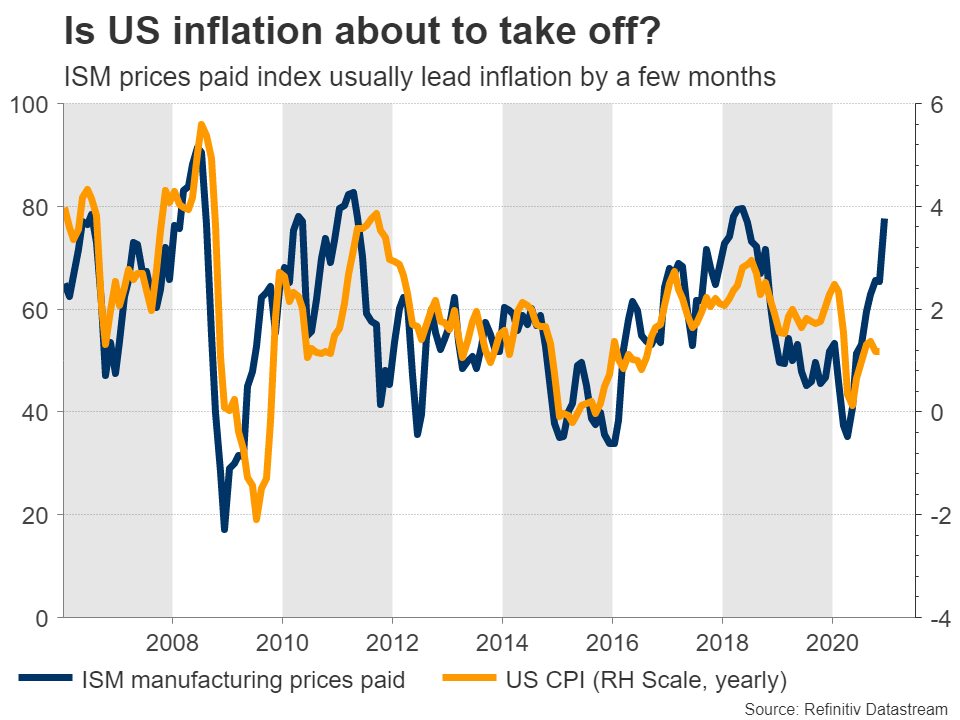

Earlier than that, we’ll get an important replace on US inflation. Forecasts recommend the CPI charge ticked as much as 1.3% on an annual foundation in December, from 1.2% beforehand, whereas the core charge is anticipated unchanged at 1.6%.

As for the dangers surrounding these forecasts, an upside shock appears extra probably than a disappointment. The Markit PMI surveys for December confirmed a pointy enhance within the costs charged by corporations, principally on account of rising price burdens. The worth parts of the ISM PMIs have been blended, however have risen sharply in latest months, additionally endorsing greater inflation going ahead.

If there may be an upside shock, that might intensify hypothesis about how quickly the Fed would possibly start to withdraw assist, and maybe present the greenback some extra reprieve. Fed Vice Chairman Clarida just lately hinted this course of might start in early 2022, and it will likely be fascinating to see whether or not Chairman Powell reaffirms that when he speaks on Thursday.

Can the greenback rebound run additional?

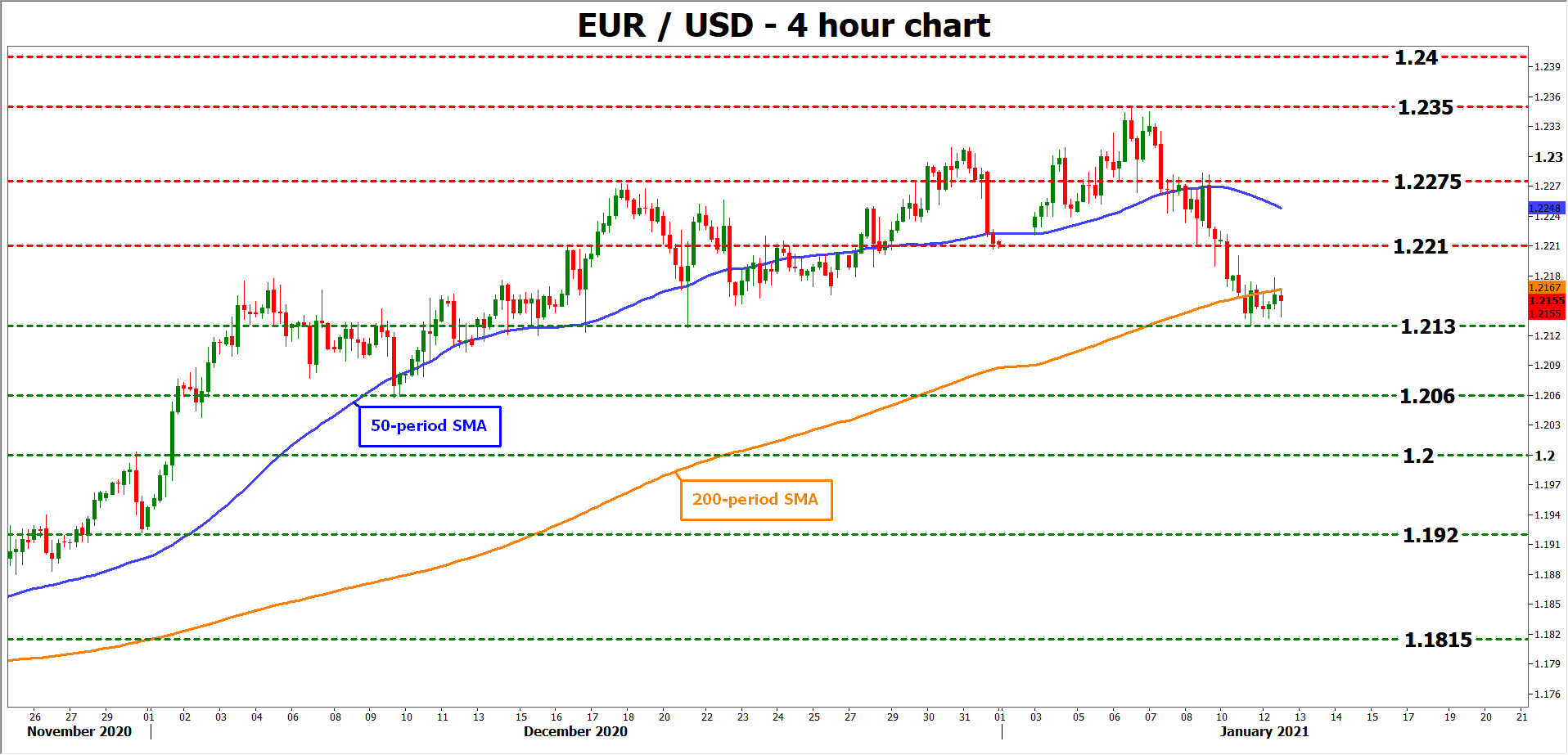

Total, there’s a stable case for the newest restoration within the greenback to proceed. If the tsunami of federal spending actually reawakens the US financial system, the Fed will likely be able to start out tapering a lot ahead of different main central banks, particularly the ECB. As well as, the US is main Europe within the vaccination race, and positioning on the greenback is extraordinarily bearish already.

Finally, every thing comes all the way down to relative financial efficiency. The US is at the moment far stronger than Europe, has extra stimulus within the pipeline, and can most likely get much more quickly.

To be clear although, all this doesn’t indicate that is the start of a brand new uptrend for the greenback. That can rely on how the US financial system performs over time, how danger sentiment evolves, and whether or not Europe suffers a double-dip recession. Nonetheless, it does recommend that the newest rebound could proceed for now, assuming Biden publicizes sufficient stimulus on Thursday.

Taking a technical take a look at euro/greenback, a possible break beneath the 1.2130 zone might encounter preliminary assist close to the 1.2060 area.

On the flipside, if Biden’s stimulus package deal disappoints for instance, the pair could head again greater for one more take a look at of 1.2210, a break of which might shift the main target in the direction of 1.2275.

EURUSDFed