US Greenback, USD/CAD, Non-Farm Payrolls, Inflation, 10-12 months Breakevens – Speaking Factors:Fairness markets gained floor thr

US Greenback, USD/CAD, Non-Farm Payrolls, Inflation, 10-12 months Breakevens – Speaking Factors:

- Fairness markets gained floor throughout APAC commerce as buyers cheered the continued decline in world coronavirus infections.

- USD might prolong latest positive aspects as inflationary strain gasoline Fed tapering bets.

- USD/CAD poised to push larger after clearing key technical resistance.

Asia-Pacific Recap

Fairness markets pushed larger throughout Asia-Pacific commerce on the again of a continued decline in world coronavirus circumstances and optimistic employment knowledge out of the US. Australia’s ASX 200 rose 1.07% regardless of retail gross sales falling 4.1% in December, whereas Japan’s Nikkei 225 surged 1.36%.

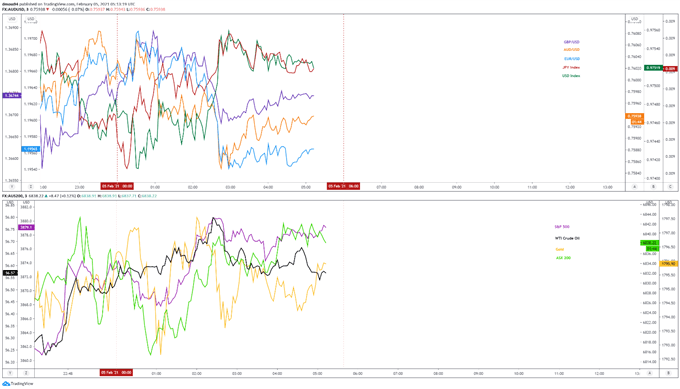

In FX markets, USD, JPY, GBP and CHF largely outperformed, whereas the cyclically-sensitive AUD, NZD and NOK slipped decrease. Gold and silver costs crept marginally larger as yields on US 10-year Treasuries held comparatively regular. Wanting forward, the US non-farm payrolls report for January headlines the financial docket alongside Canadian jobs knowledge.

Market response chart created utilizing Tradingview

Intensifying Indicators of Inflation to Buoy USD

The US Greenback might proceed to realize floor towards its main counterparts within the close to time period, as a noticeable pickup in inflation fuels bets that the Federal Reserve might tighten its financial coverage levers prior to anticipated.

The Fed’s most well-liked measure of shopper value development – the Core Private Consumption Expenditure (PCE) index – climbed 1.5percentYoY in December, exceeding market estimates of a 1.3% print. The ISM manufacturing costs sub-index additionally surged unexpectedly, rising to 82.1 in January and smashing forecasts for a extra conservative enhance to 77.

Certainly, inflationary pressures might proceed to construct within the coming weeks, as Democrats pave the best way for President Joe Biden to move the vast majority of his proposed $1.9 trillion stimulus package deal with a easy majority.

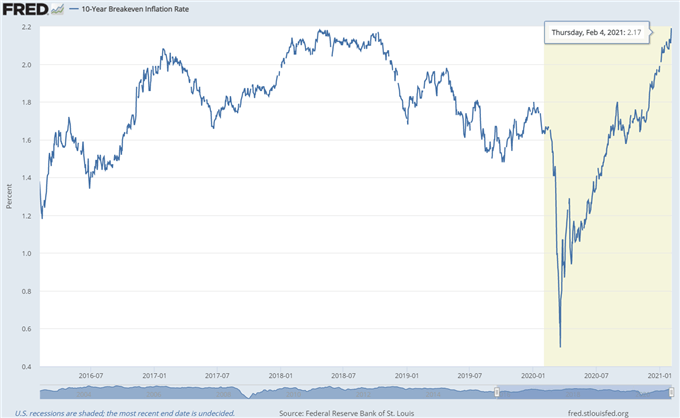

10-12 months Breakeven Inflation Fee

Supply – FRED

Constructive vaccination progress and falling coronavirus circumstances may foster additional shopper value development. The 7-day shifting common monitoring Covid-19 infections has declined by over 130,000 within the final three weeks, whereas over 33 million People have obtained no less than one dose of a coronavirus vaccine.

Nevertheless, it nonetheless appears comparatively unlikely that the Fed will look to regulate its financial coverage settings anytime quickly, after the central financial institution reiterated its pledge to persevering with rising “its holdings of Treasury securities by no less than $80 billion monthly and of company mortgage-backed securities by no less than $40 billion monthly till substantial progress has been made towards the Committee’s most employment and value stability objectives”.

A number of Fed members have additionally talked down the concept of tapering bond purchases anytime quickly, with Chairman Jerome Powell stating that “the entire give attention to exit is untimely” and St Louis Fed President James Bullard commenting that “we’re nonetheless in the course of a disaster, so it’s too early to provoke that dialogue”.

Nonetheless, a larger-than-expected rise in common hourly earnings might intensify tapering bets within the close to time period and open the door for the US Greenback to increase its latest positive aspects.

DailyFX Financial Calendar

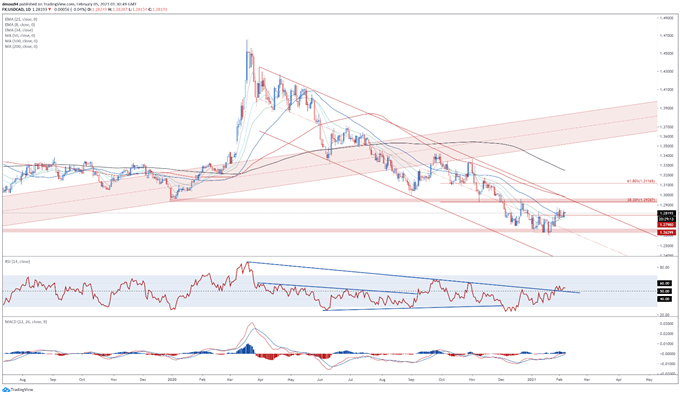

USD/CAD Every day Chart – Eyeing Descending Channel Resistance

From a technical perspective, the US Greenback appears to be like poised to proceed gaining floor towards its Canadian counterpart, as USD/CAD stays burst above the trend-defining 50-day shifting common and psychological resistance at 1.2800.

With the RSI snapping the downtrend extending from the March extremes, and the MACD climbing to its highest ranges since November, the trail of least resistance appears skewed to the upside.

A day by day shut above the January excessive (1.2881) would doubtless open the door for value to probe the 38.2% Fibonacci (1.2929). Hurdling that brings Descending Channel resistance and the 100-DMA (1.2983) into the crosshairs.

Nevertheless, if value slips again under former support-turned-resistance on the January Four excessive (1.2798) sellers might drive the alternate charge again in direction of the yearly low (1.2589).

USD/CAD day by day chart created utilizing Tradingview

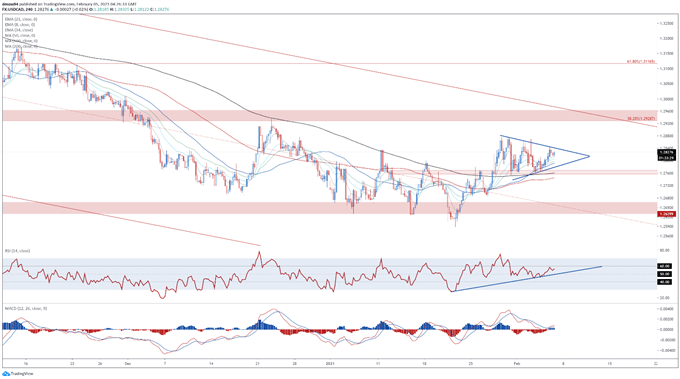

USD/CAD 4-Hour Chart – Symmetrical Triangle Hints at Additional Positive factors

Zooming right into a four-hour chart bolsters the bullish outlook depicted on the day by day timeframe, as USD/CAD carves out a Symmetrical Triangle above key vary assist at 1.2760 – 1.2790.

A convincing burst above 1.2850 would most likely validate the continuation sample and propel costs in direction of the psychologically imposing 1.2900 mark, with the sample’s implied measured transfer suggesting value might climb to problem the 1.3000 stage.

Conversely, a pullback in direction of the sentiment-defining 200-MA (1.2816) may very well be on the playing cards if patrons fail to breach triangle resistance.

USD/CAD 4-hour chart created utilizing Tradingview

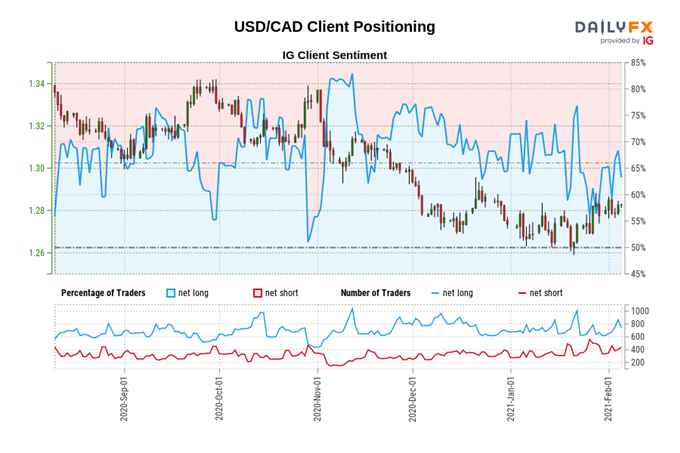

IG Shopper Sentiment Report

The IG Shopper Sentiment Report reveals 63.43% of merchants are net-long with the ratio of merchants lengthy to quick at 1.73 to 1. The variety of merchants net-long is 14.38% decrease than yesterday and seven.98% larger from final week, whereas the variety of merchants net-short is 8.06% larger than yesterday and three.38% decrease from final week.

We usually take a contrarian view to crowd sentiment, and the actual fact merchants are net-long suggests USD/CAD costs might proceed to fall.

Positioning is much less net-long than yesterday however extra net-long from final week. The mix of present sentiment and up to date adjustments offers us an additional combined USD/CAD buying and selling bias.

— Written by Daniel Moss, Analyst for DailyFX

Comply with me on Twitter @DanielGMoss

Really useful by Daniel Moss

Prime Buying and selling Classes