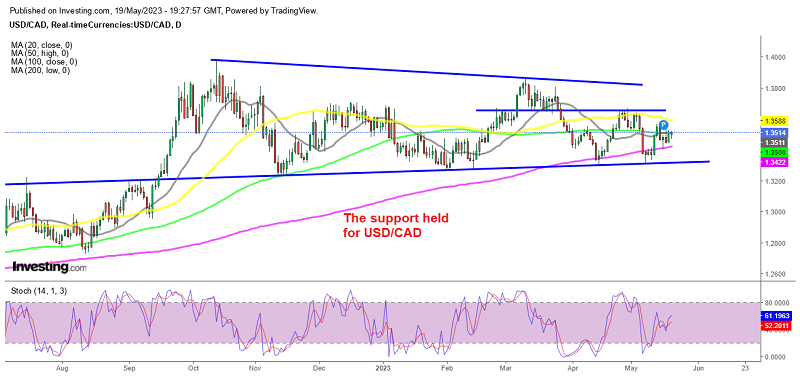

USD/CAD has been trading in a wedge (narrowing range) since October last year, with markets remaining uncertain about the US and Canadian economies. T

USD/CAD has been trading in a wedge (narrowing range) since October last year, with markets remaining uncertain about the US and Canadian economies. The economic data from both countries has been mixed in recent months, which has been pushing this pair up and down. Early this month USD/CAD tested the bottom of the range around 1.34, but last week we saw a reversal, and now buyers are in charge.

On Friday, Canada’s retail sales for March decreased by 1.4%, in line with expectations. However, the core measure performed better than predicted, with a decrease of only 0.3% compared to an expected 0.8% decline. At the same time, oil prices experienced an upward trend, creating a mixed economic environment. The combination of weaker retail data and stronger Oil prices has led to a moderate decline in the USD/CAD exchange rate, pushing it higher. The price is headed for the top of the range, so we will try to buy the dips in this pair during next week.

Canada Retail Sales for March 2023

- March retail sales -1.4%

- February sales were -0.2%

- Advanced flash estimate for April 0.2%

- Core sales ex. autos -0.3% versus -0.8% expected

- Prior core sales ex-autos came in at -0.7%

- The advanced retail sales report for March (released last month) also came at -1.4%

The advanced report last month showed an expected decline of -1.4%. Below are the gains and losses from the various sectors in March.

Canada retail sales by sector

USD/CAD

www.fxleaders.com