September WTI crude oil futures are in constructive territory for the session, with value rallying close to $41.50 per barrel. This market is a fa

September WTI crude oil futures are in constructive territory for the session, with value rallying close to $41.50 per barrel. This market is a far cry from the place it was 100 days in the past, when $22.00 per barrel was the going charge. Nonetheless, the summer time season is winding down; if we don’t see a authentic run at $45.00-$47.50 by the top of the month, a fall reversal is feasible. At the least for the second, USD/CAD bears are benefiting from {the summertime} energy in WTI.

As a basic rule, markets hate uncertainty. At the moment’s blast in Beirut has injected new questions, particularly relating to the state of terror within the Center East. Nonetheless, WTI hasn’t spiked within the aftermath of the port space explosion. At this hour (2:00 PM EST), casualties are being reported as “excessive” and no official trigger for the occasion is being given. Hypothesis surrounding a potential terror assault from Hezbollah is gaining steam as authorities try and piece collectively the wreckage.

Earlier in the present day, the Markit Manufacturing PMI (July) for Canada was launched to the general public. The determine got here in at 52.9, effectively above expectations (44.1) and June’s determine (47.8). Though solely a peripheral metric, Markit’s report does recommend that Canadian manufacturing is recovering from COVID-19 shutdowns. The USD/CAD has held agency amid the information and is approaching a key Fibonacci assist space.

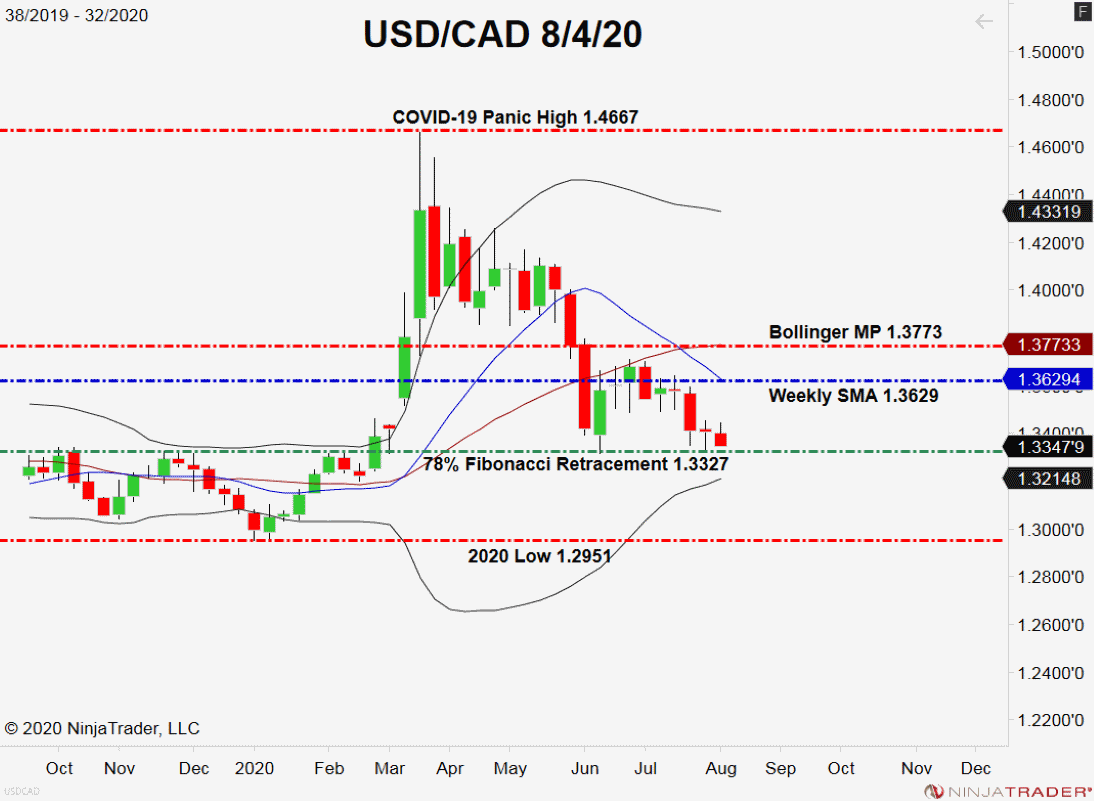

USD/CAD Falls Towards Fibonacci Assist

Final week, the USD/CAD didn’t transfer an entire lot; a weekly Doji sample was the outcome within the neighborhood of 1.3400. Now, it appears just like the bears try to take management of this market.

+2020_32+(11_45_19+AM).png)

At this level, there may be one degree on my radar for the Loonie:

- Assist(1): 78% Fibonacci Retracement, 1.3327

Backside Line: If charges fall beneath final week’s low, then important bearish extension is feasible. Given the relative energy of WTI pricing, it appears just like the USD/CAD could also be able to take out the important thing 78% retracement degree.

Till elected, I’ll have promote orders within the queue from 1.3329. With an preliminary cease above final week’s excessive at 1.3469, this place commerce produces 140 pips on a normal 1:1 threat vs reward ratio.