Canadian Greenback Speaking FactorsUSD/CAD confirmed a restricted response to a larger-than-expected decline in Canada Employment

Canadian Greenback Speaking Factors

USD/CAD confirmed a restricted response to a larger-than-expected decline in Canada Employment, and key market tendencies might proceed to affect the alternate fee because the US Greenback nonetheless displays an inverse relationship with investor confidence.

USD/CAD Charges to Watch Following Canada Employment Report

USD/CAD seems to be caught in a slender vary after taking out the 2020 low (1.2688) earlier this week, and swings in threat urge for food might sway the alternate fee forward of the following Financial institution of Canada (BoC) assembly on January 20 because the central financial institution plans to hold out its quantitative easing (QE) program “at its present tempo of a minimum of $four billion per week.”

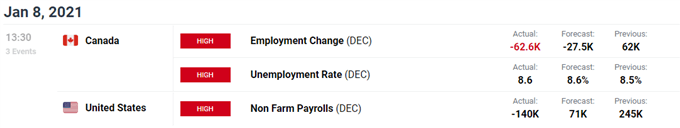

It stays to be seen if the contemporary knowledge prints popping out of Canada will affect the financial coverage outlook because the employment report exhibits a 62.6K contraction in December versus forecasts for a 27.5K decline, however the BoC might proceed to endorse a dovish ahead steering at its first assembly for 2021 as Governor Tiff Macklem and Co. “stay dedicated to offering the financial coverage stimulus wanted to help the restoration and obtain the inflation goal.”

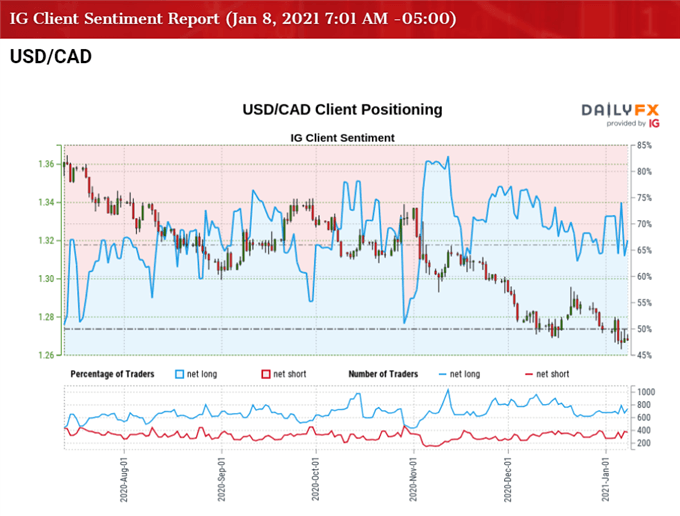

Till then, key market themes might proceed to affect USD/CAD because the BoC acknowledges that “a broad-based decline within the US alternate fee has contributed to an extra appreciation of the Canadian greenback,” and the lean in retail sentiment additionally seems to be poised to persist as merchants have been net-long the pair since Might 2020.

The IG Shopper Sentiment report exhibits 68.91% of merchants are nonetheless net-long USD/CAD, with the ratio of merchants lengthy to quick standing at 2.22 to 1. The variety of merchants net-long is 5.56% larger than yesterday and 18.40% larger from final week, whereas the variety of merchants net-short is 7.46% larger than yesterday and 33.33% larger from final week.

The rise in net-short curiosity comes because the rebound from the weekly low (1.2630) seems to have stalled forward of the weekend, whereas the rise in net-long curiosity has fueled the crowding habits in USD/CAD as 61.74% of merchants had been net-long the pair earlier this week.

With that stated, USD/CAD might proceed to consolidate forward of the following BoC assembly because it seems to be caught in a slender vary, however swings in threat urge for food sway the alternate fee because the US Greenback nonetheless broadly displays an inverse relationship with investor confidence.

Really useful by David Tune

Study Extra In regards to the IG Shopper Sentiment Report

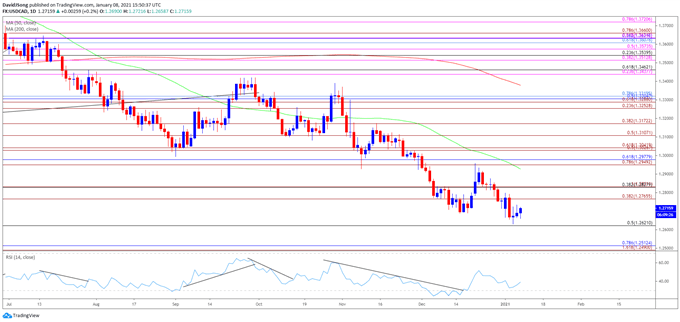

USD/CAD Charge Day by day Chart

Supply: Buying and selling View

- Take into account, USD/CAD cleared the January low (1.2957) following the US election, with the alternate fee buying and selling to contemporary yearly lows in November and December because the Relative Power Index (RSI) established a downward development.

- USD/CAD began off 2021 by taking out final 12 months’s low (1.2688) although the RSI has broke out of the bearish formation, with lack of momentum to carry above the 1.2770 (38.2% growth) area pushing the alternate fee in direction of the 1.2620 (50% retracement) space.

- Nevertheless, the failed try to check the 1.2620 (50% retracement) space might result in a near-term correction in USD/CAD because the RSI seems to be reversing forward of oversold territory, with a break/shut above 1.2770 (38.2% growth) bringing the 1.2830 (38.2% retracement) area again on the radar.

Really useful by David Tune

Traits of Profitable Merchants

— Written by David Tune, Foreign money Strategist

Observe me on Twitter at @DavidJSong