USD/CAD has been on a bearish development for greater than a yr, shedding greater than 26 cents from high to backside. The USD decline, coupled wit

USD/CAD has been on a bearish development for greater than a yr, shedding greater than 26 cents from high to backside. The USD decline, coupled with rising Oil costs have been holding this pair bearish, with retraces larger being very weak and short-lived.

Now we have been promoting the retraces up, primarily towards shifting averages. Earlier right now we noticed an try for an additional retrace up, however that was fairly weak, ending on the 20 SMA (grey) and the bearish development resumed once more.

USD/CAD Reside Chart

USD/CAD

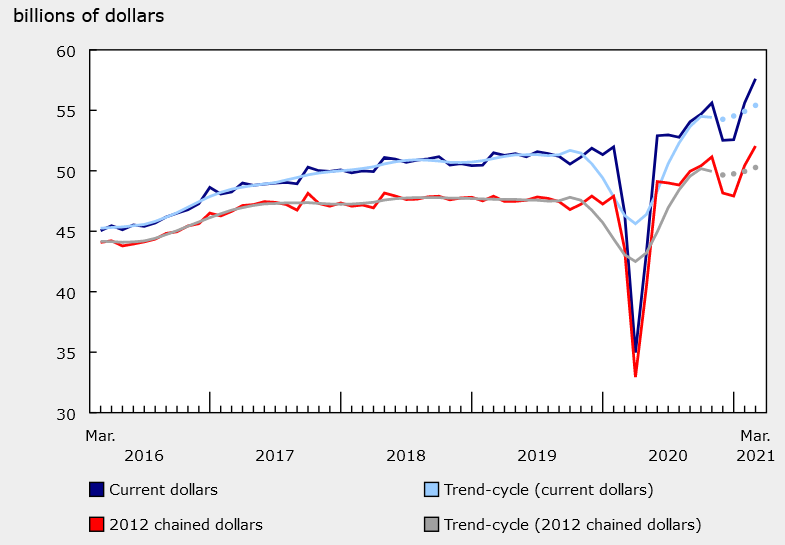

The retail gross sales report for March from Canada was optimistic once more, exhibiting that this yr the scenario is a lot better, regardless of the restrictions within the nation. So, the decline continues right here and we are going to attempt to promote retraces larger each time we see one.

Canada March 2021 Retail Gross sales Report

- March retail gross sales +3.6% vs +2.3% anticipated

- February gross sales have been +4.8% (revised to five.8%)

- Estimates ranged from +2.3% to +3.6%

- Statistics Canada advance estimate for March was +2.3%

- Core retail gross sales ex autos +4.3% vs +2.3% anticipated

- February core gross sales have been 4.8% (revised to five.6%)

- Gross sales up in 10 of 11 sub-sectors

- April advance estimate m/m -5.1% (based mostly on 46% of responses)

- Gross sales rose 1.8% in Q1

- Constructing materials and backyard tools and provides sellers +19.8% as a result of higher spring climate

- Clothes and niknaks +23.6%

- Meals and beverage shops -1.3% led by grocery shops

- Full report

April was locked down closely in a lot of Canada and continues to be so, however retail gross sales have been curbed. It’s powerful to guess what was anticipated within the month however -5.1% isn’t that unhealthy contemplating the severity of the lockdown.

Anticipate that March would be the excessive water mark not less than till June. It’s a troublesome time to commerce this report since you don’t know what represents unanticipated demand and what’s lockdown-related. Notably, clothes gross sales have been extraordinarily robust in quite a few nations after being extraordinarily depressed all through the pandemic. There’s an investing concept there.