It’s been an enormous, bearish week for the USD/CAD. Charges are down by greater than 200 pips (-1.55%) up to now 5 buying and selling periods. Th

It’s been an enormous, bearish week for the USD/CAD. Charges are down by greater than 200 pips (-1.55%) up to now 5 buying and selling periods. This marks the biggest such sell-off because the 2-6 November plunge.

One of many key drivers of the downtrend is stronger WTI crude oil costs. For the month of November, WTI futures spiked by greater than 25%. December has introduced extra of the identical, as costs are up one other 2%. Subsequently, North American producers have taken discover and chosen to develop operations. Because of this, the weekly Baker-Hughes Rig Rely got here in at 246, up from 241 per week in the past. In the intervening time, the markets are bullish on crude oil going into the Northern Hemisphere winter season.

Apart from the rise in oil, this morning noticed Canadian Unemployment (Nov.) fall to eight.5% from 8.9% month-over-month. Contemplating this morning’s disappointing U.S. Non-Farm Payrolls numbers, right this moment’s steep intraday downtrend within the USD/CAD comes as little shock.

USD/CAD Extends Weekly Losses

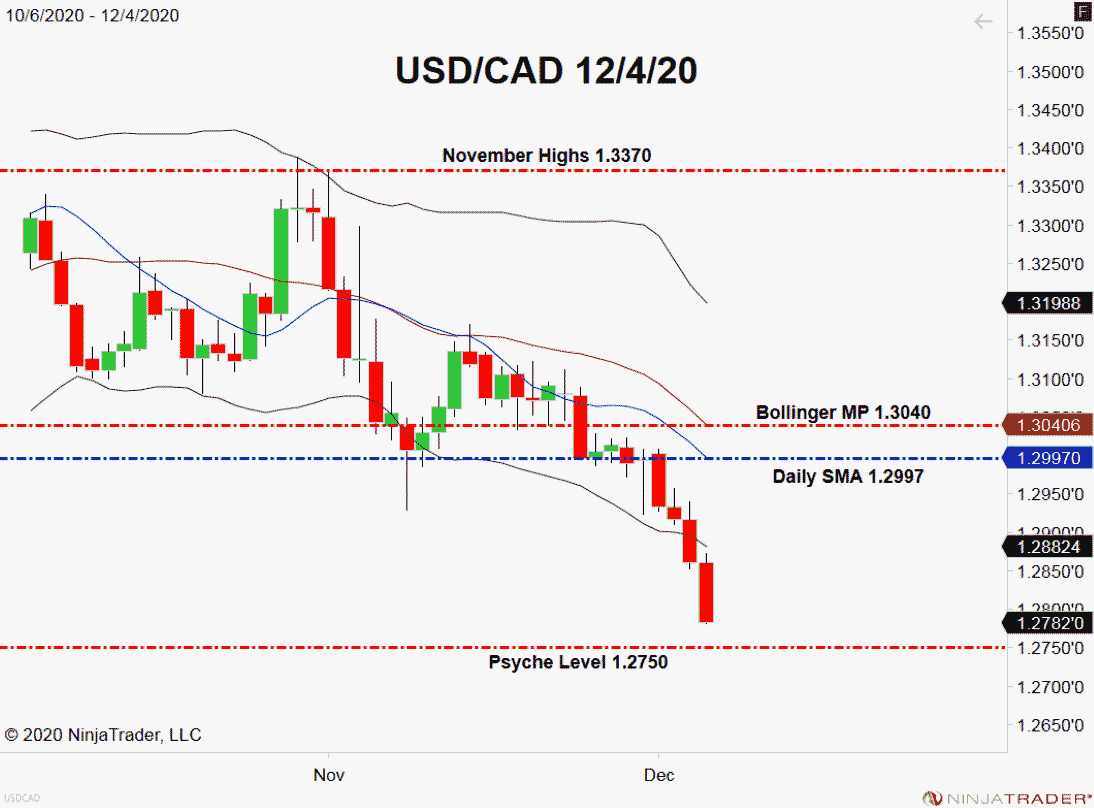

December has began with a bang for the USD/CAD. Charges have already taken out November’s lows and are driving towards 1.2750.

+2020_12_04+(11_39_45+AM).png)

Overview: Very similar to different markets, there aren’t an entire lot of technical ranges to commerce within the Loonie. Proper now, about the one numbers on my radar are the psyche obstacles at 1.2750 and 1.2800. Given the energy of the present downtrend, a robust short-side bias is warranted. Any buys are excessive threat and ought to be approached with excessive warning.

The USD/CAD is presently buying and selling at ranges final seen in Might of 2018. From a macro perspective, the 78% retracement from 2018’s low (1.2248) to 2020’s excessive (1.4667) is 1.2779. Be looking out for charges to consolidate on this space; if we see indicators of pattern exhaustion, a shopping for alternative could arrange for subsequent week.