Canadian Greenback Speaking FactorsUSD/CAD seems to be reversing course forward of the 2016 excessive (1.4690) and the alternate

Canadian Greenback Speaking Factors

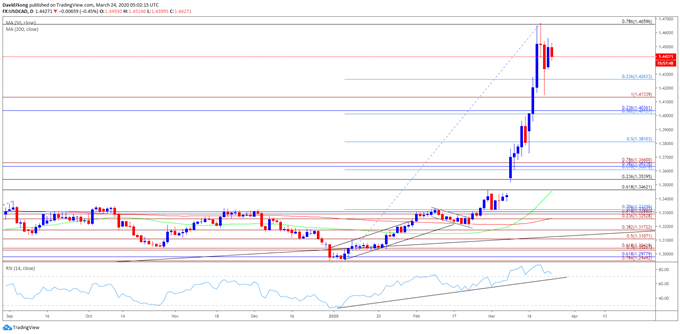

USD/CAD seems to be reversing course forward of the 2016 excessive (1.4690) and the alternate price could stage a bigger pullback over the rest of the month because the Relative Energy Index (RSI) seems to be on its method to flash a textbook promote sign.

USD/CAD Ranges to Watch Following Failed Try to Take a look at 2016 Excessive

USD/CAD consolidates because the Federal Reserve publicizes extra measures to fight the provision/demand shock, and the alternate price could proceed to pullback from the recent yearly excessive (1.4667) as main central banks take unprecedented steps to counter the weakening outlook for development.

The Federal Open Market Committee (FOMC) seems to be on monitor to unveil extra measures as Chairman Jerome Powell and Co plan toset up“a Primary Road Enterprise Lending Program to assist lending to eligible small-and-medium sized companies,” and its appears as if the worldwide group of central banks will depend on unconventional instruments to assist their economic system because the Financial institution of Canada (BoC) launches the Standing Time period Liquidity Facility (STLF), with this system meant to “present loans to eligible monetary establishments in want of momentary liquidity assist.”

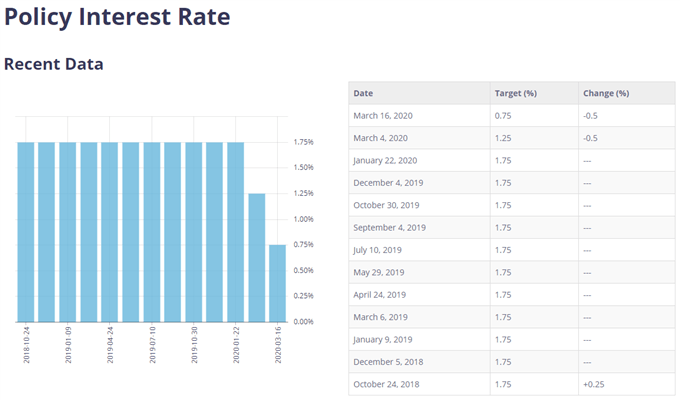

With that mentioned, the BoC could come beneath stress to ship a price minimize on the subsequent assembly on April 15 because the “Governing Council stands prepared to regulate financial coverage additional,” and the Canadian Greenback could proceed to depreciate in opposition to its US counterpart because the dollar advantages from the flight to security.

In flip, USD/CAD could proceed to exhibit a bullish conduct over the approaching months, however the advance from the 2020 low (1.2957) appears to have stalled forward of the 2016 excessive (1.4690) as the Relative Energy Index (RSI) seems to be on its method to flash a textbook promote sign.

Recommended by David Song

Forex for Beginners

Join and be a part of DailyFX Foreign money Strategist David Tune LIVE for a possibility to debate potential commerce setups.

USD/CAD Fee Day by day Chart

Supply: Buying and selling View

- Take into account, the near-term energy in USD/CAD emerged following the failed try to interrupt/shut beneaththe Fibonacci overlap round 1.2950 (78.6% growth) to 1.2980 (61.8% retracement), with the yearly opening vary highlighting the same dynamic as the alternate price failed to check the 2019 low (1.2952) in the course of the first full week of January.

- There seems to be shift in USD/CAD conduct because the alternate price breaks out of the vary from the fourth quarter of 2019 and clears the October excessive (1.3383), with the Relative Energy Index (RSI) highlighting the same dynamic because the oscillator continues to trace the upward pattern from earlier this yr.

- Nonetheless, the advance from the 2020 low (1.2957) appears to have stalled forward of the 2016 excessive (1.4690), and the alternate price could stage a bigger pullback over the approaching days because the Relative Energy Index (RSI) seems to be on its method to flash a textbook promote sign.

- Will maintain an in depth eye on the RSI because it falls again from an excessive studying, with a break of the upward pattern more likely to be accompanied by a decline within the USD/CAD because the bullish momentum abates.

- In flip, the failed try to shut above the 1.4660 (78.6% retracement) area could push USD/CAD again in the direction of 1.4270 (23.6% retracement), with the following space of curiosity coming in round 1.4130 (100% growth) adopted by the Fibonacci overlap round 1.4020 (38.2% retracement) to 1.4040 (23.6% retracement).

Recommended by David Song

Traits of Successful Traders

— Written by David Tune, Foreign money Strategist

Comply with me on Twitter at @DavidJSong