Bank of Canada, BoC, USD/CAD, Canadian Dollar, Inflation, Federal Reserve – Talking PointsBank of Canada elects to raise benchmark interest rate by 0

Bank of Canada, BoC, USD/CAD, Canadian Dollar, Inflation, Federal Reserve – Talking Points

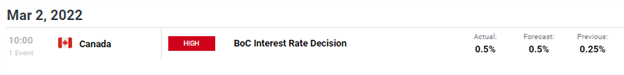

- Bank of Canada elects to raise benchmark interest rate by 0.25% to 0.50%

- USD/CAD off session lows, price underpinned by 50-day MA at 1.2684

The Bank of Canada (BoC) elected to raise its benchmark interest rate by 0.25% on Wednesday, signaling an end to pandemic-era monetary policy. The hike comes as the country looks to remove accommodation amid robust inflation pressures that were previously forecasted to be temporary. In the policy statement, the BoC stated that interest rates will need rise further and that price increases “have become more pervasive.” The hike represents the first since 2018, with markets forecasting as many as 5 additional hikes over the next 12 months.

Canadian Economic Calendar

Courtesy of the DailyFX Economic Calendar

Wednesday’s interest rate decision only constituted a statement, and no new economic forecasts. Market participants will eagerly await Bank of Canada Governor Tiff Macklem’s press conference on Thursday, where he will take questions on the state of the Canadian recovery. At his January press conference, Macklem indicated that higher borrowing costs were “imminent” as the economy had reached full capacity.

USD/CAD Daily Chart

Chart created with TradingView

USD/CAD was muted in the aftermath of the rate hike, following a brief spike of Loonie strength. Market participants may instead be placing more emphasis on Fed Chair Jerome Powell’s semi-annual testimony in Congress, which also started at 15:00 GMT. USD/CAD downside appears limited by the 50-day moving average (MA), which has supported price during Wednesday’s session.

The pair has been choppy and rangebound throughout February, as surging crude prices clash with safe-haven flows amid rising geopolitical tensions. Should price continue to hold the 50-day MA, USD/CAD could look to retest the Jan. high around 1.2814, which has acted as a strong buffer for price in February.

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

— Written by Brendan Fagan, Intern

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com