USD/CAD PRICE OUTLOOK: CANADIAN DOLLAR SPIKES HIGHER WITH CRUDE OIL ON PFIZER VACCINE NEWSUSD/CAD worth motion plummets to contem

USD/CAD PRICE OUTLOOK: CANADIAN DOLLAR SPIKES HIGHER WITH CRUDE OIL ON PFIZER VACCINE NEWS

- USD/CAD worth motion plummets to contemporary yearly lows because the Canadian Greenback surges with oil

- Crude oil costs explode larger in response to encouraging coronavirus vaccine headlines

- The Canadian Greenback might proceed climbing towards safe-haven currencies like USD, JPY

The Canadian Greenback is hovering towards anti-risk FX friends just like the US Greenback and Japanese Yen. Seemingly owing to the most recent coronavirus vaccine headlines, an eye-popping rally by crude oil costs stands out as a main driver of Canadian Greenback energy. Pfizer launched scientific trial knowledge this morning stating that its COVID-19 vaccine is greater than 90% efficient, which appears to have re-charged the fabric enchancment in market sentiment following the US election final week.

Beneficial by Wealthy Dvorak

Introduction to Foreign exchange Information Buying and selling

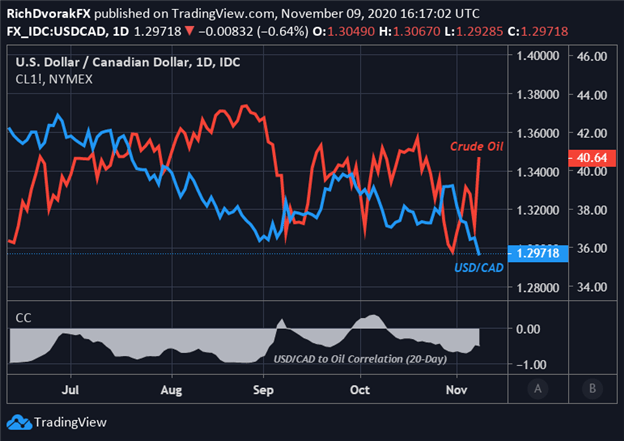

CRUDE OIL PRICE CHART WITH USD/CAD OVERLAID: DAILY TIME FRAME (11 JUN TO 09 NOV 2020)

Chart by @RichDvorakFX created utilizing TradingView

Typically talking, there’s a robust constructive relationship between the Canadian Greenback and crude oil worth motion. As such, spot USD/CAD tends to maneuver decrease because the Loonie strengthens on the again of upper crude oil costs. This inverse correlation between USD/CAD and crude oil is illustrated within the chart above. The Canadian Greenback thus exhibits potential to increase its advance, notably towards safe-haven currencies just like the US Greenback and Japanese Yen, whereas expectations for financial progress and danger urge for food enhance in response to fading coronavirus issues.

| Change in | Longs | Shorts | OI |

| Each day | -30% | 24% | -9% |

| Weekly | -40% | 14% | -20% |

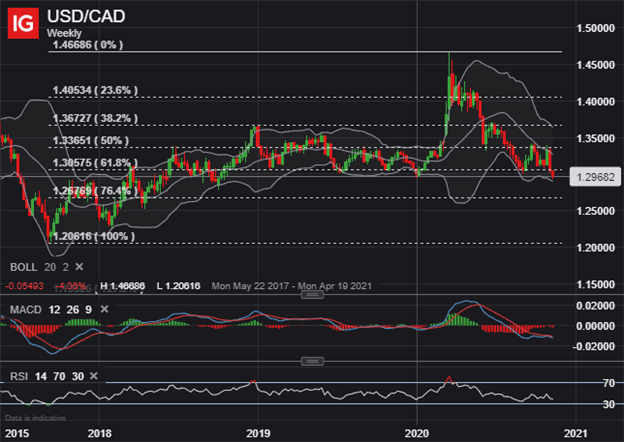

USD/CAD PRICE CHART: WEEKLY TIME FRAME (MAY 2017 TO NOVEMBER 2020)

USD/CAD worth motion now hovers at year-to-date lows following a 400-pip plunge during the last seven buying and selling periods. This got here subsequent to the formation of a double-top sample across the 1.3400-hande, which additionally aligned with a rejection of the 20-week easy transferring common. Latest Canadian Greenback energy towards the Buck briefly pushed the main forex pair under the 1.2950-price mark, however spot USD/CAD bulls are at present making an attempt to defend 2019 lows.

| Change in | Longs | Shorts | OI |

| Each day | 17% | -7% | 13% |

| Weekly | 55% | -62% | 5% |

Nonetheless, with anticipated market volatility imploding as measured by the S&P 500-derived VIX, or fear-gauge, coupled with crude oil costs spiking larger, there is perhaps potential for USD/CAD to proceed edging decrease. This might convey the 76.4% Fibonacci retracement stage of its September 2017 to March 2020 bullish leg into focus as an space of technical assist that will alleviate promoting stress. However, if a return of danger aversion and reversal in crude oil costs materializes, this might gasoline a rebound larger in USD/CAD worth motion.

— Written by Wealthy Dvorak, Analyst for DailyFX.com

Join with @RichDvorakFX on Twitter for real-time market perception