Swiss Franc, USD/CHF, EUR/CHF, SNB – Speaking FactorsSwiss Franc steadies versus the Euro and US Greenback after weak begin to yrSight deposits co

Swiss Franc, USD/CHF, EUR/CHF, SNB – Speaking Factors

- Swiss Franc steadies versus the Euro and US Greenback after weak begin to yr

- Sight deposits cooled however stay traditionally elevated as intervention continues

- Weaker Franc takes stress off foreign money intervention, boosting CPI pressures

Uncover what sort of foreign exchange dealer you’re

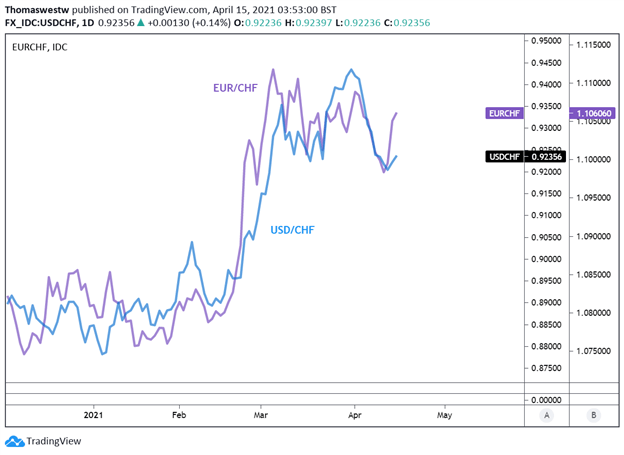

The Swiss Franc’s month-to-month transfer is on observe to understand relative to the US Greenback for the primary time since December of 2020. The transfer by means of the primary three months of this yr in opposition to the Buck noticed USD/CHF rise to its highest mark since July 2020, easing stress on the Swiss Nationwide Financial institution (SNB) to chill its home foreign money intervention following a rampant pandemic-fueled strengthening in CHF.

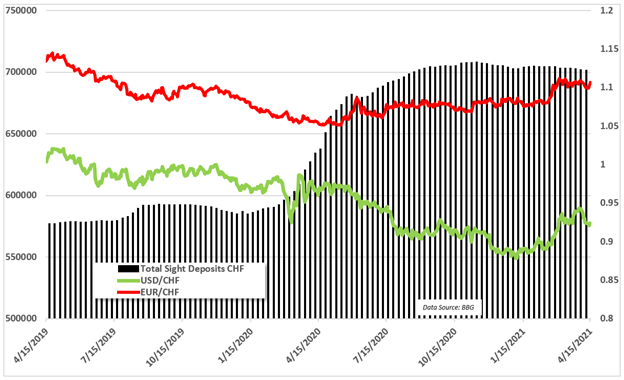

The appreciation within the Franc in opposition to the US Greenback and Euro in 2020 led the Swiss Nationwide Financial institution to extend sight deposits – a mechanism used to affect the Franc’s change charge – to report ranges in a bid to manage the Franc’s livid appreciation. As an export-driven economic system, a stronger Franc locations downward stress on costs in Switzerland, which is an undesirable impact in opposition to the prevailing macroeconomic panorama.

Swiss Nationwide Financial institution Sight Deposits versus USD/CHF, EUR/CHF

Intervention by the SNB has since cooled however stays elevated in historic reference. The nation’s foreign money intervention caught the attention of the USA following the motion seen in 2020 when the US labeled Switzerland a foreign money manipulator. The central financial institution’s chief, Thomas Jordan, was undeterred, stating the label may have “no affect on our financial coverage.”

Nonetheless, the newest SNB financial coverage assertion did ease off on language surrounding foreign money intervention. This could possibly be because of the foreign money manipulator label being slapped on in December, the Franc’s latest depreciation versus the Euro and US Greenback, or a mixture of the 2.

Regardless, the SNB’s intervention will seemingly proceed, as affirmed by SNB chief Jordan final month. Whereas intervention has cooled barely, any main strengthening in CHF will seemingly translate to an uptick in sight deposits. Swiss coverage makers might want to fastidiously steadiness coverage going ahead, as a miscalculation or early signaling in tightening coverage could drive vital Franc energy.

USD/CHF, EUR/CHF Each day Chart

Chart created with TradingView

USD/CHF, EUR/CHF TRADING RESOURCES

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the feedback part beneath or @FxWestwateron Twitter

aspect contained in the

aspect. That is in all probability not what you meant to do!nn Load your software’s JavaScript bundle contained in the aspect as an alternative.www.dailyfx.com