Chinese Yuan, USD/CNH, China PMI, OPEC, Technical Forecast - Talking PointsYuan strength eases versus US Dollar, but USD/CNH near yearly lowsChine

Chinese Yuan, USD/CNH, China PMI, OPEC, Technical Forecast – Talking Points

- Yuan strength eases versus US Dollar, but USD/CNH near yearly lows

- Chinese PMI data for November on tap, including Hong Kong data

- USD/CNH looks poised to continue lower after bearish MACD cross

Friday’s Asia-Pacific Forecast

Asia-Pacific markets will look to extend a round of dip-buying seen on Wall Street overnight as traders shrugged off Omicron fears. The Dow Jones Industrial Average (DJIA) closed 1.82% higher in New York. An upbeat initial jobless claims figure showed the labor market in the United States remains tight. The data pushed the median estimate for tomorrow’s highly-anticipated non-farm payrolls report up to 550k. In the meantime, traders will be assessing fresh PMI data for China and Hong Kong due out today.

The Chinese Yuan weakened versus the US Dollar overnight, although USD/CNH remains near its lowest levels of the year. Strong Chinese export growth this year has helped propel the Yuan in 2021 despite serious concerns in the domestic property sector and a firmer US Dollar. Moreover, Chinese corporations typically increase their conversion of US Dollars into the domestic currency in December, which could help prop up the Yuan.

Asia will see PMI data for Hong Kong and China cross the wires today. China’s services sector has seen upward momentum in recent months, helping to quell fears of an economic slowdown in the country. An improved services PMI reading for November may help the Yuan’s positioning versus the Greenback. The Caixin manufacturing survey showed a contraction for November, although NBS data rose into expansion territory. Caixin focuses on smaller and medium-size firms, whereas the NBS data caters more to large firms.

India and Singapore will also report PMI data for November, with India’s services sector expected to remain in expansion although at a slower pace. Elsewhere, oil prices saw marginal gains after OPEC and its allies decided to boost the cartel’s total production by an additional 400k barrels a day in January. However, the group left the meeting open, which will allow sudden changes if needed amid the pandemic.

USD/CNH Technical Forecast

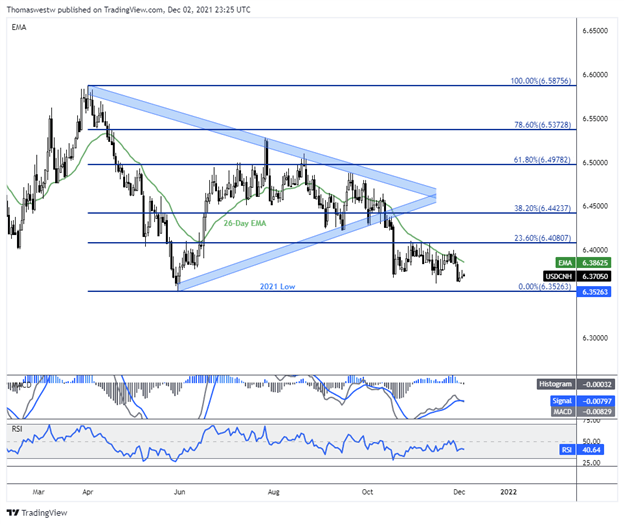

USD/CNH has languished near its 2021 low (6.3526) since a sharp drop in October from a Symmetrical Triangle. Since then, the 23.6% Fibonacci retracement level from the yearly high/low has capped upside movement, along with the falling 26-day Exponential Moving Average (EMA). Prices may extend lower following a bearish MACD crossover below the signal line in negative territory. Breaking the yearly low will likely bring additional weakness.

USD/CNH Daily Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com