After a summer season stuffed with FED QE and authorities stimulus, the USD has taken it on the chin vs the majors. Nonetheless, early August is s

After a summer season stuffed with FED QE and authorities stimulus, the USD has taken it on the chin vs the majors. Nonetheless, early August is shaping as much as be a bit totally different. Foreign exchange gamers are standing pat for the second, apparently pleased with the buck at present ranges. In fact, the calm by no means lasts ― we’re doubtless in for an energetic Monday following the weekend break.

On the commodity entrance, WTI crude oil is off greater than $0.75 for the session on the heels of an especially-bleak Baker Hughes Rig Rely. The U.S. rely got here in at 176, down from 180 final week. So, American shale continues to contract in response to final spring’s oil market meltdown.

One other massive commodity story is at present’s 2% drop in gold. Costs stay above $2000.00, nevertheless it seems like we’re going to see consolidation on this space. Be looking out for an prolonged interval of horizontal motion with $2000.00 being a catalyst for 2-way motion.

Let’s take a more in-depth take a look at the USD as we roll towards the weekend break.

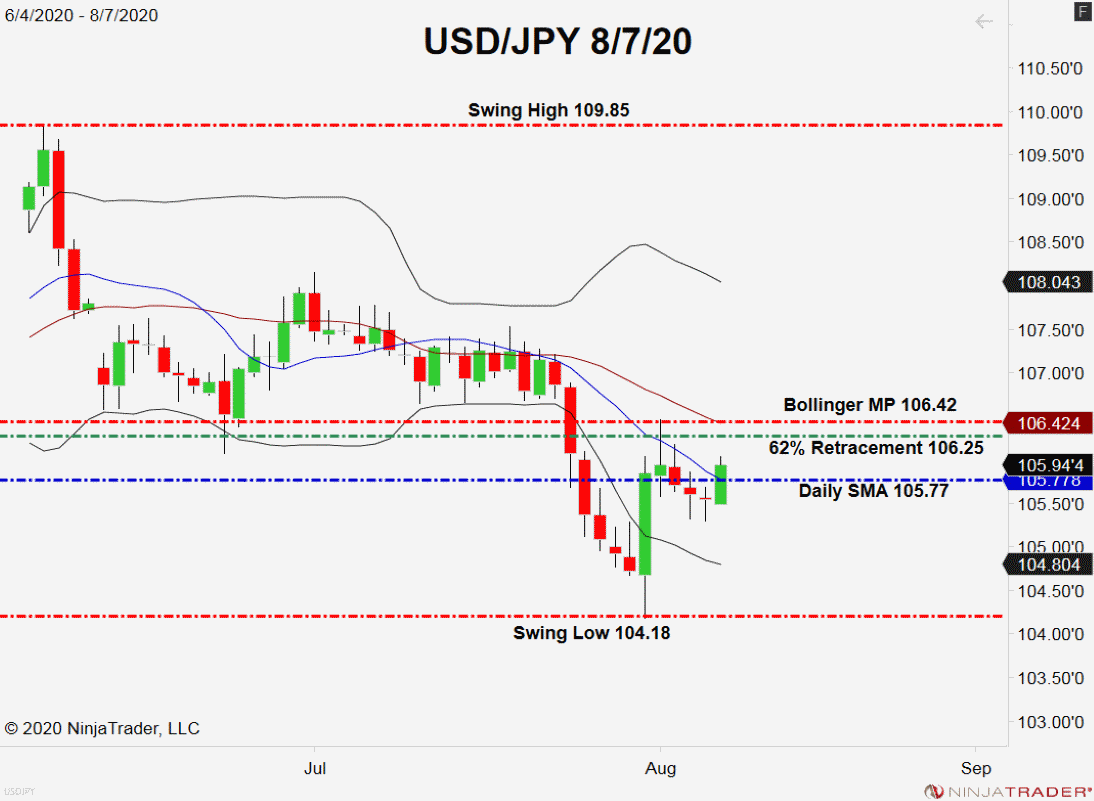

USD/JPY Rallies Forward Of Weekend

In a Dwell Market Replace from yesterday, I issued a short-trade advice for the USD/JPY. The commerce initially carried out properly, producing a 20+ pip optimistic transfer. Nonetheless, bids are profitable the day and value has reversed course. As of this writing, the commerce remains to be alive with the stop-loss at 106.09 but to be hit.

+2020_08_07+(11_37_52+AM).png)

Listed here are the degrees to observe for early subsequent week:

- Resistance(1): 62% Retracement, 106.25

- Resistance(2): Bollinger MP, 106.42

- Help(1): Day by day SMA, 105.77

Backside Line: If the present bull run within the USD/JPY continues after the weekend, I’ll be seeking to promote the 62% Retracement from 106.24. With an preliminary cease loss at 106.54, this commerce produces 30 pips on a typical 1:1 danger vs reward ratio.