Japanese Yen Speaking FactorsUSD/JPY approaches pre-pandemic ranges because the 10-Yr Treasury yield climbs to a contemporary yea

Japanese Yen Speaking Factors

USD/JPY approaches pre-pandemic ranges because the 10-Yr Treasury yield climbs to a contemporary yearly excessive (1.77%) forward of April, and the alternate price seems to be on observe to check the March 2020 excessive (111.72) because the Relative Power Index (RSI) holds above 70 and sits in overbought territory.

USD/JPY Rally Eyes March Excessive as RSI Sits in Overbought Territory

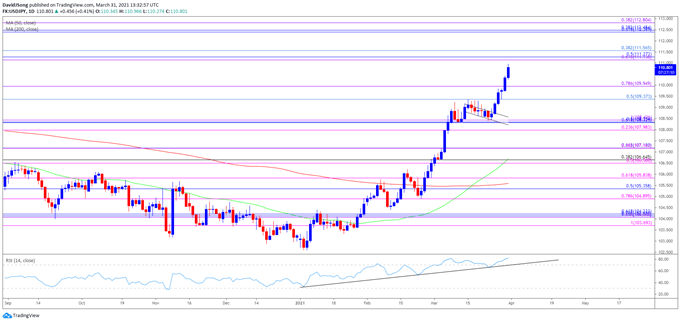

USD/JPY trades to a contemporary yearly excessive (110.97) as a bull flag formation unfolds in March, with a ‘golden cross’ formation taking shake throughout the identical interval because the 50-Day SMA (106.70) crossed above the 200-Day SMA (105.60).

The RSI displays the same dynamic because it continues to trace the upward pattern from the beginning of the 12 months, and the overbought studying within the oscillator is more likely to be accompanied by an extra appreciation in USD/JPY just like the conduct seen earlier this month.

Latest developments surrounding the USD/JPY rally signifies a possible shift in market conduct because the RSI pushes into overbought territory for the primary time since February 2020, and the US Greenback might proceed to outperform the Japanese Yen despite the fact that the Federal Reserve stays on observe to “improve our holdings of Treasury securities by a minimum of $80 billion per thirty days and of company mortgage-backed securities by a minimum of $40 billion per thirty days” amid the continued rise in longer-dated US Treasury yields.

It stays to be seen if the replace the Non-Farm Payrolls (NFP) report will affect the near-term outlook for USD/JPY because the US financial system is anticipated so as to add 650Ok jobs in March, however an extra enchancment within the labor market might preserve the Dollar afloat because it places strain on the Federal Open Market Committee (FOMC) to undertake a much less dovish ahead steering for financial coverage.

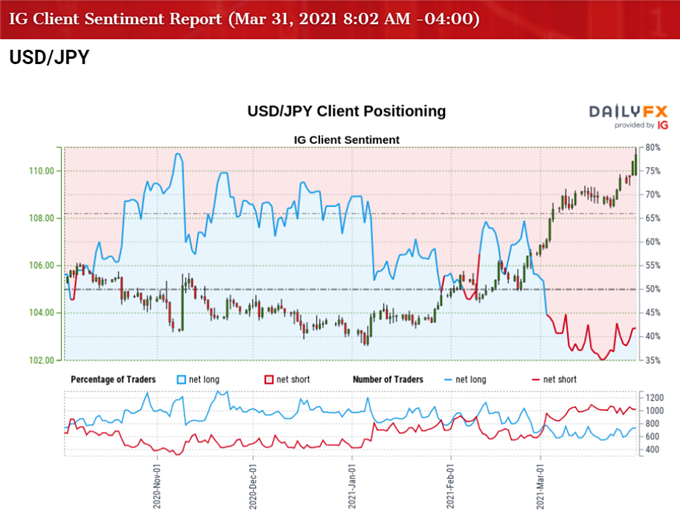

In the meantime, the appreciation in USD/JPY has spurred a extra materials shift in retail sentiment as merchants flip net-short for the second time this 12 months, with the IG Consumer Sentiment report exhibiting 40.56% of merchants at present net-long the pair as the ratio of merchants quick to lengthy stands at 1.47 to 1.

The variety of merchants net-long is 11.70% decrease than yesterday and 1.48% decrease from final week, whereas the variety of merchants net-short is 0.82% decrease than yesterday and seven.33% decrease from final week. The decline in net-long curiosity could possibly be a perform of revenue taking conduct as USD/JPY trades to a contemporary yearly excessive (110.97), whereas market participation seems to be thinning going into April as open curiosity stands 7.33% decrease from final week.

With that stated, the USD/JPY rally signifies a possible shift in market conduct amid the flip in retail sentiment, and the alternate price seems to be on observe to check the March excessive (111.72) because the Relative Power Index (RSI) continues to trace the upward pattern from earlier this 12 months and sits in overbought territory.

Advisable by David Music

Study Extra Concerning the IG Consumer Sentiment Report

USD/JPY Price Every day Chart

Supply: Buying and selling View

- USD/JPY approaches pre-pandemic ranges as a ‘golden cross’ materialized in March, with a bull flag formation unfolding throughout the identical interval because the alternate price trades to contemporary yearly highs.

- The Relative Power Index (RSI) highlights the same dynamic because the indicator climbs above 70 for the first time since February 2020, and the overbought studying within the oscillator is more likely to be accompanied by an extra appreciation in USD/JPY just like the conduct seen earlier this month.

- The string of failed makes an attempt to interrupt/shut beneath the 108.00 (23.6% growth) to 108.40 (100% growth) area has pushed USD/JPY above the Fibonacci overlap round 109.40 (50% retracement) to 110.00 (78.6% growth), with the following space of curiosity coming in round 111.10 (61.8% growth) to 111.60 (38.2% retracement) space on the radar,which largely traces up with the March 2020 excessive (111.72).

- The following space of curiosity is available in round 112.40 (61.8% retracement) to 112.80 (38.2% growth), and the RSI might proceed to indicate the bullish momentum gathering tempo so long as it tracks the upward pattern from earlier this 12 months and holds above 70.

Advisable by David Music

Traits of Profitable Merchants

— Written by David Music, Forex Strategist

Observe me on Twitter at @DavidJSong

ingredient contained in the

ingredient. That is most likely not what you meant to do!nn Load your utility’s JavaScript bundle contained in the ingredient as an alternative.www.dailyfx.com