Japanese Yen Speaking FactorsThe USD/JPY rally unravels following the failed try to check the March 2020 excessive (111.72), and

Japanese Yen Speaking Factors

The USD/JPY rally unravels following the failed try to check the March 2020 excessive (111.72), and up to date developments within the Relative Energy Index (RSI) point out an extra decline within the change charge because the oscillator falls again from overbought territory to mirror a textbook promote sign.

USD/JPY Vulnerable to Bigger Pullback as RSI Promote Sign Emerges

USD/JPY extends the sequence of decrease highs and lows from earlier this week to largely observe the pullback in longer-dated US Treasury yields, and the bearish value sequence could push the change charge in the direction of former resistance because it searches for help.

It stays to be seen if the decline from the March excessive (110.97) will turn into a correction or a shift in pattern as a ‘golden cross’ takes form in 2021, and the broader rise in longer-dated Treasury yields could maintain the change charge afloat because the above-forecast print for US Non-Farm Payrolls (NFP) places strain on the Federal Reserve to cut back its emergency measures.

Nonetheless, the Federal Open Market Committee (FOMC) seems to be in no rush to change gears because the central again stays on observe to “enhance our holdings of Treasury securities by at the least $80 billion monthly and of company mortgage-backed securities by at the least $40 billion monthly,” and the minutes from the March assembly could underscore a dovish ahead steerage for financial coverage as most Fed officers see the benchmark rate of interest siting close to zero by way of 2023.

In flip, the FOMC Minutes could maintain USD/JPY beneath strain if Chairman Jerome Powell and Co. present a higher willingness to handle the rise longer-dated US Treasury through ‘Operation Twist,’ however extra of the identical from the Fed could prop up the change charge as contemporary information prints popping out of the US financial system level to a stronger restoration.

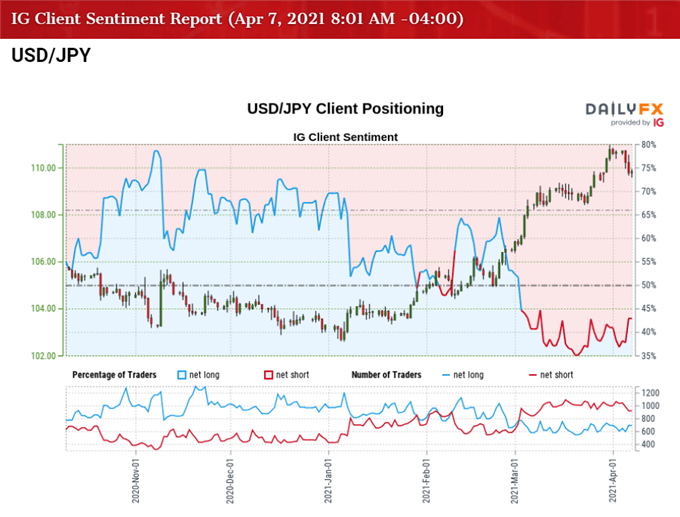

In the meantime, the appreciation in USD/JPY has spurred a shift in retail sentiment as merchants flip net-short for the second time this 12 months, with the IG Consumer Sentiment reportdisplaying 43.85% of merchants at present net-long the pair as the ratio of merchants brief to lengthy at 1.28 to 1.

The variety of merchants net-long is 12.46% greater than yesterday and 10.09% greater from final week, whereas the variety of merchants net-short is 5.93% decrease than yesterday and three.80% decrease from final week. The rise in net-long place has helped to alleviate the lean in retail sentiment as 40.56%, whereas the decline in net-short curiosity could possibly be a operate of revenue taking conduct as USD/JPY bounce again from a contemporary weekly low (109.58).

With that mentioned, the USD/JPY rally signifies a possible shift in market conduct amid the flip in retail sentiment, however current developments within the Relative Energy Index (RSI) point out an extra decline within the change charge because the oscillator falls again from overbought territory to snap the upward pattern established at first of the 12 months.

Beneficial by David Music

Be taught Extra Concerning the IG Consumer Sentiment Report

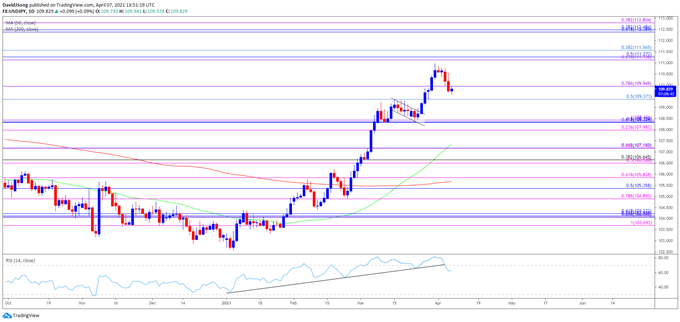

USD/JPY Price Every day Chart

Supply: Buying and selling View

- USD/JPY approaches pre-pandemic ranges as a ‘golden cross’ materialized in March, with a bull flag formation unfolding throughout the identical interval because the change charge trades to contemporary yearly highs.

- The Relative Energy Index (RSI) confirmed an identical dynamic because the indicator climbed above 70 for the first time since February 2020, however current developments within the oscillator point out an extra decline within the change charge as it falls again from overbought territory to snap the upward pattern established at first of the 12 months.

- In flip, the USD/JPY rally unravels following the failed try to check the March 2020 excessive (111.72), with the current sequence of decrease highs and lows elevating the scope for a take a look at of the previous resistance zone round 109.40 (50% retracement) to 110.00 (78.6% enlargement).

- Subsequent space of curiosity is available in round 108.00 (23.6% enlargement) to 108.40 (100% enlargement) adopted by the 107.20 (61.8% enlargement) area, which largely traces up with the 50-Day SMA (107.34).

- Nonetheless, lack of momentum to shut under the previous resistance zone round 109.40 (50% retracement) to 110.00 (78.6% enlargement) could maintain the 111.10 (61.8% enlargement) to 111.60 (38.2% retracement) space on the radar, with the subsequent space of curiosity coming in round 112.40 (61.8% retracement) to 112.80 (38.2% enlargement).

Beneficial by David Music

Traits of Profitable Merchants

— Written by David Music, Forex Strategist

Observe me on Twitter at @DavidJSong

factor contained in the

factor. That is most likely not what you meant to do!nn Load your utility’s JavaScript bundle contained in the factor as an alternative.www.dailyfx.com