In what has been a dreadful week for the USD, Thursday has been comparatively constructive. So far at present, the Buck is displaying properly tow

In what has been a dreadful week for the USD, Thursday has been comparatively constructive. So far at present, the Buck is displaying properly towards the majors. Positive factors vs the euro have paced the motion as foreign exchange gamers price-in the enhancing U.S. labor market. With Friday on the horizon, can the greenback publish a late-week turnaround?

On the financial information entrance, the important thing occasions for at present have been the weekly jobless claims numbers. Here’s a fast take a look at the highlights:

Occasion Precise Projected Earlier

Persevering with Jobless Claims (June 26) 18.062M 18.950M 18.760M

Preliminary Jobless Claims (July 3) 1.314M 1.375M 1.413M

Preliminary Jobless Claims 4-Week Common (July 3) 1.437M NA 1.500M

In brief, unemployment claims stay traditionally excessive however are enhancing. That is prone to proceed because the 31 July deadline for the improved U.S. COVID-19 advantages quickly approaches. Because the calendar flips to August, be looking out for a dramatic drop in jobless claims.

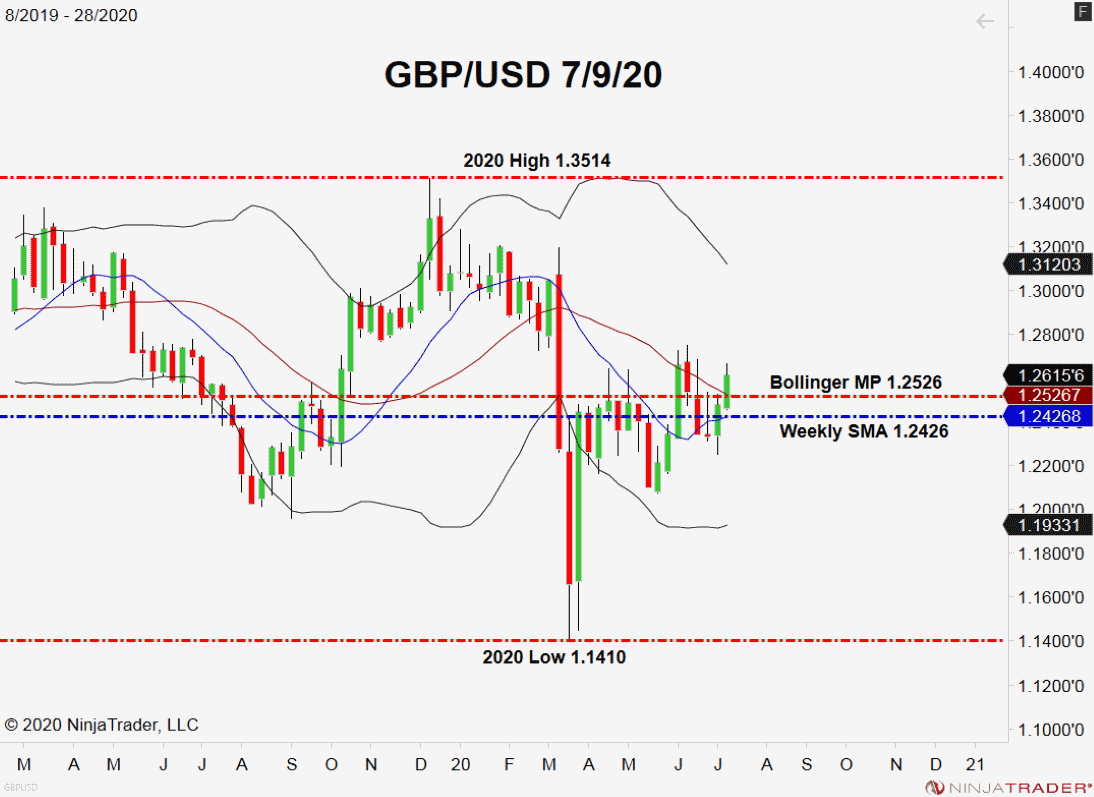

GBP/USD Falls From Weekly Highs

Not less than for now, the USD is displaying some power vs the majors. Nevertheless, the weekly efficiency of the GBP/USD paints a a lot totally different image.

+2020_28+(11_32_16+AM).png)

Backside Line: Make no mistake, the USD is presently on its again foot towards the worldwide majors. Excessive fiscal stimulus and FED QE have promoted inflation; tomorrow’s U.S. PPI figures will give us a greater concept of the place producer costs stand.

Within the occasion we see a Friday pullback within the GBP/USD, I’ll be seeking to purchase in at 1.2529. With an preliminary cease at 1.2494, this trend-following commerce produces 70 pips on a 1:2 danger vs reward administration plan.