The primary three days of December have been brutal for the Buck. Massive losses vs the majors have been highlighted by a bullish breakout within

The primary three days of December have been brutal for the Buck. Massive losses vs the majors have been highlighted by a bullish breakout within the EUR/USD and a bearish plunge within the USD/CHF. In the event you’re lengthy the US greenback, issues don’t look good as 2021 approaches.

On the financial information entrance, there have been just a few gadgets worthy of observe launched this morning. Right here’s a fast take a look at the highlights:

Occasion Precise Projected Earlier

Persevering with Jobless Claims (Nov. 20) 5.520M 5.915M 6.089M

Preliminary Jobless Claims (Nov. 27) 712Ok 775Ok 787Ok

ISM Companies PMI (Nov.) 55.9 56.0 56.6

It’s been uncommon for the previous 9 months, however there’s some excellent news on the employment entrance. Each Persevering with and Preliminary Jobless Claims are down considerably week-over-week. This comes as a shock and is actually serving to to spice up danger belongings immediately. Then again, the ISM Companies PMI fell from October however just about hit projections. All in all, this wasn’t a nasty group of stats.

Sadly for bag holders, the USD is faltering huge time vs the majors. It seems that foreign exchange gamers are anticipating extra greenback devaluation stemming from one other stimulus package deal and the Fed’s ongoing coverage of limitless QE.

USD Extends Losses Versus The Majors

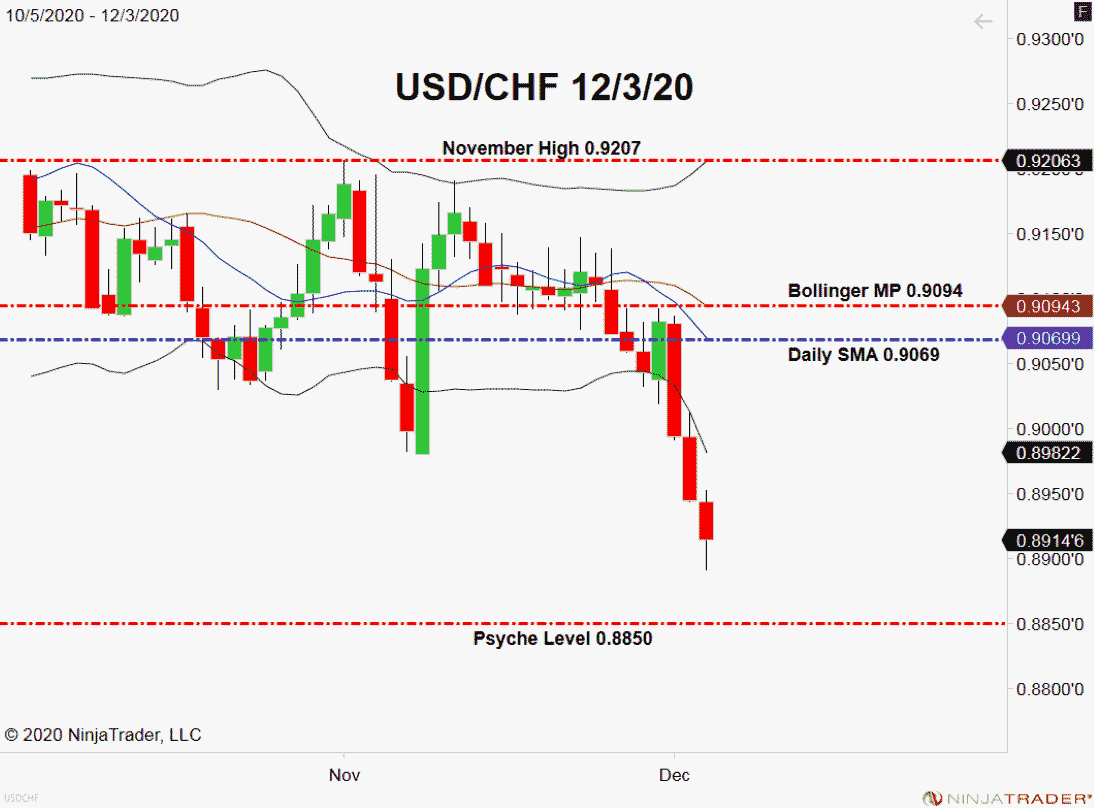

The USD/CHF every day chart under sums the scenario up for the USD ― values are in a freefall as December will get underway.

+2020_12_03+(10_52_45+AM).png)

Overview: Proper now, there aren’t a complete lot of technical ranges up for scrutiny within the USD/CHF. About the one help in sight are big-round-numbers, particularly 0.8850 and 0.8800. A bearish bias is warranted and it’s short-or-nothing towards the USD till confirmed in any other case.

Along with the dreadful efficiency towards the majors, the Buck is lagging behind the Chinese language yuan badly. Since 1 November, the USD/CNY is down roughly 2.25%. This is a vital level, because the USD/CNY is at the moment buying and selling at ranges (6.5418) not seen since June of 2018.