usd-cadSkerdian Meta•Friday, February 28, 2025•2 min read Add an article to your Reading ListRegister now to be able to add articles to your reading

USDCAD bounced 2.5 cents higher this week, after the US PCE inflation, despite a jump in Canadian GDP for Q4.

After signing a 25% tariff on imports from Canada and Mexico, President Donald Trump made several statements that fueled uncertainty. Initially, the market interpreted his remarks as a possibility of canceling the tariffs if Canada cooperated. This was followed by a postponement until early March, then speculation of another delay until April. However, Trump later clarified that the tariffs would indeed take effect in March.

During this period, the USD/CAD exchange rate experienced significant volatility. In early February, it surged to a record high of 1.4792 after a strong bullish gap, only to reverse sharply the same week with an even larger bearish candlestick, pulling the pair down to 1.4150.

USD/CAD Chart Weekly – Bouncing Hard Off the 20 SMA

Today, two key economic reports impacted the USD/CAD pair. The US PCE inflation report, the Federal Reserve’s preferred measure of inflation, was released alongside Canada’s GDP data, which was expected to show a return to growth in December after contracting in November.

US January PCE Report![US PCE]()

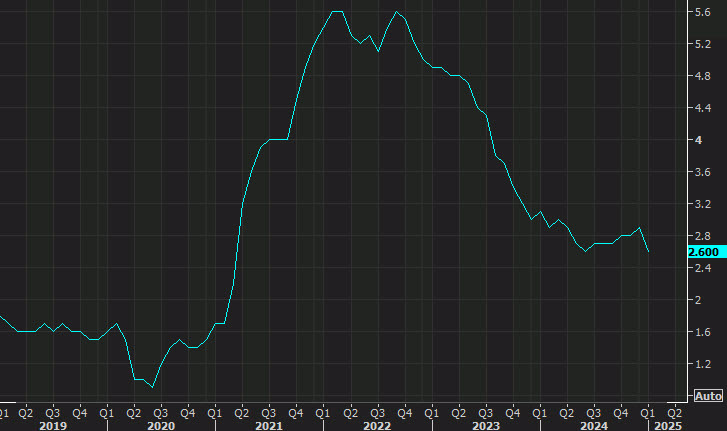

Core PCE (Excluding Food & Energy)

- Year-over-year: +2.6% (as expected, prior +2.8%)

- Month-over-month: +0.3% (as expected)

- Unrounded core: +0.285% (prior +0.156%, expected +0.27%)

- Excluding food, energy, and housing: +0.3% m/m (prior +0.2%)

- Supercore (services ex-shelter): +0.2% m/m, +3.1% y/y (lowest since Feb 2021)

Headline PCE

- Year-over-year: +2.5% (as expected)

- Month-over-month: +0.3% (as expected)

- Unrounded headline: +0.325% (prior +0.2557%, expected +0.31%)

Consumer Spending & Income (January)

- Personal income: +0.9% (expected +0.3%, prior +0.4%)

- Personal spending: -0.2% (expected +0.1%, prior +0.7% revised to +0.8%)

- Real personal spending: -0.5% (prior +0.4%, revised to +0.5%)

- Savings rate: 4.6% (prior 3.8%)

Core PCE is stabilizing, indicating inflation may be back on an improving trend. Strong income growth stands out, but lower spending, particularly on vehicles (likely due to weather), suggests a temporary dip that could reverse with better conditions.

Canada Q4 GDP Report – Key Highlights

Household spending adds to GDP growth

Stronger-than-expected growth suggests easing interest rates are supporting the economy. Household spending and exports are driving growth, potentially linked to anticipated US tariffs. US trade data aligns with this trend, indicating a possible front-loading of exports ahead of policy changes.

USD/CAD Live Chart

USD/CAD

www.fxleaders.com