USD/JPY Evaluation:The greenback has weakened in opposition to the Yen after higher than anticipated Japanese Flash Manufacturing

USD/JPY Evaluation:

- The greenback has weakened in opposition to the Yen after higher than anticipated Japanese Flash Manufacturing PMI knowledge; US Flash Manufacturing PMI out later at present

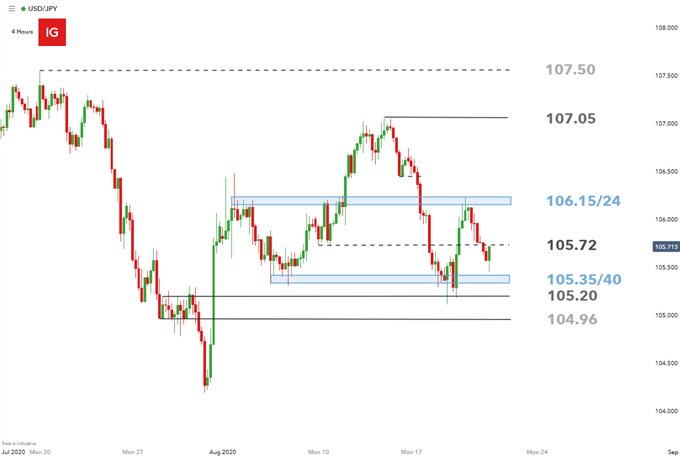

- USD/JPY seems to be buying and selling again inside a channel, nearing a zone of assist

- IG Shopper Sentiment: Current developments trace at a possible reversal of present momentum

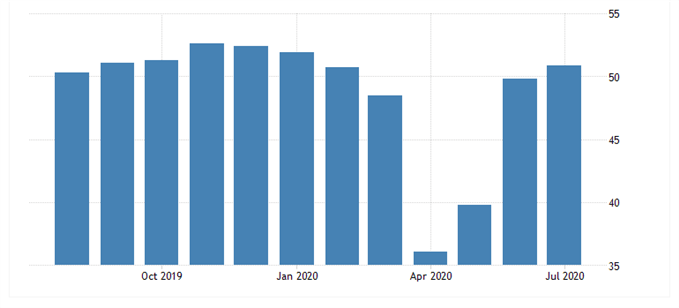

Indicators of Potential Financial Restoration Stay Unclear

Within the early hours of Friday morning, Japanese Flash Manufacturing PMI knowledge got here in at 46.6, barely higher than the estimated determine of 45. Crucially nevertheless, the upper determine stays under 50 which means that Japanese buying managers, on common, take into account the trade to nonetheless be in a contractionary part.

Why is PMI knowledge considered as an necessary main indicator for an financial system? Learn How Foreign exchange Merchants Use ISM/PMI Information

After worse than anticipated jobless claims yesterday, market individuals flip their focus to the US Advertising Flash PMI later at present. Present consensus is 51.9 which might mark the second straight month above 50 ought to expectations maintain.

Chart of US Manufacturing PMI Forward of the Information Launch (Month-to-month)

Chart Created on TradingEconomics

For all market-moving knowledge releases and occasions see the DailyFX Financial Calendar

USD/JPY Technical Ranges

Worth motion has constructed on bearish momentum which has seen the pair commerce decrease over the previous 2 days whereas buying and selling again inside the zones of assist and resistance proven by the blue rectangles. Extra just lately nevertheless, after approaching the zone of assist round 105.35 – 105.40, the worldwide reserve forex seems to have resisted a transfer decrease on the again of what seems to be quick time period greenback power (vs G10 currencies)

Within the occasion of a stronger greenback, USD bulls might take into account a break and shut above the 105.72 because the preliminary hurdle earlier than bringing into play the 106.15 – 106.24 zone of resistance.

If the demand for Japanese Yen continues on the expense of the greenback, USD/JPY bears might take into account a break and shut under the 105.35 – 105.40 zone because the litmus check for continued decrease costs. Ought to this transpire, the subsequent degree of assist turns into 105.20 adopted intently by the 104.96 degree.

USD/JPY 4-Hour Chart

Chart ready by Richard Snow, IG

Advisable by Richard Snow

What’s subsequent for the Yen? See our quarterly forecast

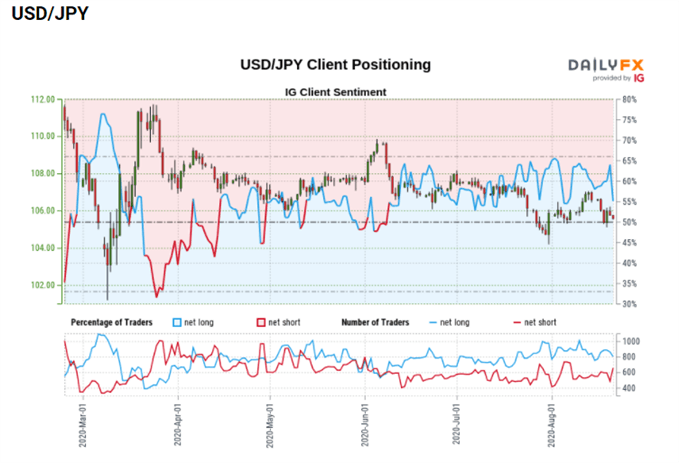

USD/JPY Sentiment knowledge hints at potential reversal

On the time of writing, USD/JPY retail dealer knowledge exhibits 53.21% of merchants are net-long with the ratio of merchants lengthy to quick at 1.14 to 1.

USD/JPY IG Shopper Sentiment

DailyFX Sentiment Chart, IG

- Nonetheless, a considerable improve in each day quick positions of 33.72% opens the door to potential reversal of the present close to time period pattern.

- Current modifications in sentiment warn that the present USD/JPY worth pattern might quickly reverse increased regardless of the very fact merchants stay net-long.

| Change in | Longs | Shorts | OI |

| Every day | -4% | 0% | -2% |

| Weekly | 1% | -2% | 0% |

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX