Dow Jones, S&P 500, Non-Farm Payrolls, Everlasting Job Losses, Fiscal Stimulus – Speaking Factors:Fairness markets gained thr

Dow Jones, S&P 500, Non-Farm Payrolls, Everlasting Job Losses, Fiscal Stimulus – Speaking Factors:

- Fairness markets gained throughout APAC commerce as traders wager on the approaching supply of further fiscal assist.

- Disappointing jobs figures for January could persuade US lawmakers to cross additional stimulus within the close to time period.

- Dow Jones and S&P 500 indices poised to proceed climbing to file highs as each indices breach key resistance.

Asia-Pacific Recap

Fairness markets climbed larger throughout Asia-Pacific commerce, as traders mulled the prospect of additional fiscal assist out of the US and cheered the continued decline in international coronavirus circumstances. Australia’s ASX 200 rose 0.59% whereas Japan’s Nikkei 225 surged 2.12%, on stories that the federal government could ease coronavirus restrictions sooner than initially scheduled.

In FX markets, the US Greenback largely outperformed alongside the Australian and New Zealand {Dollars}, whereas the Japanese Yen and Swiss France misplaced floor in opposition to their main counterparts. Gold and silver costs crept larger regardless of yields on US 10-year Treasuries climbing to their highest ranges since March of 2020.

Wanting forward, shopper confidence figures out of Mexico headline the financial docket alongside a speech from European Central Financial institution President Christine Lagarde.

DailyFX Financial Calendar

Disappointing Jobs Report Bolsters Stimulus Calls

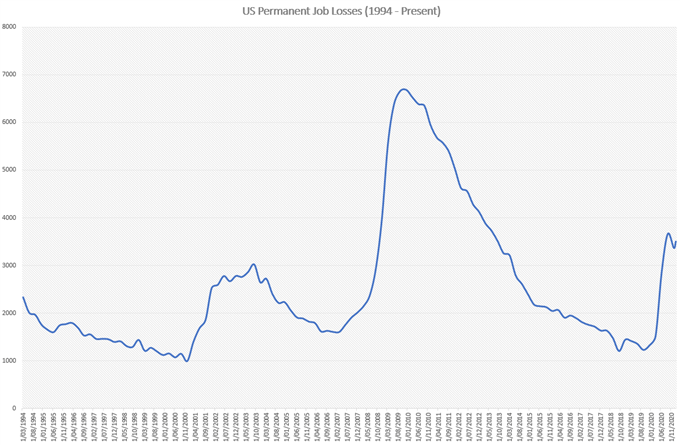

The comparatively weak tempo of job progress in January could bolster calls for extra fiscal assist and in flip underpin US fairness markets within the close to time period. Friday’s non-farm payrolls report confirmed that the native financial system added a paltry 49,000 jobs final month whereas the unemployment fee fell from 6.7% to six.3%, pushed partially by fewer individuals actively looking for employment.

Contemplating over 10 million Individuals stay jobless as a result of influence of the coronavirus pandemic, and virtually 40% of these have been unemployed for over 6 months, its hardly shocking that almost all of lawmakers imagine that additional fiscal assist is warranted.

Nonetheless, Republicans have pushed again on President Biden’s $1.9 trillion stimulus proposal, provided that the output hole within the fourth quarter of final yr was a shortfall of $665 billion. GOP Senator Pat Toomey said that “what you hear is these broad generalities about, effectively, individuals are struggling, so let’s spend one other $2 trillion. It’s not the correct answer”.

Information Supply – Bloomberg

However, with Democrats in each the Home and the Senate submitting joint finances resolutions, permitting Biden to cross nearly all of his proposed bundle with a easy majority, it appears seemingly that supplementary support can be supplied within the close to time period.

Certainly, Treasury Secretary Janet Yellen has warned that with out enough assist, it may take 4 years for the native labor market to get well to pre-pandemic ranges. Subsequently, the intensifying push for further stimulus, in tandem with the notable decline in coronavirus circumstances and a marked enhance in vaccination charges, could put a premium on the US benchmark Dow Jones Industrial Common and S&P 500 indices.

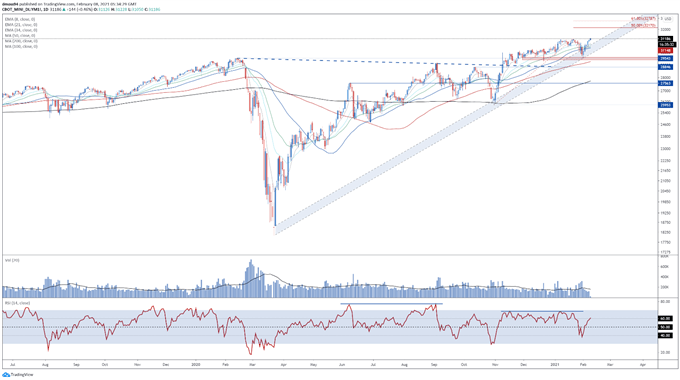

Dow Jones Futures Every day Chart – Aiming Greater After Clearing Resistance

DJIA futures every day chart created utilizing Tradingview

From a technical perspective, the Dow Jones Industrial Common (DJIA) appears to be like set to increase its current push larger, as worth pushes previous resistance on the January excessive (31188).

With worth monitoring above all 6 transferring averages, and the RSI climbing again above 60, the trail of least resistance appears larger.

A every day shut above 31200 is probably going required to sign the resumption of the first uptrend and clear a path for worth to problem the psychologically imposing 32000 mark.

Nonetheless, if 32000 holds agency, a short-term pullback in the direction of the trend-defining 50-day transferring common (30406) might be on the playing cards.

The IG Consumer Sentiment Report reveals 24.50% of merchants are net-long with the ratio of merchants quick to lengthy at 3.08 to 1. The variety of merchants net-long is 1.77% decrease than yesterday and 55.11% decrease from final week, whereas the variety of merchants net-short is 4.27% decrease than yesterday and 63.49% larger from final week.

We sometimes take a contrarian view to crowd sentiment, and the very fact merchants are net-short suggests Wall Avenue costs could proceed to rise.

Positioning is much less net-short than yesterday however extra net-short from final week. The mix of present sentiment and up to date modifications provides us an additional combined Wall Avenue buying and selling bias.

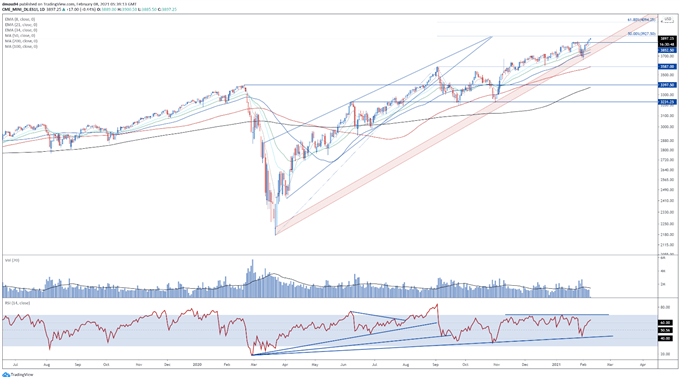

S&P 500 Futures Every day Chart – Keying in on 3900

S&P 500 futures every day chart created utilizing Tradingview

The S&P 500 additionally appears to be like poised to proceed climbing larger, as costs simply slice by resistance on the January excessive (3862).

As soon as once more, with the RSI climbing into bullish territory above 60, and worth monitoring firmly above all 6 transferring averages, the trail of least resistance appears larger.

A every day shut above the 50% Fibonacci (3927) would seemingly intensify shopping for strain within the close to time period and pave the best way for the index to probe the 4000 mark.

Alternatively, failing to clear 3900 may set off a short-term pullback to former resistance-turned assist at 3850.

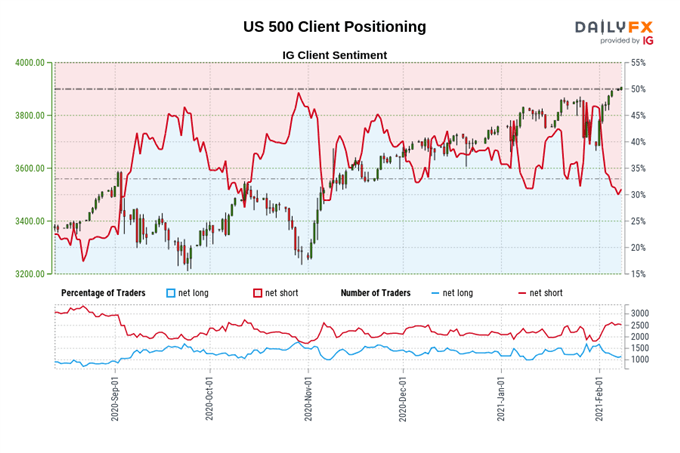

The IG Consumer Sentiment Report reveals 32.30% of merchants are net-long with the ratio of merchants quick to lengthy at 2.10 to 1. The variety of merchants net-long is 9.20% larger than yesterday and 29.93% decrease from final week, whereas the variety of merchants net-short is 2.32% decrease than yesterday and 31.36% larger from final week.

We sometimes take a contrarian view to crowd sentiment, and the very fact merchants are net-short suggests US 500 costs could proceed to rise.

Positioning is much less net-short than yesterday however extra net-short from final week. The mix of present sentiment and up to date modifications provides us an additional combined US 500 buying and selling bias.

— Written by Daniel Moss, Analyst for DailyFX

Observe me on Twitter @DanielGMoss

Really helpful by Daniel Moss

Enhance your buying and selling with IG Consumer Sentiment Information