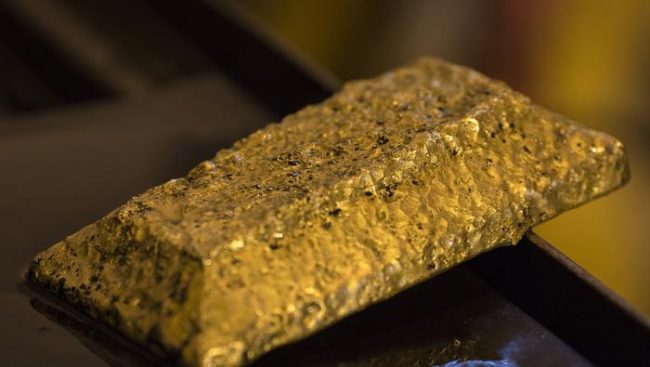

Gold Worth Outlook:

- Gold costs have been comparatively stagnant the previous couple of weeks because the commodity consolidates

- With little finish in sight, gold might proceed to profit from looser financial coverage and low rates of interest

- That stated, a bullish break from its present technical sample will nonetheless require a catalyst

Gold Worth Forecast: What Will Spark a XAU/USD Break Out Rally?

Gold costs have been comparatively stagnant in the previous couple of weeks regardless of notable volatility in different markets. To make sure, gold has seen worth exercise, but it’s significantly extra managed than the swings witnessed in July and August and directional progress has been virtually nonexistent. Consequently, the dear steel has etched out a wedge from the lows of August to the peaks of worth motion shortly thereafter.

Gold (XAU/USD) Worth Chart: 4 – Hour Time Body (Might 2020 – September 2020)

With weeks of consolidation underneath its belt, gold has coiled like a spring and is rapidly operating out of room in its technical formation, suggesting a break could also be due. That stated, the September FOMC assembly was lauded by many as an opportune second, however worth would counsel a failure to launch on the again of the central financial institution assembly. Thus, gold merchants are left in the hunt for catalysts after the elemental groundwork for a continuation increased was arguably laid out by the Fed only a day in the past.

Really useful by Peter Hanks

Enhance your buying and selling with IG Consumer Sentiment Information

Seeking to the financial calendar for help, it reveals a notable lack of high-risk occasions within the week forward which can see gold merely proceed sideways as a substitute of stage a risky break increased or decrease. Whereas the longer-term outlook for gold stays constructive in my view, the present panorama appears to lack the required substances to stage a assured run increased.

Really useful by Peter Hanks

Traits of Profitable Merchants

Whereas, a shock uptick in threat aversion or continued USD weak spot may assist goad the yellow steel increased, I might argue these themes additionally lack the punch required for conviction. Subsequently, gold might proceed its gradual journey sideways whereas bulls look to carry above attainable assist round $1,921 within the shorter-term and $1,863 over the intermediate timeframe. Within the meantime, observe @PeterHanksFX on Twitter for updates and evaluation.

–Written by Peter Hanks, Strategist for DailyFX.com

Contact and observe Peter on Twitter @PeterHanksFX