Implied volatility, synonymous with anticipated volatility, is a variable that exhibits the diploma of motion anticipated for a g

Implied volatility, synonymous with anticipated volatility, is a variable that exhibits the diploma of motion anticipated for a given market or safety. Usually labeled as IV for brief, implied volatility quantifies the anticipated magnitude, or dimension, of a transfer in an underlying asset.

WHAT IS IMPLIED VOLATILITY?

Implied volatility is a quantity displayed in share phrases reflecting the extent of uncertainty, or threat, perceived by merchants. IV readings, that are derived from the Black-Scholes choices pricing mannequin, can point out the diploma of variation anticipated for a specific fairness index, inventory, commodity, or main foreign money pair over a said time frame.

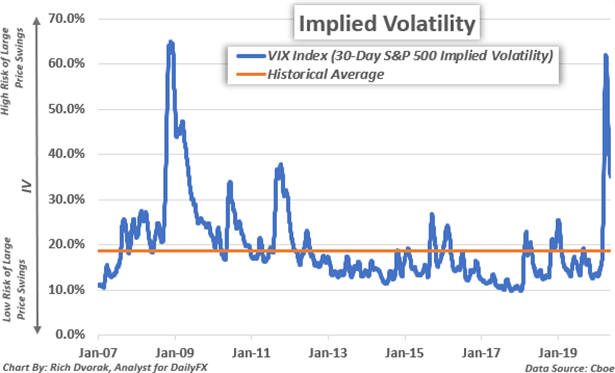

As an example, the favored VIX Index is solely the 30-day implied volatility studying for the S&P 500. A excessive VIX stage (i.e. %), or excessive implied volatility studying, signifies that threat is comparatively elevated and there’s a larger likelihood of bigger than regular value swings.

Advisable by Wealthy Dvorak

Constructing Confidence in Buying and selling

IMPLIED VOLATILITY VS HISTORICAL VOLATILITY – WHAT IS THE DIFFERENCE?

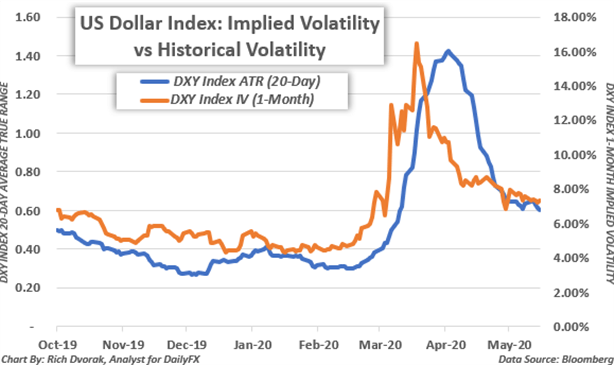

Implied volatility is the anticipated dimension of a future value change. Implied volatility broadly displays how huge or small of a transfer is anticipated to be over a specific time-frame. Then again, historic volatility, or realized volatility, signifies the precise dimension of a earlier value change. Historic volatility illustrates the general stage of market exercise that has already been noticed.

The common true vary (ATR) of an asset or safety is an instance of an indicator that illustrates historic volatility. Although implied volatility and historic volatility differ barely within the regard of future expectations versus previous observations, the 2 metrics are carefully associated and have a tendency to maneuver in related patterns.

Advisable by Wealthy Dvorak

Try our newest record of prime buying and selling alternatives.

Implied volatility readings are sometimes larger when there’s a massive diploma of uncertainty corresponding with potential for market affect – and infrequently surrounds financial knowledge releasesor different scheduled threat occasions like central financial institution conferences. This may result in bigger value swings and thus can materialize into larger readings of realized volatility. Likewise, when historic volatility stays anchored throughout calm market situations, or when perceived threat is comparatively subdued, IV tends to be decrease.

IMPLIED VOLATILITY CAN REFLECT MARKET RISK AND UNCERTAINTY

Implied volatility is a projection of how a lot market motion is anticipated – whatever the path. In different phrases, implied volatility displays the anticipated vary of potential outcomes and uncertainty round how excessive or low an underlying asset would possibly rise or fall.

Excessive implied volatility signifies there’s a larger likelihood of huge value swings anticipated by merchants whereas low implied volatility indicators the market expects value actions to be comparatively tame. Implied volatility measurements may assist merchants gauge market sentimentcontemplating IV broadly depicts the extent of perceived uncertainty – or threat.

IMPLIED VOLATILITY TRADING RANGES CAN INDICATE TECHNICAL SUPPORT AND RESISTANCE LEVELS

Implied volatility measurements could be integrated into varied buying and selling methods as nicely. This is because of their usefulness for figuring out potential areas of technical assist and resistance. An implied volatility buying and selling vary is usually calculated beneath the belief that costs will keep contained inside a one-standard deviation transfer. Mathematically, this implies that there’s a 68% statistical chance that value motion will fluctuate inside the outlined implied volatility buying and selling vary over a specified time-frame.

That mentioned, if costs commerce on the higher barrier of its pre-defined implied volatility buying and selling vary, then there’s an 84% statistical chance that costs will gravitate decrease and a 16% chance that costs will proceed rising. Then again, if costs commerce on the decrease barrier of its pre-defined implied volatility buying and selling vary, then there’s an 84% statistical chance that costs will drift larger and a 16% chance that costs will proceed falling.

ADVANTAGES OF IMPLIED VOLATILITY AS A FOREX SIGNAL

Largely owed to the inherent mean-reverting attribute of main foreign money pairs, implied volatility buying and selling ranges sometimes function sturdy foreign exchange indicators. For instance, this EUR/GBP evaluationthat outlined a 24-hour implied volatility buying and selling vary for EUR/GBP supplied an illustrated instance of how these technical boundaries will help merchants establish potential inflection factors and buying and selling alternatives.

On 14 January 2020, spot EUR/GBP value motion was buying and selling at 0.8541 and its implied volatility measurement was clocked at 7.3% for the in a single day (i.e. 1-day) choices contract. Utilizing these worth inputs, and the options-derived buying and selling vary formulation beneath, it was estimated that EUR/GBP would fluctuate between implied assist of 0.8508 and implied resistance of 0.8574 over the following 24-hours with a 68% statistical chance.

In different phrases, the calculated 24-hour buying and selling vary mirrored a 1-standard deviation implied transfer of

+/- 0.0033 from spot, which meant that Euro-Pound volatility was anticipated to be contained inside a 66- pip band round its then-current value of 0.8541 for the 15 January 2020 buying and selling session.

Advisable by Wealthy Dvorak

Foreign exchange for Rookies

As buying and selling progressed and market exercise unfolded, EUR/GBP jumped to an intraday excessive of 0.8578, however the foreign money pair closed the 15 January 2020 session at 0.8547 after spot costs pivoted sharply decrease. This was pushed by an inflow of promoting stress that adopted a rejection of its implied excessive technical barrier.

USING IMPLIED VOLATILITY TO TRADE COMMODITIES, STOCKS, & INDICIES

Along with foreign exchange, implied volatility gauges could be integrated into buying and selling methodsfor commodities, shares, and indices. As talked about above, measures of implied volatility can point out the market’s general stage of uncertainty. Correspondingly, cross-asset implied volatility benchmarks are likely to mirror helpful relationships with their respective underlying markets and will present perception as to the place that market would possibly head subsequent.

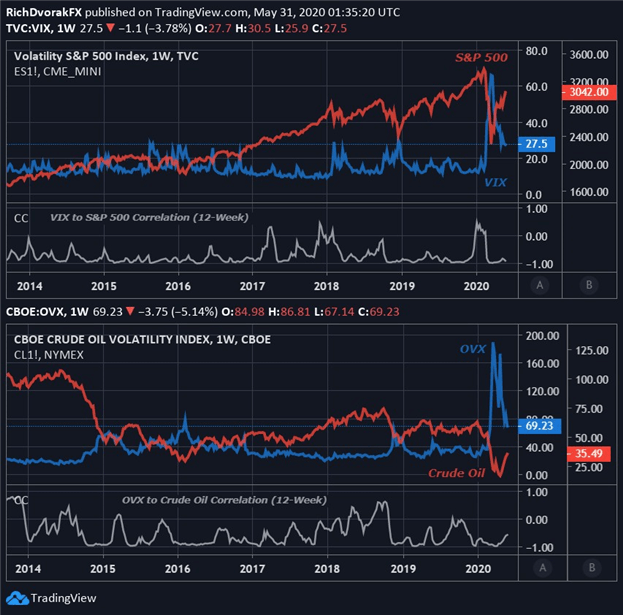

Chart created by @RichDvorakFXwith TradingView

Arguably the preferred implied volatility benchmark is the S&P 500 VIX Index. The VIX Index sometimes rises amid turbulent market situations and rising uncertainty, although the ‘fear-gauge’ tends to soar throughout aggressive selloffs in shares. In flip, the VIX usually holds a powerful inverse relationship with the S&P 500.

The OVX Index, which displays 30-day anticipated crude oil value volatility, offers an instance of one other generally cited IV benchmark. Seeing that the worth of crude oil and shares react equally to deteriorating threat urge for food, it’s unsurprising that sentiment-linked crude oil often maintains a adverse correlation with each the VIX and OVX.

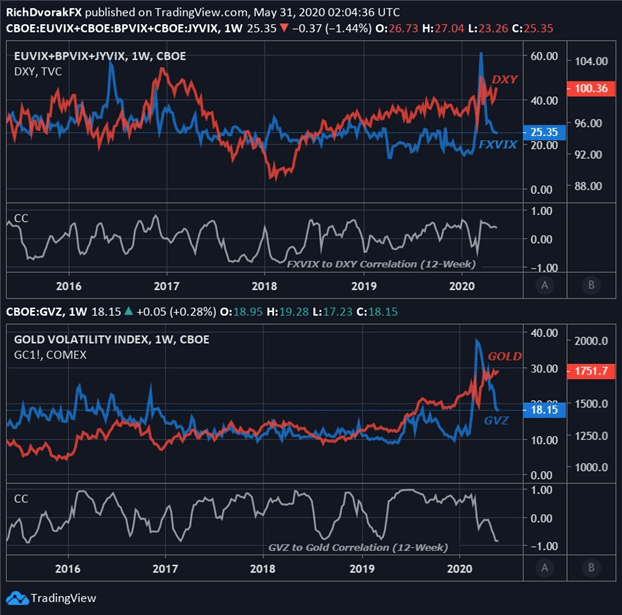

Chart created by @RichDvorakFXwith TradingView

Though this inverse relationship sometimes noticed between an asset’s value and its implied volatility studying serves as a normal rule of thumb, that’s not at all times the case and there are particular exceptions. The correlation of value with implied volatility is dynamic, which means it’s continuously altering, which corresponds with a relative strengthening or weakening from their historic relationship.

Advisable by Wealthy Dvorak

Get Your Free USD Forecast

Equally, in terms of frequent safe-haven belongings, a direct relationship between value and implied volatility could present. As an example, the US Greenback Index (DXY) broadly follows the ebb and circulation of anticipated foreign money volatility(FXVIX). Additionally, a optimistic correlation is commonly mirrored by the worth of gold and gold volatility (GVZ). These examples assist illustrate the dear perception that implied volatility readings can present when integrated into macro approaches and different complete buying and selling methods.

Open a demo FX buying and selling account with IG and commerce currencies that reply to systemic tendencies.

— Written by Wealthy Dvorak, Analyst for DailyFX.com

Join with @RichDvorakFXon Twitter for real-time market perception