The weekly Baker-Hughes Rig Rely is out and issues don’t look good. U.S. oil rigs in operation fell to 189, down from 199 final week right now. Wh

The weekly Baker-Hughes Rig Rely is out and issues don’t look good. U.S. oil rigs in operation fell to 189, down from 199 final week right now. Whole North American rigs fell to 266, off 72% year-over-year. Immediately’s Baker-Hughes determine is an all-time low and indicative of the stress upon the U.S./Canadian shale oil trade. August WTI crude futures are taking the information in stride, holding values close to $40.00.

A bit earlier, FED Chairman Jerome Powell completed his scheduled talking engagement. Not a lot got here to gentle, with feedback largely addressing financial inequality points. Mainly, Powell introduced extra of the identical. He acknowledged that the coronavirus pandemic hit underprivileged communities onerous and highlighted the necessity for higher training and employment alternatives.

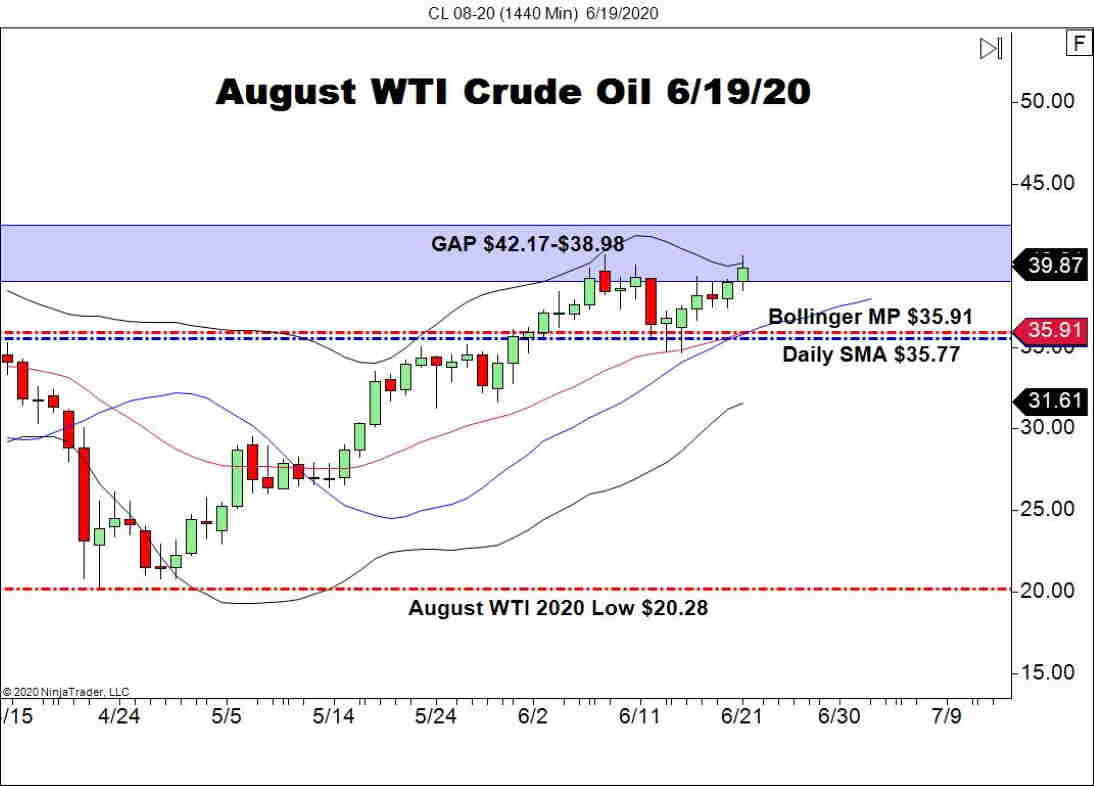

All in all, it’s been a stable week for WTI crude oil futures. Costs proceed to fill in early-March’s GAP in a grinding vogue.

August WTI Crude Oil Futures Fill In The GAP

Oil costs are on the rally as August WTI crude plods greater. With the 4th of July vacation solely two weeks out, it seems that the highest of the GAP ($42.17) goes to be examined shortly.

++6_19_2020.jpg)

Backside Line: Proper now, the technical space to concentrate on in August WTI crude is the GAP space of $42.17-$38.98. Costs at the moment are firmly on this zone; in the event that they check the GAP’s higher bounds, a promoting alternative might come into play.

Till elected, I’ll have promote orders queued up from $42.04. With an preliminary cease loss at $42.56, this commerce yields 52 ticks on an ordinary 1:1 danger vs reward ratio.