Crude oil

Crude Oil

Crude oil is the most popular tradable instrument in the energy sector, offering exposure to global market conditions, geopolitical risk, and economics. The instrument is strategically relied upon and situated in the global economy. Crude oil has proven to be a unique option for traders given volatility and the efficacy of both swing trading and longer-term strategies. Despite its popularity, crude oil is a very complex investing instrument, given the litany of fluctuations in oil prices, risk, and impact of politics stemming from OPEC. Short for the Organization of the Petroleum Exporting Countries, OPEC operates as an intergovernmental organization of 13 countries, helping set and dictate the global oil market.How to Trade Crude Oil Crude oil is most commonly traded as an exchange-traded fund (ETF) or through other instruments with exposure to it. This includes energy stocks, the USD/CAD, and other investing options. Crude oil itself is traded across a duality of markets, including the West Texas Intermediate Crude (WTI) and Brent crude. Brent is the more relied upon index in recent years, while WTI is more heavily traded across futures trading at the time of writing. Other than geopolitical events or decisions by OPEC, crude oil can move due to a variety of different ways. The most basic is through simple supply and demand, which is affected by global output. Increased industrial output, economic prosperity, and other factors all play a role in crude prices. By extension, recessions, lockdowns, or other stifling factors can also influence crude prices. For example, an oversupply or mitigated demand due to the aforementioned factors would result in lower crude prices. This is due to traders selling crude oil futures or other instruments. Should demand rise or production plateau, traders will bid increasingly on crude, whereby driving prices up.

Crude oil is the most popular tradable instrument in the energy sector, offering exposure to global market conditions, geopolitical risk, and economics. The instrument is strategically relied upon and situated in the global economy. Crude oil has proven to be a unique option for traders given volatility and the efficacy of both swing trading and longer-term strategies. Despite its popularity, crude oil is a very complex investing instrument, given the litany of fluctuations in oil prices, risk, and impact of politics stemming from OPEC. Short for the Organization of the Petroleum Exporting Countries, OPEC operates as an intergovernmental organization of 13 countries, helping set and dictate the global oil market.How to Trade Crude Oil Crude oil is most commonly traded as an exchange-traded fund (ETF) or through other instruments with exposure to it. This includes energy stocks, the USD/CAD, and other investing options. Crude oil itself is traded across a duality of markets, including the West Texas Intermediate Crude (WTI) and Brent crude. Brent is the more relied upon index in recent years, while WTI is more heavily traded across futures trading at the time of writing. Other than geopolitical events or decisions by OPEC, crude oil can move due to a variety of different ways. The most basic is through simple supply and demand, which is affected by global output. Increased industrial output, economic prosperity, and other factors all play a role in crude prices. By extension, recessions, lockdowns, or other stifling factors can also influence crude prices. For example, an oversupply or mitigated demand due to the aforementioned factors would result in lower crude prices. This is due to traders selling crude oil futures or other instruments. Should demand rise or production plateau, traders will bid increasingly on crude, whereby driving prices up.

Read this Term had a volatile run of it today. The price moved down sharply early in session on the back of hopes for a Ukraine/Russia cease-fire. There were some conflicting reports about the peace prospects which subsequently took some of the steam out of that idea.

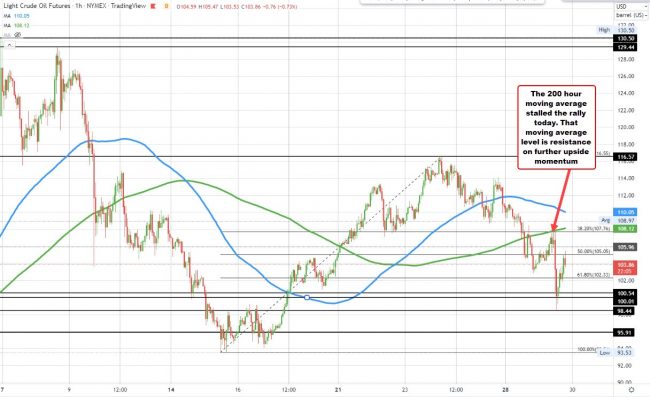

The price is settling at $104.24. That is down $-1.72 or -1.62%. The low for the day reached $98.44. That was the lowest level since March 17, but comfortably above the March low at $93.53 back on March 15.

The high was up at $107.84. The settle price is near the middle of the range (although closer to the highs).

Technically looking at the hourly chart, the high price today did stall against its 200 hour moving average currently at $108.12. The inability to move above that level increases the moving averages and importance going forward. Stay below keeps the sellers in play.

On the downside, there is some disappointment in not been able to stay below the $100 level. Back on March 15 and March 16, the price traded below the $100 level but could not sustain the momentum. The price moved back above the $100 level on March 17 and moved up to a high of $116.55 before rotating back to the downside of the last few days.

Going forward if the price can rotate back below the $100 without moving above the 200 hour MA, the selling might intensify.

www.forexlive.com