It has been a quiet day for WTI crude oil as each EIA inventories and the Baker-Hughes rig rely have been launched to the general public. Neverthe

It has been a quiet day for WTI crude oil as each EIA inventories and the Baker-Hughes rig rely have been launched to the general public. Nevertheless, though costs are consolidating close to $48.00, traded volumes are robust. For February WTI futures, we now have already seen greater than 210,000 contracts change palms. All in all, participation hasn’t been too dangerous contemplating that it’s a vacation week.

On the information entrance, the previous 24 hours has been an lively interval for crude oil. Right here’s a take a look at the highlights:

Occasion Precise Projected Earlier

API Weekly Crude Oil Shares (Dec. 25) -4.875M NA 2.700M

EIA Weekly Crude Oil Shares (Dec. 25) -6.065M -2.583M -0.562M

Baker-Hughes U.S. Rig Depend 267 NA 264

In abstract, issues are wanting up for the worldwide oil complicated. It seems as if wintertime demand is holding robust and U.S. producers are optimistic about 2021. Regardless of main questions concerning COVID-19 lockdowns, vaccines, and many others., this market is holding inside a stone’s throw of $50.00. For those who keep in mind the damaging valuations of final spring, immediately’s WTI pricing is really outstanding.

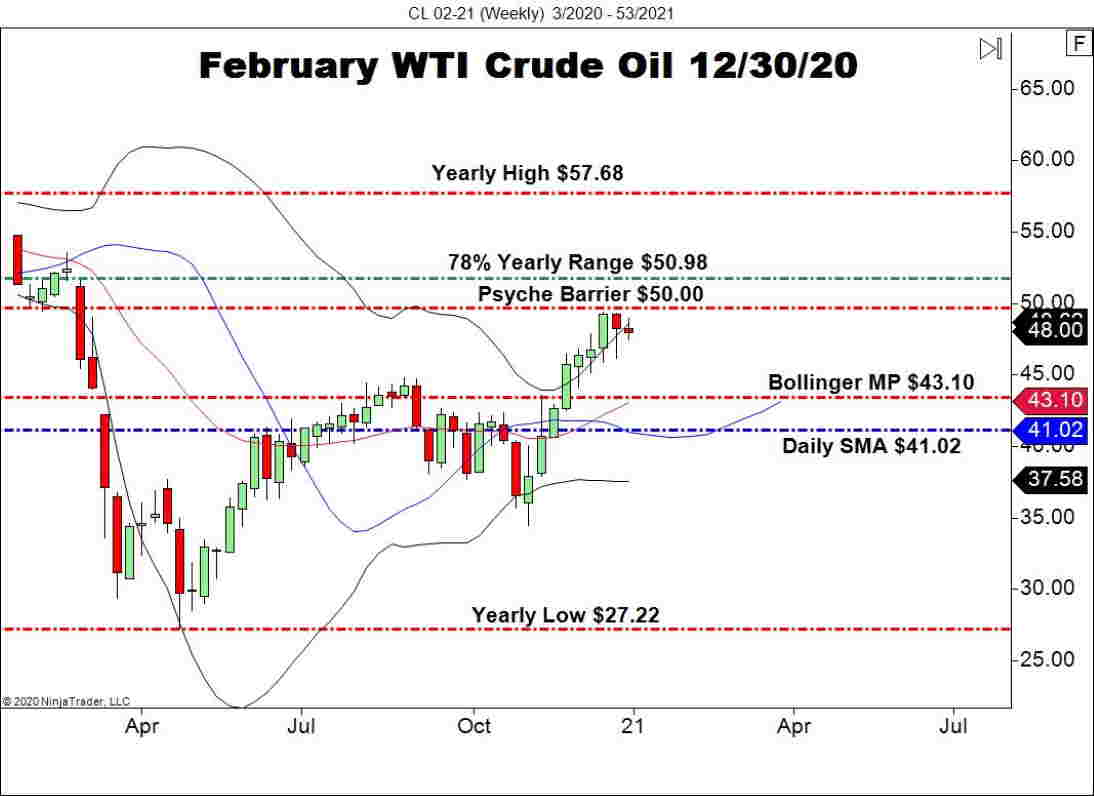

WTI Crude Oil Holds The Line At $48.00

In the intervening time, February WTI crude oil futures are in a holding sample. Costs stay in weekly bullish territory and seem poised to drive larger.

++3_2020+-+53_2021.jpg)

Overview: As we roll into 2021, the $50.00 deal with goes to be a pivotal long-term technical stage for WTI. Nonetheless, uncertainty concerning the way forward for COVID-19 and Biden administration fracking restrictions will play largely into valuations. Like is the case more often than not, we’ll simply have to attend and see what occurs.