GOLD FORECAST: XAU/USD PRICE ACTION STILL STRUGGLING AMID STRONG US DOLLARGold costs have weathered sustained promoting stress be

GOLD FORECAST: XAU/USD PRICE ACTION STILL STRUGGLING AMID STRONG US DOLLAR

Gold costs have weathered sustained promoting stress because the treasured steel peaked 7-months in the past. XAU/USD value motion now trades roughly -16% off its document shut with weak point largely mirroring the continuing upswing in actual yields. This has corresponded with a notably stronger US Greenback, which in flip, has weighed negatively on the route of gold. That mentioned, and in mild of the US Greenback lately extending to four-month highs, there might be potential for gold value motion to face additional draw back.

Really useful by Wealthy Dvorak

Methods to Commerce Gold

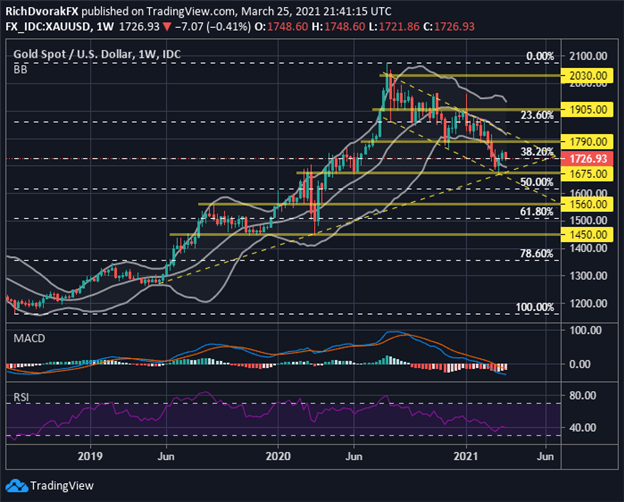

XAU/USD – GOLD PRICE CHART: WEEKLY TIME FRAME (JULY 2018 TO MARCH 2021)

Chart by @RichDvorakFX created utilizing TradingView

XAU/USD at the moment oscillates across the $1,725-price degree and week-to-date lows. This can be a massive space of technical confluence underpinned by the 38.2% Fibonacci retracement of its 2018 low to 2020 excessive. If gold bulls fail to defend this degree and final week’s lows are taken out, that would open up the door to a different stretch of weak point.

Gold bears may attempt to check technical help round $1,675 below this state of affairs. Though, the bullish long-term trendline connecting the Might 2019 and March 2020 swing lows stands out as a formidable barrier with potential to stymie gold promoting stress. The underside Bollinger Band, along with the broader bull flag chart sample, might assist hold gold value motion afloat as effectively. If latest US Greenback energy subsides, nonetheless, gold bulls may make a heartier rebound try. It already seems that downward momentum has waned judging by the MACD indicator.

| Change in | Longs | Shorts | OI |

| Each day | 2% | -18% | -2% |

| Weekly | -2% | -5% | -3% |

To not point out, the relative energy index exhibits XAU/USD is only a stone’s throw away from ‘oversold’ territory. This brings to focus potential for an eventual reversal larger. If gold can catch a bid and eclipse final week’s excessive, it might open up the door for a push towards the $1,790-price degree. Notching a weekly shut above the 20-week easy transferring common, maybe coinciding with a topside breakout from its descending channel, may sign treasured steel bulls are wrestling again management.

— Written by Wealthy Dvorak, Analyst for DailyFX.com

Join with @RichDvorakFX on Twitter for real-time market perception

aspect contained in the

aspect. That is most likely not what you meant to do!nn Load your utility’s JavaScript bundle contained in the aspect as a substitute.www.dailyfx.com