Major indices are selling off today as a new Covid-19 variant emerged in South Africa. As we enter a positive seasonal period for the market, is the new variant a cause for concern or will the volatility create a buying opportunity?

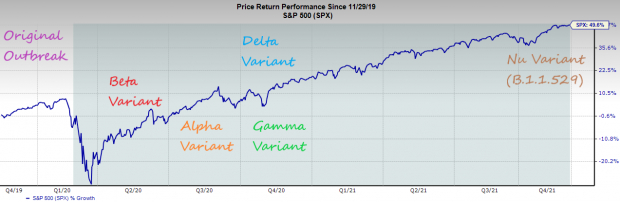

Nearly two years into the pandemic, numerous variants have been discovered and thoroughly researched. While each new variant announcement has typically created some short-term pain for stocks, overall the market has shown us not to worry.

In the graph below of the S&P 500, we can see the general timing of the four current Variants of Interest (designated by the World Health Organization) as well as the most recent strain (expected to be named with the Greek letter Nu):

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The WHO has called an emergency meeting Friday to determine if they will declare this new strain a Variant of Concern. As news of the new strain has spread, money markets are now pricing in a delay for the first rate hike to September 2022 rather than July.

With the notion that future rate hikes may be delayed, financial stocks are taking a hit as their outlook for increased profits comes under scrutiny. Yet with recent growth estimates for Q4 recently surging as high as 8%, the volatility may create a buying opportunity for investors.

If this new variant turns out to be less worrisome, the Fed may raise rates earlier than anticipated. And if that’s the case, financial stocks should continue to do well. Let’s take a look at three financials that have been outperforming this year and are poised to continue their run into 2022.

Evercore Inc. (EVR)

Evercore is headquartered in New York and operates as an investment banking company. EVR provides advisory services to multinational companies in several areas including mergers, acquisitions, restructuring and other corporate transactions. EVR is part of the Financial – Investment Bank industry group, which is ranked in the top 23% of all 253 industries.

EVR, currently a Zacks #1 Strong Buy, has shown a robust history of earnings surprises as you can see below. Over the last four quarters, Evercore has posted an average surprise of over 51%. The company most recently reported quarterly earnings in late October with EPS of $3.96, representing a 19.3% surprise over consensus.

Evercore Inc Price, Consensus and EPS Surprise

Evercore Inc price-consensus-eps-surprise-chart | Evercore Inc Quote

For the year, the current Zacks Consensus Estimate stands at $14.63 – a significant 52.1% growth rate over last year’s EPS of $9.62. EVR is next scheduled to report earnings on February 2nd, 2022.

Fifth Third Bancorp (FITB)

Fifth Third is a diversified financial services company headquartered in Cincinnati, Ohio. FITB’s primary businesses include Wealth & Asset Management, Commercial Banking, Branch Banking, and Consumer Lending.

With a Zacks #3 ranking (Hold), Fifth Third is showing a notable history of earnings surprises, beating expectations in each of the last six quarters. The stock has advanced over 57% this year on the heels of its diverse revenue base. Over the last four quarters, FITB has delivered an average earnings surprise of nearly 20%.

Fifth Third Bancorp Price, Consensus and EPS Surprise

Fifth Third Bancorp price-consensus-eps-surprise-chart | Fifth Third Bancorp Quote

On an annual basis, the current Zacks Consensus Estimate for 2021 EPS sits at $3.77, which would translate to 74.5% growth over 2020. FITB is scheduled to report quarterly earnings on January 20th, 2022.

Charles Schwab Corp. (SCHW)

Charles Schwab is a savings and loan holding company providing a full range of wealth management, banking, securities brokerage, and financial advisory services to individual investors and independent investment advisors. SCHW is headquartered in San Francisco, CA.

Sporting a Zacks #2 ranking (Buy), SCHW has climbed over 50% on the year. The company also boasts an impressive history in terms of earnings surprises with an average beat of 3.65% over the last four quarters. SCHW most recently reported EPS back in October of $0.84, a 5% surprise over consensus.

The Charles Schwab Corporation Price, Consensus and EPS Surprise

The Charles Schwab Corporation price-consensus-eps-surprise-chart | The Charles Schwab Corporation Quote

What the Zacks Model Reveals

The combination of positive Earnings ESP (Earnings Surprise Prediction) and a Zacks Rank #1 (Strong Buy), #2 (Buy) or #3 (Hold) increases the chances of an earnings beat. SCHW’s ESP is presently +1.4%. You can uncover the best stocks to buy or sell with our Earnings ESP filter.

On the year, the current Zacks Consensus Estimate for SCHW stands at EPS of $3.22, a roughly 31% increase over last year. The company is due to announce quarterly earnings on January 18th, 2022.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Click to get this free report

Fifth Third Bancorp (FITB): Free Stock Analysis Report

The Charles Schwab Corporation (SCHW): Free Stock Analysis Report

Evercore Inc (EVR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com