Low-cost shares in investor parlance are people who have a lovely valuation. It might be with respect to gross sales, or earnings, or e-book worth, or no matter. And it might be relative to the group, or business, or a benchmark index just like the S&P 500. You would be in search of the efficiency 12 months to this point, or you might be wanting on the efficiency over the previous 12 months.

However what in the event you’re in search of one thing completely different? What in the event you’re keen to attend a bit longer on a smaller outlay to generate an analogous price of positive aspects?

A technique this might be doable is by shopping for shares which can be low-cost on the pocket, i.e. they’ve a low greenback worth. Since they’re priced low, these shares are more likely to belong to smaller firms with a fewer variety of analysts overlaying them. However the threat might nonetheless be low in the event you do your homework and test for the well being of the businesses.

There are three issues that ought to concern you significantly. The primary can be the situation of the steadiness sheet. Administration effectiveness can also be vital to test since small firms go on to turn out to be greater firms solely after they have sturdy individuals on the helm. The third factor to test can be the businesses’ current earnings efficiency. If issues look good on all three fronts and there’s a usually constructive estimated progress development, there’s a good likelihood of the inventory’s outperformance.

At Zacks, we additionally use the Zacks Rank for shares (#1 for Sturdy Purchase, #2 for Purchase, #Three for Maintain, #Four for Promote and #5 for Sturdy Promote). This rating system has proved efficient in choosing winners for years on finish.

While you match the rank with the Zacks Model Rating System (for worth, progress or momentum), you additionally get shares that significantly fit your funding model.

Listed below are just a few examples-

Alto Elements, Inc. ALTO

Generally known as Pacific Ethanol earlier than Jan 2021, Sacramento, CA-based Alto Elements is a producer of specialty alcohols utilized in mouthwash, cosmetics, prescribed drugs, hand sanitizers, disinfectants, cleaners, alcoholic drinks, taste extracts and vinegar. It additionally provides important substances like dried yeast, corn gluten meal, corn gluten feed, distillers grains, liquid feed, fuel-grade ethanol (produced and procured from third-party suppliers) and distillers corn oil. Alto additionally provides transportation, storage and supply providers via third-party service suppliers.

This Zacks Rank #2 firm with a VGM Rating of A is priced at $6.34.

The corporate clearly had its fortunes turning with the onset of the pandemic. The excessive demand for alcohol-based hand sanitizers that began through the pandemic and is extra possible than to not become an everlasting development is the largest constructive for Alto.

Now, to test for threat, we have to take a more in-depth have a look at its key numbers-

And so, we see that administration efficiency metrics like Return on Fairness (ROE, measuring how effectively investor funds are being utilized) and Return on Belongings (ROA, measuring how effectively property are being utilized) have been steadily declining between March 2017 and March 2020, with a complete reversal since then. In consequence, each numbers are at the moment effectively above 2017 peaks. ROA varies by business however ROE is usually most well-liked above 15%. Since Alto’s ROE is at the moment 15.4%, it passes.

One other factor to test is the steadiness sheet. Is the corporate taking over an entire lot of debt to cater to this demand? It’s thereby rising funding threat? For the reason that Debt-to-Complete Capitalization ratio is a mere 17.6%, there’s clearly nothing to fret about on this regard both.

Transferring on to its current efficiency. Since there’s a single analyst offering estimates for this firm, it is sensible to see how the corporate has accomplished traditionally with respect to those estimates. What we’re seeing is blended efficiency, with the strong 141.2% beat within the final quarter coming off an 85.7% miss within the previous quarter.

This type of shock historical past is commonly seen within the case of those small firms, and it’s heartening to notice that the 4-quarter common is +25.2%. The estimate revision development additionally seems encouraging, with the 2021 earnings estimate shifting from 5 cents to 44 cents within the final 30 days whereas the 2022 estimate moved from 82 cents to 93 cents.

Conduent Inc. CNDT

Based mostly in Basking Ridge, N.J, Conduent Included is a enterprise course of providers firm. It offers healthcare, digital funds, authorized and compliance, human assets, finance and accounting, procurement and digital transformation options in addition to BPO providers and studying providers to residents, sufferers, prospects and staff. The corporate serves aerospace, defence, automotive providers, banking, communication and media, healthcare, industrial, vitality, insurance coverage, retail, client merchandise and transportation industries.

This Zacks Rank #2 firm with a VGM Rating of B is priced at $7.87.

Administration has accomplished a comparatively good job right here, provided that the ROE has been rising steadily since June 2019 and the ROA since March 2020. Whereas the ROE of 14.1% is a bit wanting desired, the development is constructive, so this will not be a giant threat, particularly contemplating all the opposite components.

The Debt-Cap ratio, whereas considerably increased than the 30-40% vary in 2018, is at 51.5%, which continues to be manageable.

Right here too there’s a single analyst providing estimates which were solidly overwhelmed within the final 4 quarters at a median price of 112.7%. The estimate revision development can also be constructive: 2021 earnings estimate shifting from 59 to 64 cents within the final 30 days with the 2022 estimate going from 61 to 67 cents.

Envela Corp. ELA

Irving, TX-based Envela Company, along with its subsidiaries, is within the jewellery and bullion enterprise. The corporate offers with shoppers, sellers, Fortune 500 firms, municipalities, faculty districts and different organizations in america. It provides bridal, style and customized jewellery, fine-watch merchandise, diamonds, different gems, watches and jewellery parts.

It additionally buys and sells varied types of gold, silver, platinum, and palladium merchandise, authorities cash, personal mint medallions, artwork bars, commerce unit bars; and numismatic gadgets, reminiscent of uncommon cash, foreign money, medals, tokens and different collectibles. It additionally provides jewellery and watch restore providers, end-of-life electronics recycling providers and varied IT providers. The corporate modified its title from DGSE Corporations to Envela Company in December 2019.

The Zacks Rank #2 firm with a VGM Rating of B is at the moment buying and selling at $5.37.

At 43.7%, the ROE is clearly engaging and signifies that administration is doing a commendable job.

The debt-cap ratio of 40.2% additionally isn’t a lot of a priority. Furthermore, it has been declining since June 2019, which is encouraging.

So far as its current efficiency is anxious, ELA has topped estimates in each the final two quarters, for which numbers can be found. The 2021 and 2022 EPS estimates stay unchanged over the past 30 days.

Elevate Credit score, Inc. ELVT

Based mostly in Forth Price, Elevate Credit score provides on-line credit score options to non-prime shoppers. The corporate provides on-line installment loans and contours of credit score. Its merchandise embrace credit score constructing, monetary wellness applications, credit score reporting, free credit score monitoring and on-line monetary literacy movies and instruments.

The Zacks Rank #2 firm with a VGM Rating of A goes for $3.80.

Its ROE of 34.1% could be very engaging, as are the developments in ROE and ROA, each of which have been rising since September 2018.

The corporate has no debt.

Furthermore, its current efficiency has been stellar, with triple-digit surprises in every of the final three quarters and a excessive double-digit shock within the quarter instantly previous them. General, the four-quarter shock is at 201.3%. Estimates for 2021 and 2022 are unchanged within the final 30 days however they’re up from 32 cents to 43 cents and 45 cents to 58 cents, respectively within the final 60 days.

Nokia Corp. NOK

Shaped out of an amalgamation of Nokia AB, Finnish Rubber Works Ltd and Finnish Cable Works Ltd., Nokia Corp divested all of its non-telecom ventures within the 1990s. The Finnish telecom gear supplier at the moment operates via 4 segments — Cell Networks, Community Infrastructure, Cloud and Community Providers, and Nokia Applied sciences. It additionally discloses segment-level knowledge for Group Frequent and Different.

The Zacks Rank #2 firm with a VGM Rating A is priced at $5.61.

Whereas its ROE of 12.9% nonetheless lags the specified 15%, it’s heartening to notice that each ROE and ROA have been rising since March 2019.

Furthermore, the Debt-Cap ratio of 26.8% is sort of low.

So far as the corporate’s current efficiency is anxious, it has topped estimates in three of the final 4 quarters and missed in a single, clocking a median beat of 215.2%. Estimates for 2021 and 2022 stay unchanged within the final 30 days however are up 6 cents and a penny, respectively within the final 60 days.

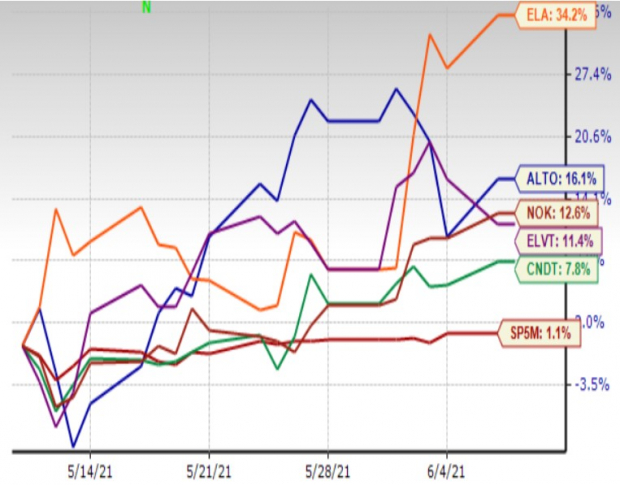

One-Month Worth Efficiency

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Extra Inventory Information: This Is Greater than the iPhone!

It might turn out to be the mom of all technological revolutions. Apple offered a mere 1 billion iPhones in 10 years however a brand new breakthrough is anticipated to generate greater than 77 billion gadgets by 2025, making a $1.Three trillion market.

Zacks has simply launched a Particular Report that spotlights this fast-emerging phenomenon and Four tickers for making the most of it. When you do not buy now, you could kick your self in 2022.

Click on right here for the Four trades >>

Click on to get this free report

Nokia Company (NOK): Free Inventory Evaluation Report

Conduent Inc. (CNDT): Free Inventory Evaluation Report

Elevate Credit score, Inc. (ELVT): Free Inventory Evaluation Report

Envela Company (ELA): Free Inventory Evaluation Report

Alto Elements, Inc. (ALTO): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.