Choose Medical Holdings Corp. SEM is poised to develop on the again of its rising affected person admissions, diversified enterprise, rising high line, beneficial money flows, acquisitions and partnerships with varied healthcare entities.

The inventory has seen the Zacks Consensus Estimate for current-year earnings being revised 12% upward over the previous seven days.

Having mentioned that, right here we see some company-specific components that assist the inventory stand out in its trade.

Favorable VGM Rating and Prime Zacks Rank: The corporate presently has a Zacks Rank #2 and a VGM Rating of A. Our analysis exhibits that shares with a VGM Rating of A or B mixed with a Zacks Rank #1 (Robust Purchase) or 2 (Purchase) or 3 (Maintain) supply the most effective funding alternatives. You may see the entire checklist of right now’s Zacks #1 Rank shares right here.

Robust Steering: Following second-quarter 2021 outcomes, the corporate revised its earnings estimates for the second time this 12 months. Revenues are actually estimated to be $5.85-$6.05 billion, up from the earlier outlook of $5.7-$5.9 billion (indicating 7.5% progress from the 2020 reported determine). Adjusted EBITDA for 2021 is forecast between $970 million and $1 billion, hinting at progress from the prior steerage of $870-$900 million (suggesting 23% progress from the 2020 reported determine). Earnings per share are anticipated inside $2.91-$3.08, greater than the earlier projection of $2.41-$2.58 for 2021 (implying 55.2% soar from 2020 reported determine).

Over the 2021-2023 forecast interval, the corporate’s long-term steerage for revenues, adjusted EBITDA and earnings per share have been unchanged from the prior outlook. The corporate is concentrating on a income CAGR within the vary of 4-6%, adjusted EBITDA within the 7-8% band and EPS inside 17-20%. A powerful steerage instills buyers’ confidence within the inventory.

Rising Prime Line: Revenues have been rising over time. The identical was up 17.5% within the first six months of 2021. Enlargement of services and the rising incidence of illnesses will steadily enhance affected person admissions, fuelling progress in flip.

Diversified and Complementary Strains of Enterprise: The corporate is a number one operator in its enterprise segments primarily based on the variety of services in america. Its management place and fame as a high-quality, cost-effective healthcare supplier in every of its enterprise segments permits it to draw sufferers and workers, aids in advertising and marketing efforts to referral sources and helps negotiate payor contracts. As of Jun 30, 2021, the corporate had operations in 46 states and the District of Columbia. It operated 99 crucial sickness restoration hospitals in 28 states, 30 rehabilitation hospitals in 12 states, and 1,833 outpatient rehabilitation clinics in 38 states and the District of Columbia. Concentra, a three way partnership subsidiary, operated 518 occupational well being facilities in 41 states as of Jun 30 2021.

With its presence in these areas, the corporate is well-positioned to profit from rising demand for medical providers owing to an growing old inhabitants in america, which is able to drive progress throughout its enterprise segments.

Confirmed Monetary Efficiency and Robust Money Stream: The corporate has a longtime monitor document of enhancing the monetary efficiency of its services owing to its disciplined method to income progress, expense administration and a agency concentrate on free money move technology. This, in flip, permits it to deploy sufficient funds to the enterprise. The corporate expects to generate roughly $450-$500 million of free money move within the upcoming years.

Inorganic Progress: Since its inception in 1997 to this point, the corporate has accomplished many important acquisitions together with the buyouts of Physiotherapy, Concentra and U.S. HealthWorks. The corporate improved the working efficiency of those companies over time by making use of its normal working practices and realizing efficiencies from its centralized operations and administration. These takeovers complemented the corporate’s natural progress.

Profitable Partnerships With Massive Healthcare Methods: Over the previous a number of years, the corporate has partnered with massive healthcare programs to supply post-acute care providers. It affords working experience to those ventures by its expertise in operating crucial sickness restoration hospitals, rehabilitation hospitals and outpatient rehabilitation services. Alliances with different healthcare entities additionally helped the corporate develop its high line.

Bottomline

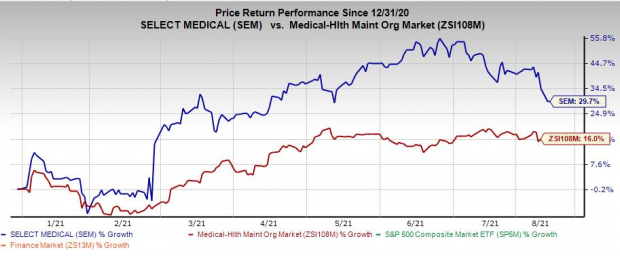

Yr to this point, the inventory with a market capitalization of $4.83 billion has gained 29% in contrast with its trade’s progress of 16.7%.

Picture Supply: Zacks Funding Analysis

Different shares in the identical area, specifically Group Well being Methods, Inc. CYH, Tenet Healthcare Company THC and Da Vita Inc. DVA have rallied 72%, 69% and 13%, respectively, over the identical timeframe.

Choose Medical is presently undervalued with its value to earnings ratio of 12.81 in contrast with the trade common of 17.59. With this valuation, the inventory appears addition to at least one’s funding portfolio.

Zacks’ Prime Picks to Money in on Synthetic Intelligence

In 2021, this world-changing know-how is projected to generate $327.5 billion in income. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ pressing particular report reveals Three AI picks buyers have to learn about right now.

See Three Synthetic Intelligence Shares With Excessive Upside Potential>>

Click on to get this free report

DaVita Inc. (DVA): Free Inventory Evaluation Report

Tenet Healthcare Company (THC): Free Inventory Evaluation Report

Group Well being Methods, Inc. (CYH): Free Inventory Evaluation Report

Choose Medical Holdings Company (SEM): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.