ABM Industries, Inc. ABM introduced that it has inked a deal to accumulate a amenities companies firm, Ready Providers, for $830 million in money. Topic to approval underneath the Hart-Scott-Rodino Antitrust Act and different closing circumstances, the deal is anticipated to finish by September finish.

Headquartered in San Francisco, Ready Providers is likely one of the main family-owned suppliers of constructing upkeep, engineering and facility operations in america. The corporate was based in 1926.

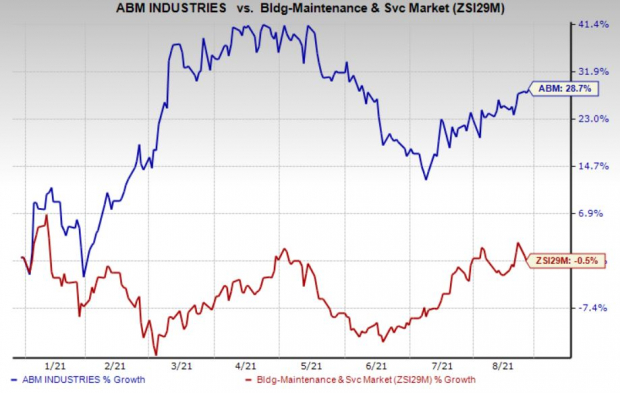

To this point this 12 months, shares of ABM Industries have gained 28.7% in opposition to 0.5% decline of the trade it belongs to.

Picture Supply: Zacks Funding Analysis

How Will ABM Industries Profit?

The acquisition is predicted to spice up the corporate’s adjusted earnings per share instantly after closing. The corporate can be hopeful of witnessing nearly $30-$40 million in price synergies, publish closure of the deal.

The buyout can be anticipated to extend ABM Industries’ engineering and technical companies revenues to nearly $2 billion, and likewise broaden the corporate’s sustainability and power effectivity choices. Inclusion of Ready’s janitorial companies must also strengthen ABM Industries’ janitorial companies enterprise and supply development alternatives to broaden EnhancedClean throughout broader footprint.

Scott Salmirs, president and chief govt officer of ABM Industries, said, “This acquisition is totally aligned with the strategic plan now we have developed to speed up our income development and margin enlargement within the coming years. Ready represents a superb strategic and cultural match for us, including to our scale in engineering and janitorial companies, which signify precedence development areas for ABM over the following 5 years. Moreover, Ready’s dedication to delivering excellent service to its purchasers whereas participating with its workforce members matches effectively with ABM’s tradition and values. Collectively, we are going to construct upon our respective strengths and shared values as we offer a broader array of companies to an expanded shopper roster.”

Contemplating the rising demand for environmentally accountable options, the newest deal is predicted to spice up ABM Industries’ aggressive place out there.

Zacks Rank and Shares to Contemplate

ABM Industries at present carries a Zacks Rank #3 (Maintain). You possibly can see the whole checklist of as we speak’s Zacks #1 Rank (Robust Purchase) shares right here.

Some better-ranked shares within the broader Zacks Enterprise Providers sector are Equifax EFX, BGSF Inc. BGSF and Avis Price range CAR, every carrying a Zacks Rank #2 (Purchase).

The long-term anticipated earnings per share (three to 5 years) development fee for Equifax, BGSF and Avis Price range is 15.2%, 20% and 57.2%, respectively.

Zacks Names “Single Finest Decide to Double”

From 1000’s of shares, 5 Zacks consultants every have chosen their favourite to skyrocket +100% or extra in months to return. From these 5, Director of Analysis Sheraz Mian hand-picks one to have probably the most explosive upside of all.

You already know this firm from its previous glory days, however few would count on that it is poised for a monster turnaround. Contemporary from a profitable repositioning and flush with A-list celeb endorsements, it might rival or surpass different current Zacks’ Shares Set to Double like Boston Beer Firm which shot up +143.0% in just a little greater than 9 months and Nvidia which boomed +175.9% in a single 12 months.

Free: See Our High Inventory and four Runners Up >>

Click on to get this free report

Avis Price range Group, Inc. (CAR): Free Inventory Evaluation Report

Equifax, Inc. (EFX): Free Inventory Evaluation Report

ABM Industries Included (ABM): Free Inventory Evaluation Report

BGSF, Inc. (BGSF): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com