The market expects Ally Monetary (ALLY) to ship a year-over-year enhance in earnings on increased revenues when it experiences outcomes for the quarter ended March 2021. This widely-known consensus outlook is vital in assessing the corporate’s earnings image, however a strong issue that may affect its near-term inventory value is how the precise outcomes evaluate to those estimates.

The earnings report, which is anticipated to be launched on April 16, 2021, would possibly assist the inventory transfer increased if these key numbers are higher than expectations. However, in the event that they miss, the inventory might transfer decrease.

Whereas the sustainability of the speedy value change and future earnings expectations will largely rely on administration’s dialogue of enterprise circumstances on the earnings name, it is value handicapping the likelihood of a optimistic EPS shock.

Zacks Consensus Estimate

This auto finance firm and financial institution is anticipated to submit quarterly earnings of $1.09 per share in its upcoming report, which represents a year-over-year change of +347.7%.

Revenues are anticipated to be $1.76 billion, up 24.4% from the year-ago quarter.

Estimate Revisions Pattern

The consensus EPS estimate for the quarter has been revised 0.54% increased over the past 30 days to the present stage. That is basically a mirrored image of how the overlaying analysts have collectively reassessed their preliminary estimates over this era.

Traders ought to understand that an mixture change might not all the time mirror the path of estimate revisions by every of the overlaying analysts.

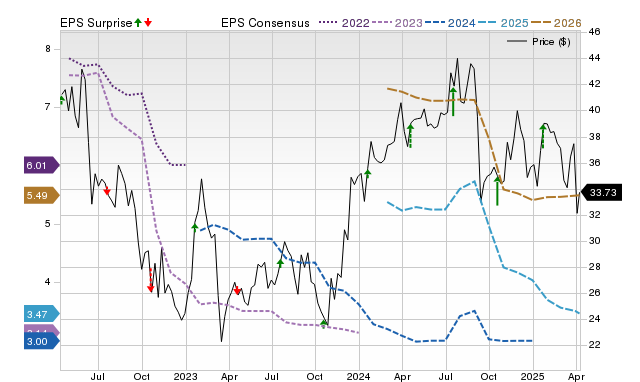

Value, Consensus and EPS Shock

Earnings Whisper

Estimate revisions forward of an organization’s earnings launch supply clues to the enterprise circumstances for the interval whose outcomes are popping out. Our proprietary shock prediction mannequin — the Zacks Earnings ESP (Anticipated Shock Prediction) — has this perception at its core.

The Zacks Earnings ESP compares the Most Correct Estimate to the Zacks Consensus Estimate for the quarter; the Most Correct Estimate is a newer model of the Zacks Consensus EPS estimate. The concept right here is that analysts revising their estimates proper earlier than an earnings launch have the most recent data, which might doubtlessly be extra correct than what they and others contributing to the consensus had predicted earlier.

Thus, a optimistic or unfavorable Earnings ESP studying theoretically signifies the possible deviation of the particular earnings from the consensus estimate. Nonetheless, the mannequin’s predictive energy is important for optimistic ESP readings solely.

A optimistic Earnings ESP is a powerful predictor of an earnings beat, notably when mixed with a Zacks Rank #1 (Sturdy Purchase), 2 (Purchase) or 3 (Maintain). Our analysis reveals that shares with this mixture produce a optimistic shock practically 70% of the time, and a strong Zacks Rank really will increase the predictive energy of Earnings ESP.

Please word {that a} unfavorable Earnings ESP studying just isn’t indicative of an earnings miss. Our analysis reveals that it’s troublesome to foretell an earnings beat with any diploma of confidence for shares with unfavorable Earnings ESP readings and/or Zacks Rank of 4 (Promote) or 5 (Sturdy Promote).

How Have the Numbers Formed Up for Ally Monetary?

For Ally Monetary, the Most Correct Estimate is increased than the Zacks Consensus Estimate, suggesting that analysts have lately turn out to be bullish on the corporate’s earnings prospects. This has resulted in an Earnings ESP of +8.46%.

However, the inventory at the moment carries a Zacks Rank of #2.

So, this mixture signifies that Ally Monetary will almost certainly beat the consensus EPS estimate.

Does Earnings Shock Historical past Maintain Any Clue?

Analysts usually contemplate to what extent an organization has been in a position to match consensus estimates prior to now whereas calculating their estimates for its future earnings. So, it is value looking on the shock historical past for gauging its affect on the upcoming quantity.

For the final reported quarter, it was anticipated that Ally Monetary would submit earnings of $1.05 per share when it really produced earnings of $1.60, delivering a shock of +52.38%.

During the last 4 quarters, the corporate has crushed consensus EPS estimates 3 times.

Backside Line

An earnings beat or miss is probably not the only real foundation for a inventory shifting increased or decrease. Many shares find yourself shedding floor regardless of an earnings beat because of different elements that disappoint buyers. Equally, unexpected catalysts assist a variety of shares acquire regardless of an earnings miss.

That stated, betting on shares which can be anticipated to beat earnings expectations does enhance the percentages of success. Because of this it is value checking an organization’s Earnings ESP and Zacks Rank forward of its quarterly launch. Ensure that to make the most of our Earnings ESP Filter to uncover one of the best shares to purchase or promote earlier than they’ve reported.

Ally Monetary seems a compelling earnings-beat candidate. Nonetheless, buyers ought to take note of different elements too for betting on this inventory or staying away from it forward of its earnings launch.

Need the most recent suggestions from Zacks Funding Analysis? Right this moment, you possibly can obtain 7 Greatest Shares for the Subsequent 30 Days. Click on to get this free report

Ally Monetary Inc. (ALLY): Get Free Report

To learn this text on Zacks.com click on right here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.