The meme inventory frenzy has led to plenty of buying and selling that appears irrational from the basics standpoint. So some folks have been pulling some cash out of slower shifting shares to put money into riskier names which may provide sturdy progress. Though this seems like playing, some folks have made fortunes.

After which, there was a good quantity of revenue taking, which have additionally saved the lid on costs.

Right now, I’ve zeroed in on some shares which have seen current weak point for seemingly irrational causes.

The primary on my record is Hibbett Sports activities, Inc. HIBB, which sells footwear, athletic gear and attire in small and mid-sized markets within the South, Southwest, Mid-Atlantic and Midwest U.S.

A have a look at its historic efficiency exhibits that the final 5 years’ income progress has been comparatively regular with some acceleration after the pandemic hit, each final yr, as folks targeted on exercising at residence and this yr, as they ready for the reopening. This power together with price administration has allowed the corporate to generate some sturdy earnings progress in current quarters.

Since there’s just one analyst offering estimates on this inventory, there isn’t a lot of a consensus. Nevertheless, the shock historical past from the March 2019 quarter signifies that estimates are typically conservative. So apart from the primary two quarters of 2020 when outcomes have been impacted by the pandemic, Hibbett has topped estimates in each quarter.

And within the final 30 days, the analyst has taken the 2022 (ending January) earnings estimate up 70%. The 2023 estimate was raised by 27%. That is an apparent indication that outcomes are enhancing.

Nevertheless, this Zacks #1 (Robust Purchase) inventory is down 11.7% over the previous week with no adverse information circulation. Its ahead P/E of 9.27X trails the P/E of 18.61X of the Retail-Miscellaneous/Diversified business (to which it belongs) and can also be beneath its personal median stage over the previous yr.

Traders do appear to be passing up a chance right here.

The following inventory on my record is the Shanghai-based Chinese language private finance software program supplier Jiayin Group Inc. JFIN.

The out there information from the March 2019 quarter exhibits a downward spiral in income proper as much as the pandemic and thru the primary two quarters of final yr, which seem to have been impacted by the pandemic. There was a pleasant rebound thereafter within the September quarter. However the pattern didn’t final. It was solely due to price efficiencies that the corporate managed continued earnings progress within the final quarter.

So let’s see what the estimates say. Right here once more, there is only one analyst offering estimates. The shock historical past (from September 2019) exhibits that after the preliminary two quarters, the corporate has topped estimates in each quarter for which an estimate was out there by substantial margins. This appears to point that estimates have tended in direction of the conservative.

So it’s encouraging that the 2021 estimate was raised from 82 cents to 95 cents (16%) whereas the 2022 estimate was raised from $1.15 to $1.30 (11%).

Furthermore, after shedding 21.2% of its worth over the previous week, the Zacks Rank #2 (Purchase) inventory trades at simply 4.95X ahead earnings, which is beneath its median stage of 4.69X over the previous yr and is just about incomparable with the 406.54X common for the Web Software program business, to which it belongs.

So the principle factor that may be mentioned for this inventory is that it’s actually low-cost. Whereas income progress seems to be enhancing, a stable pattern is just not identifiable. So there are dangers to investing on this one.

Third on my record is Zacks #1 ranked OneWater Marine Inc. ONEW, which sells each new and pre-owned leisure boats within the premium phase, in addition to the associated components, equipment, finance, insurance coverage, upkeep & restore and ancillary providers.

The corporate depends on acquisitions to broaden its product line, consolidate its place in its business and generate progress. Throughout the previous few days, it has introduced a small acquisition and a particular dividend of $1.80 a share, payable to Class A shareholders as on Jun 28, 2021.

Its income has been rising steadily over the past two years and earnings are additionally rising strongly from year-ago durations.

The shock historical past is overwhelmingly optimistic, with the final 4 quarters’ shock averaging 224.1%.

The estimate revision pattern can also be optimistic and with Three estimates within the consensus, it’s comparatively extra dependable. The Zacks Consensus earnings estimate for the yr ending September 2021 is up 8% within the final 30 days. The 2022 estimate is up round 6%.

Regardless of the positives, the shares have misplaced 12.8% of their worth over the previous week. They at present commerce at 6.70X ahead earnings, which is beneath their median stage of 8.34X over the previous yr and method beneath the 28.00X of the Leisure & Recreation Merchandise business, to which it belongs.

This one undoubtedly seems to be like a chance going begging.

Celebration Metropolis Holdco Inc. PRTY is a comparatively mature participant within the Shopper Merchandise – Discretionary business. It designs, manufactures, contracts for manufacture and distributes get together items, together with paper and plastic tableware, metallic and latex balloons, Halloween and different costumes, equipment, novelties, items and stationery. It additionally has specialty retail get together provide shops primarily within the U.S. and Canada.

The Zacks Rank #2 firm’s efficiency over the past 5 years consists of very low progress between 2015 and 2018, adopted by a declining pattern thereafter. Though it’s leaping again from the pandemic lows, I see no pattern reversal but. The EPS trajectory seems to be equally disappointing.

The shock historical past is checkered however the revisions pattern is optimistic. Accordingly, the 2021 estimate is up 22 cents (55%) whereas the 2022 estimate is up 15 cents (22%) within the final 30 days.

So the previous week’s 11.2% decline in worth appears inexplicable.

The hit to income through the pandemic makes P/E an insufficient measure of its valuation. On a price-to-sales foundation, the shares are buying and selling at a 0.50X a number of, above their very own median stage over the previous yr (which is comprehensible given the impression of the pandemic). Nevertheless, they’re additionally buying and selling nicely beneath the business common of seven.28X.

Though the corporate might see stronger gross sales this yr given the potential for extra get-togethers (in actual fact a pent-up want for them), the long-term worth isn’t obvious.

And at last, now we have Zacks #1 ranked REV Group, Inc. REVG. The corporate, which operates within the Transportation – Providers business, sells three sorts of autos.

The primary group (Hearth & Emergency) includes ambulances, hearth equipment, college buses, mobility vans and municipal transit buses. The second (Industrial) consists of industrial and business providers by means of terminal vehicles, cut-away buses and road sweepers. The third group (Recreation) consists of autos leisure autos and luxurious buses for shopper leisure. It additionally sells associated aftermarket components and providers.

The income progress pattern within the final 5 years (barring 2020, which was pandemic-impacted) has been good. The corporate has additionally jumped out of the pandemic lows. The earnings progress pattern additionally seems to be encouraging, with assist from price containment.

The corporate additionally has an lively M&A program, below which it has made some necessary acquisitions. Because of this, it took on a considerable quantity of debt in 2019 that it continues to pay down. Nevertheless, debt ranges are manageable and might’t be thought of a danger to funding within the shares.

Moreover, the estimate revisions pattern is stable. Each 2021 (ending October) and 2022 estimates are up within the final 30 days. Whereas the 2021 estimate is up 25 cents (26%), the 2022 estimate is up 14 cents (10%).

So it’s one thing of a shock that the shares misplaced 18.3% of their worth over the previous week.

REVG shares are buying and selling at 10.98X earnings and 0.39X gross sales. On an absolute foundation, each these multiples are fairly low. They’re additionally low with respect to the business, which averages 21.34X and a couple of.25X, respectively.

So REVG seems to be like a stable purchase.

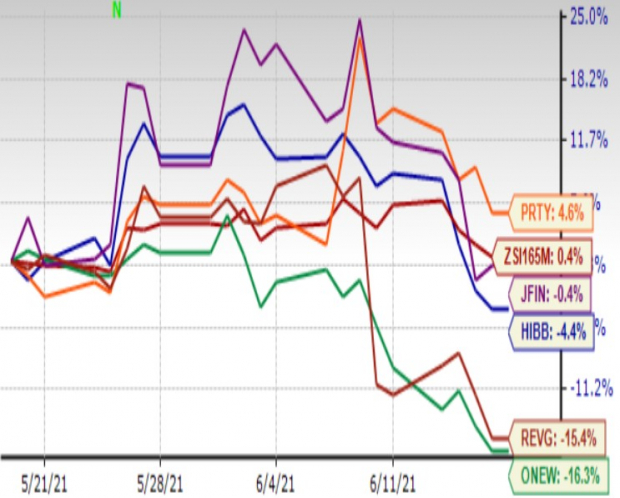

One-Month Value Efficiency

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Zacks Names “Single Greatest Decide to Double”

From hundreds of shares, 5 Zacks specialists every have chosen their favourite to skyrocket +100% or extra in months to return. From these 5, Director of Analysis Sheraz Mian hand-picks one to have essentially the most explosive upside of all.

You understand this firm from its previous glory days, however few would count on that it’s poised for a monster turnaround. Contemporary from a profitable repositioning and flush with A-list celeb endorsements, it might rival or surpass different current Zacks’ Shares Set to Double like Boston Beer Firm which shot up +143.0% in somewhat greater than 9 months and Nvidia which boomed +175.9% in a single yr.

Free: See Our Prime Inventory and Four Runners Up >>

Click on to get this free report

Hibbett Sports activities, Inc. (HIBB): Free Inventory Evaluation Report

Celebration Metropolis Holdco Inc. (PRTY): Free Inventory Evaluation Report

REV Group, Inc. (REVG): Free Inventory Evaluation Report

Jiayin Group Inc. Sponsored ADR (JFIN): Free Inventory Evaluation Report

OneWater Marine Inc. (ONEW): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.