Nationwide Beverage Corp. FIZZ makes LaCroix and different drinks. FIZZ inventory has gone on a wild experience in 2021, as a part of a wave of quick squeezes that hit Wall Road earlier within the 12 months. The corporate’s near-term earnings outlook has trended within the incorrect path and it is perhaps a bit dangerous to take a swig of FIZZ shares.

Misplaced its Fizz?

Nationwide Beverage sells glowing waters, juices, vitality drinks, and a few carbonated mushy drinks, ranging far past its widely-popular LaCroix. The flavored seltzer model, with a number of flavors, has been round for many years, however actually kicked issues into excessive gear over the past five-plus years as customers looked for alternate options to sugary sodas.

LaCroix started to fly off cabinets and helped create the present seltzer drink craze that’s spilled over into the alcoholic beverage market. Nationwide Beverage’s success noticed PepsiCo launch its Bubly model, whereas Coca-Cola purchased Topo Chico in 2017 and launch its personal glowing water model.

Plus, retail giants like Goal TGT promote their very own retailer manufacturers and startups are popping up on a regular basis. The crowded market makes issues tougher on Nationwide Beverage, and a few manufacturers have undercut LaCroix on value.

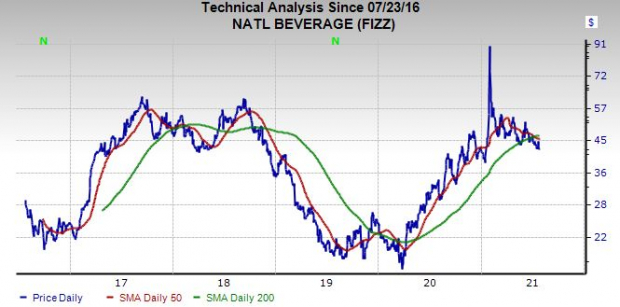

The inventory can be presently closely shorted (round 24% of float finally report), even after a brief squeeze helped it skyrocket earlier this 12 months. FIZZ has additionally seen its consensus earnings estimates slip. And of the 2 brokerage suggestions Zacks has for the inventory, one is a “Maintain” and the opposite is a “Sturdy Promote.”

Picture Supply: Zacks Funding Analysis

Backside Line

Nationwide Beverage’s earnings revisions assist it land a Zacks Rank #5 (Sturdy Promote) in the mean time. FIZZ’s Drinks – Tender drinks house additionally sits within the backside 25% of over 250 Zacks industries. Due to this fact, traders may need to avoid FIZZ because it seems to be extra of a dealer’s inventory in the mean time.

Time to Spend money on Authorized Marijuana

Should you’re searching for huge positive factors, there couldn’t be a greater time to get in on a younger trade primed to skyrocket from $17.7 billion again in 2019 to an anticipated $73.6 billion by 2027.

After a clear sweep of 6 election referendums in 5 states, pot is now authorized in 36 states plus D.C. Federal legalization is predicted quickly and that might be a nonetheless higher bonanza for traders. Even earlier than the most recent wave of legalization, Zacks Funding Analysis has advisable pot shares which have shot up as excessive as +285.9%.

You’re invited to take a look at Zacks’ Marijuana Moneymakers: An Investor’s Information. It contains a well timed Watch Checklist of pot shares and ETFs with distinctive development potential.

At this time, Obtain Marijuana Moneymakers FREE >>

Click on to get this free report

Nationwide Beverage Corp. (FIZZ): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.