In a bid to broaden presence, Builders FirstSource, Inc. BLDR lately introduced the acquisition of California TrusFrame (“CTF”). This acquisition will allow Builders FirstSource to broaden its product choices and enlarge its manufacturing capability to serve each new and present prospects everywhere in the residential market. The transaction is valued at $179.5 million.

CTF is a California-based main producer of prefabricated constructing elements, roof trusses, ground trusses and wall panels. The corporate gives its merchandise to dwelling builders, framers and contractors for single-family and multi-family finish markets throughout California. Over the last 12 months ending Jul 31, 2021, CTF generated revenues of roughly $143 million.

With respect to this, president and CEO of Builders FirstSource, Dave Flitman acknowledged, “We’re happy to strengthen our broad portfolio of industry-leading options and valued-added merchandise with the acquisition of CTF.

Buyout Synergies Aiding Development

Builders FirstSource primarily considers inorganic strikes as a part of its enterprise development technique. Firstly, the corporate targets to accumulate these entities which primarily manufacture prefabricated elements and secondly, it focuses on coming into new homebuilding markets the place it doesn’t presently function.

On Aug 17, 2021, Builders FirstSource accomplished the acquisition of WTS Paradigm, LLC. WTS Paradigm is a software program options and companies supplier for the constructing merchandise {industry}. On Jul 1, Builders FirstSource acquired Alliance Lumber, thereby increasing the corporate’s attain in Arizona and different fastest-growing areas of the nation.

On Might 3, Builders FirstSource acquired a family-owned main provider of lumber and different constructing supplies firm — John’s Lumber. The acquisition improved Builders FirstSource’s product portfolio and broaden its attain inside Michigan.

On Jan 1, 2021, it accomplished all-stock merger transaction with BMC. The acquisition of BMC will assist it enhance its geographical attain in a extremely fragmented {industry}, improve value-added choices and generate increased degree of free money circulation to spend money on development. Throughout second-quarter 2021, acquisitions contributed to internet gross sales development of three.5%.

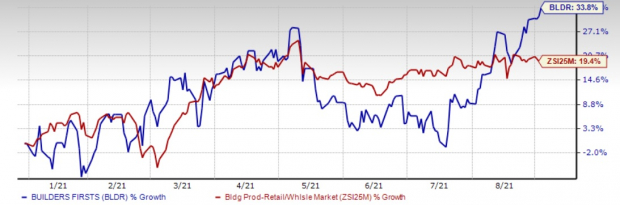

To this point this yr, share of Builders FirstSource have surged 33.8% in contrast with the Zacks Constructing Merchandise – Retail {industry}’s 19.4% rally. Together with strategic acquisitions, the corporate is benefiting from price synergies, digital options, strong housing and restore & reworking actions.

Picture Supply: Zacks Funding Analysis

Zacks Rank

Builders FirstSource — which shares house with Fastenal Co. FAST, Beacon Roofing Provide Inc. BECN and Lowe’s Firms, Inc. LOW within the Zacks Constructing Merchandise – Retail {industry} — presently carries a Zacks Rank #3 (Maintain). You may see the whole listing of at the moment’s Zacks #1 Rank (Sturdy Purchase) shares right here.

Tech IPOs With Large Revenue Potential: Final years high IPOs surged as a lot as 299% throughout the first two months. With file quantities of money flooding into IPOs and a record-setting inventory market, this yr could possibly be much more profitable.

See Zacks’ Hottest Tech IPOs Now >>

Click on to get this free report

Fastenal Firm (FAST): Free Inventory Evaluation Report

Lowes Firms, Inc. (LOW): Free Inventory Evaluation Report

Beacon Roofing Provide, Inc. (BECN): Free Inventory Evaluation Report

Builders FirstSource, Inc. (BLDR): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com