All people desires to purchase shares low-cost, to allow them to maintain them as they develop and make sizable good points on them. However many people don’t have a transparent thought of what constitutes an inexpensive inventory.

A few of us assume that so long as we’re paying a decrease greenback quantity, we’re shopping for a inventory low-cost. Additionally, we might at instances have much less to spare, or might imagine that the market’s simply too dangerous to spend money on. At instances like this, we might wish to put much less cash to work. However this is only one means of taking a look at it.

The opposite means to have a look at the state of affairs is by way of what the inventory is prone to yield sooner or later. So if an organization is predicted to develop income and earnings at 50% every, we must be prepared to pay a bigger quantity for its shares than we might be prepared to pay for an organization that’s rising at 10%. That’s simple logic.

So there are two items to this. On the one facet, we’ve the expansion potential and on the opposite, we’ve the value motion. Each time there’s a mismatch on this, i.e. each time the expansion potential seems higher than the value motion, it’s a chance to purchase. Conversely when the value motion will get forward of the expansion potential it’s a dangerous wager.

Figuring out the alternatives is a reasonably simple job.

The primary cause for this mismatch is when analysts elevate their estimates. As a result of when estimates enhance, development expectations enhance. So there’s a favorable mismatch resulting in a chance. This chance can be not misplaced on traders, which is why share costs have a tendency to maneuver upward each time estimates transfer north.

The newest Zacks Earnings Tendencies Report reveals that between Jan 6 2021 and June 16 2021, the estimated combination earnings development for the S&P 500 members (as a consultant group) has gone from 41.6% to 60.5%. On a per share foundation, that’s a rise of 17.5%.

In the meantime, the year-to-date appreciation within the S&P 500 is 13.3%.

So there’s clearly a mismatch, and due to this fact, alternative.

However the most effective alternatives might not be within the S&P 500. A great way of figuring out actual winners is to display for low P/E shares with good development potential and up to date revision to estimates. A few of these are highlighted below-

Lennar Company LEN

Lennar is concerned within the building and sale of single-family connected and indifferent properties, and the acquisition, growth and sale of residential land immediately and thru unconsolidated entities.

The Zacks Rank #1 (Robust Purchase) rated inventory has Worth, Development and Momentum Scores of B, C and A, respectively. It belongs to the Constructing Merchandise – Dwelling Builders trade, which is within the prime 4% of Zacks-classified industries. Now as most of us already know, the residential building market is extraordinarily scorching this 12 months, pushed by constructive demographics and pandemic-related changes.

Shares within the prime 50% of Zacks-ranked industries usually outperform these within the backside 50%, particularly if the industries are inside the prime 10% and particularly when the shares have a purchase rank. That is significantly constructive for LEN.

This firm additionally has different issues going for it. As an illustration, analysts have raised its 2021 and 2022 estimates by a median 16.1% and 26.6%, respectively within the final 4 weeks. This works out to earnings development of 73.4% this 12 months and three.6% within the subsequent. Encouragingly, that is anticipated to come back off income development of 27.1% this 12 months and 6.5% within the subsequent.

Lennar’s common 4-quarter shock of 27.2% signifies conservatism on the a part of analysts. So latest upward revisions are unlikely to disappoint.

The corporate additionally pays a dividend that yields 1.02%.

Given the above, Lennar ought to have had a excessive valuation. However its P/E of 8.16X, which is at its lowest level over the previous 12 months, is properly beneath the S&P 500’s 21.61X though main the trade’s 7.86X. So the shares are actually enticing at these ranges.

Caleres, Inc. CAL

Caleres designs, sources and markets footwear for women and men, promoting by way of retail shops, ecommerce web sites and at wholesale. It owns manufacturers like Nike, Skechers, Bearpaw, Converse, Vans, New Steadiness, Adidas, Asics, Sperry and Sof Sole, LifeStride, Dr. Scholl’s, Fergalicious, Naturalizer and Carlos.

The Zacks Rank #1 inventory will get a C for Worth, A for Development and B for Momentum. It belongs to the Footwear and Retail Attire trade (prime 16%).

The pandemic has had a constructive impact on the footwear enterprise, as individuals targeted on train and health within the pursuits of sustaining good well being and in addition as a result of it was one of many actions that might be performed at house. Now, because the world will get prepared to maneuver out once more, persons are displaying an enthusiastic angle towards attire, footwear and private care.

This constant stage of demand has thrown analyst estimates to the wind. Whereas the corporate topped estimates at triple digit charges in every of the final three quarters, the final quarter’s 2,900% was the icing on the best.

Naturally, the one analyst offering estimates continues to revise upward. So the final 4 weeks have taken the fiscal 2022 (ending Jan) estimate up 53.9% and the 2023 estimate up 54.7%. So earnings at the moment are anticipated to develop 242.9% this 12 months and 16.0% within the subsequent. Anticipated income development of 27.1% and 1.3% can be encouraging.

Caleres additionally pays a dividend that yields 1.05%.

The corporate’s P/E has moved round due to the loss it made within the pandemic-hit Jun 2020 quarter though the present worth of 13.01X is decrease than the common 30.10X for the trade, the 21.61X for the S&P 500 and the 16X common for our universe.

Costamare Inc. CMRE

Costamare is a containership proprietor that has the majority of its fleets underneath multi-year time charters with main liner firms working regularly-scheduled routes between giant industrial ports. It additionally offers a variety of delivery providers, corresponding to technical help and upkeep, insurance coverage consulting, monetary and accounting providers.

The Zacks Rank #1 inventory has a Worth Rating of B, Development Rating of D and Momentum Rating of B. It’s a part of the Transportation – Transport trade, which is on the prime 29% of Zacks-ranked industries.

Costamare’s 2021 and 2022 estimates are up 16.7% and 22.9% within the final Four weeks, representing EPS development of 105.9% and 12.4% within the two years. The lone analyst offering estimates has been kind of heading in the right direction within the latest previous (the common 4-quarter shock is simply 1.83%). The income development estimates are 40.1% for 2021 and 11.2% for 2022.

The corporate’s dividend yields 3.37%.

It at present trades at 5.44X earnings, which is beneath the trade’s 6.56X and the median worth of 6.10X over the previous 12 months. The S&P 500 additionally has a a lot greater a number of as seen above.

Guess, Inc. GES

Guess designs, markets, distributes and licenses informal attire and equipment for males, ladies and youngsters in accordance with American life-style and European style sensibilities.

The Zacks Rank #1 inventory has Worth, Development and Momentum Scores of C, F and A, respectively. The Textile – Attire trade of which it’s a component is on the prime 10% of Zacks-ranked industries.

The 2022 (ending Jan) and 2023 earnings estimates are up 40.8% and 11.4%, respectively, representing EPS development of three,500.0% (partly due to simpler comps) and 14.6%.

The corporate topped estimates at triple-digit charges in three of the final 4 quarters and at a excessive double-digit charge within the different quarter. The 4-quarter common is due to this fact 319.3%. So analyst estimates are nonetheless too conservative.

And the most effective half is that earnings aren’t the one factor rising in leaps and bounds. Income development estimates for the 2 years are 35.2% and 6.4%, respectively.

The corporate’s dividend yields 1.76%.

Valuation additionally seems enticing. Whereas the penny’s loss within the Jun 2020 quarter makes annual comparability a bit troublesome, the 10.47X P/E seems low-cost with respect to the associated trade’s 21.3X, the S&P 500 and our protection universe.

International Ship Lease, Inc. GSL

International Ship Lease is a quickly rising containership constitution proprietor. Integrated within the Marshall Islands, GSL commenced operations in December 2007. Its owned containerships are chartered out underneath long-term, fastened charge charters to world class container liner firms.

The Zacks Rank #1 inventory has Worth, Development and momentum Scores of B, D and B, respectively. It’s a part of the Transportation – Transport trade.

Containerships are rising sooner than the remainder of the market due to loading and unloading efficiencies they provide that due to this fact scale back the price of the voyage.

Within the final 4 weeks, GSL’s 2021 and 2022 earnings estimates are up 22.0% and 50.2%, respectively. This has led to earnings development projections of 71.1% and 70.3% within the two years. The corporate has topped the Zacks Consensus Estimates in every of the final 4 quarters at a median charge of 20.2%. What’s extra, the income development estimates for each years are up a strong 32.7% and 36.1%.

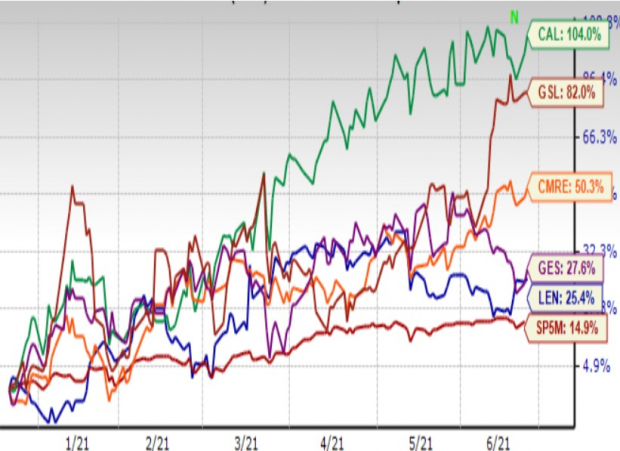

12 months-to-Date Value Efficiency

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Breakout Biotech Shares with Triple-Digit Revenue Potential

The biotech sector is projected to surge past $775 billion by 2024 as scientists develop therapies for hundreds of ailments. They’re additionally discovering methods to edit the human genome to actually erase our vulnerability to those ailments.

Zacks has simply launched Century of Biology: 7 Biotech Shares to Purchase Proper Now to assist traders revenue from 7 shares poised for outperformance. Our latest biotech suggestions have produced good points of +50%, +83% and +164% in as little as 2 months. The shares on this report might carry out even higher.

See these 7 breakthrough shares now>>

Click on to get this free report

Guess, Inc. (GES): Free Inventory Evaluation Report

Lennar Company (LEN): Free Inventory Evaluation Report

Costamare Inc. (CMRE): Free Inventory Evaluation Report

International Ship Lease, Inc. (GSL): Free Inventory Evaluation Report

Caleres, Inc. (CAL): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.