Here’s an unpopular truth when it comes to investing – good investing can be boring at times. While trying to get in early on the next big growth story may be exhilarating, allowing solid companies to drive the growth of your portfolio over time will most often pay significant dividends into the future.

Waste removal is an industry that isn’t all that glamorous. Yet when some of the top financial institutions in the world are the largest holders of these stocks, there’s a good reason for it and you’d better pay attention.

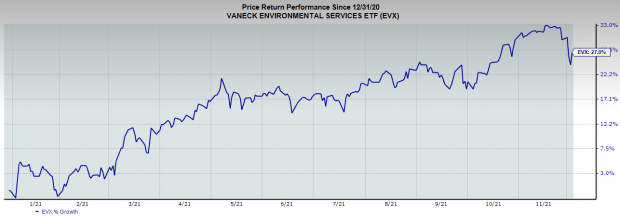

The VanEck Environmental Services ETF EVX tracks the performance of companies involved in waste collection, transfer and disposal services, recycling, soil remediation, wastewater management and environmental consulting services. EVX has outperformed the major indices this year with a return of nearly 27%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The three waste removal firms we will discuss below are the top three constituents in EVX, garnering nearly 30% of the ETF’s total holdings. Volatility has been the name of the game over the past few weeks for the general market, but all three of these companies are still trading within just a few percent of their respective 52-week highs.

Stocks that hold up well through market corrections tend to lead when the indices resume their uptrends. Let’s take a more in-depth look at these three waste removal companies that are showing strength this year.

Republic Services, Inc. (RSG)

Republic Services provides waste collection, recycling, disposal, and energy services for commercial, industrial, municipal, and residential customers in the United States and Puerto Rico. Headquartered in Phoenix, AZ, RSG operates over 300 collection facilities in 39 different states.

A Zacks #2 Buy stock, RSG has put together a notable track record of earnings surprises, surpassing estimates in each of the last 20 quarters. The company most recently reported EPS for the quarter ending in September of $0.08, a 7.8% surprise over estimates. RSG has a trailing four-quarter average earnings surprise of 14.2%, which has supported the stock’s 42% return for the year.

Republic Services, Inc. Price, Consensus and EPS Surprise

RSG management continues to raise guidance and their consistency with dividend payments and share buybacks will ensure that investor confidence remains strong. Analysts covering the firm have revised their full-year earnings estimates upward by nearly 2% over the past 60 days to $4.14, a 16.3% growth rate over 2020. RSG’s next earnings report is due out on February 28th, 2022.

Waste Management, Inc. (WM)

Waste Management is a leading provider of integrated environmental solutions in North America, serving municipal, commercial and industrial customers. Headquartered in Houston, TX, WM has the largest network of recycling facilities and landfills in the industry, and its fleet of natural gas trucks is the largest heavy-duty truck fleet in North America.

WM, currently a Zacks #3 Hold, has built a healthy track record of earnings surprises, beating consensus estimates in 16 out of its last 17 quarters. WM stock has advanced more than 40% this year on the heels of a 3.5% average earnings surprise over the past four quarters.

Waste Management, Inc. Price, Consensus and EPS Surprise

Dividend payments and share buybacks have continued to provide support for the stock. The Zacks Consensus Estimates for revenue and EPS for the current year stand at $17.81 billion (17.1% growth) and $4.84 (20.1% growth), respectively. WM is next scheduled to report quarterly earnings on February 17th, 2022.

Waste Connections, Inc. (WCN)

Waste Connections is an integrated solid waste services company, providing collection, transfer and disposal services in exclusive and secondary markets. The company also provides intermodal services for the movement of cargo and solid waste containers. WCN operates primarily in the United States and is headquartered in The Woodlands, TX.

WCN has a Zacks #3 Hold rank and has strung together a noteworthy history of earnings surprises, exceeding estimates in each of the last twenty quarters. The company most recently reported earnings in late October of $0.89, a 4.7% surprise over consensus. WCN produced an average earnings surprise of 6% over the last four quarters, boosting the stock’s 32% YTD return.

Waste Connections, Inc. Price, Consensus and EPS Surprise

Analysts have revised full-year earnings estimates upward by 2.2% over the past 60 days, anticipating EPS of $3.22. This translates to a respectable 22% growth rate over the 2020 EPS of $2.64. WCN’s next earnings report is due out on February 16th, 2022.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Click to get this free report

Waste Management, Inc. (WM): Free Stock Analysis Report

Republic Services, Inc. (RSG): Free Stock Analysis Report

Waste Connections, Inc. (WCN): Free Stock Analysis Report

VanEck Environmental Services ETF (EVX): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

www.nasdaq.com