The reply to this query varies based mostly on completely different circumstances in folks’s lives.

When folks first get into bitcoin as a financial savings gadget, or when conventional finance-type folks have a look at it as a possible funding, they’re rapidly confronted with the sizing downside. What quantity of my belongings ought to I put on this new and promising asset class?

For many maxis, this query is on the ridiculous facet: naturally, as a lot as humanly (or prudently) potential. Die-hard maxis borrow fiat to accumulate extra sats — the Pierre Rochard speculative assault. Should you maintain every other asset than BTC, you are successfully shorting bitcoin; you don’t need to quick bitcoin.

If we step again for a second into the sneakers of the danger/diversification methods of less-convinced — and extra risk-averse — fund managers or common folks, bitcoin is solely a query of prudent sizing. Should you can’t stand 100%, and 0% is simply too low – what’s an affordable proportion?

Earlier this summer season, Paul Tudor Jones described what he wished with “bitcoin as a portfolio diversifier” – “The one factor I do know for sure, I need 5% in gold, 5% in bitcoin, 5% in money, 5% in commodities.”

Between 1% and 5% is a typical allocation suggestion, even amongst “crypto-curious” folks – principally, I believe, as a result of 5% is a pleasant, simple quantity (e.g. few folks will goal a 7.648% allocation). Different suggestions have ranged from low single-digit percentages to upwards of 10%. Single-digit allocations are removed from unusual: even some high-profile college endowments appear to have one thing like that.

In fact, since issues transfer quick on this house, when you’re focusing on a proportion, you additionally want a rule for when to rebalance your portfolio, and by how a lot. Should you continuously rebalance your bitcoin holdings into different belongings if and when bitcoin will increase in worth, you are lacking out on a whole lot of that potential upside – and would possibly lose an unacceptable quantity in tax liabilities and buying and selling charges. That is normally fantastic if all you’re after is a bit additional return on prime of an in any other case conventional funding thesis, however fairly disastrous if bitcoin certainly repeats its tendencies for mulitplying by 10 occasions its worth. In these circumstances, your meagre additional return goes to appear like the individuals who purchased vehicles or yachts for bitcoin in 2013: terribly costly.

Economists Yukun Liu and Aleh Tsyvinski of Yale and Rochester universities respectively, concluded in a three-year-old paper that an publicity to bitcoin of between 1% and 6% was the optimum dimension, relying on how excessive you projected its future annual extra returns (30, 50, 100, or 200% respectively). These figures are outdated by now and we’ve had large-scale retail and institutional adoption since, which appears to have elevated the correlation with the general market. Presumably, too, as I’ve argued elsewhere, the return profile additionally has to come back down. Within the view of Liu and Tsyvinski, each these elements ought to scale back the optimum bitcoin allocation to a portfolio. William Baldwin at Forbes writes, appropriately in my view, that

“…bitcoin’s historical past is brief. It’s one factor to look again on a century of historical past for shares and bonds and draw conclusions about how a lot return and the way a lot volatility you’ll be able to anticipate from them. It’s fairly one other to extrapolate something from the freakish first decade of a digital object.”

Joe Weisenthal at Bloomberg continuously factors out that bitcoin has turn out to be eerily correlated with different risk-on belongings:

“Certainly one of Bitcoin’s huge promoting factors is its diversification advantages, however lately it is nearly tick-by-tick simply your normal dangerous asset. It could possibly be a cloud inventory or Tesla. Or heck, even gold.”

And Amy Arnott for Morningstar, displaying that BTC’s relation to different belongings is altering:

“As mainstream traders more and more embrace bitcoin, its worth as a diversification software is diminishing; consequently, there’s no assure that including bitcoin will enhance a portfolio’s risk-adjusted returns, particularly to the identical extent it did previously.”

Now, bitcoin isn’t truly buying and selling on forward-looking inflation expectations, however is way extra prone to actual rates of interest of which inflation is just an element — over and above to particular occasions like China miner scares or Elon Musk tweets, anyway. That is the way it shares a relation with gold, whose major disadvantage as a monetary asset is its alternative value in a high-interest setting. Should you don’t suppose that’s coming again, stacking sats is a reasonably opportunity-cost free funding selection.

The sound funding recommendation of not placing all of your eggs in a single basket has its academic-finance model in diversification. That doesn’t simply imply to carry shares in a number of completely different corporations, if all these corporations are uncovered to the identical dangers or roughly commerce identically to 1 one other – and with central banks working their cash printers scorching, all the things is slowly turning into the identical commerce. The theoretical level of what’s referred to as fashionable portfolio concept is that completely different segments of your portfolio compensate for different segments such that random shocks, good or unhealthy, ends in having most of your nest egg intact no matter what occurs. You need uncorrelated (or negatively-correlated) belongings such that in case of emergencies or one-off occasions, you protect your financial savings.

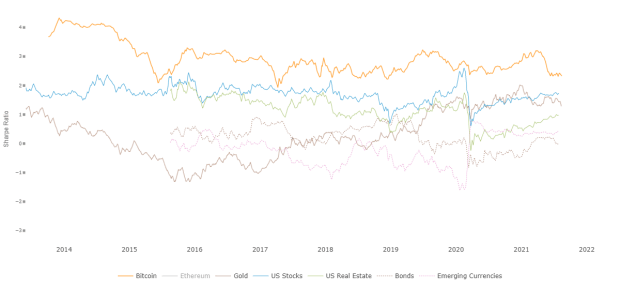

For a long-term investor, managing his or her personal funds (or possibly that of a family) and planning over many years, that may not be such a vital factor. The recommendation for normal folks to dollar-cost common into passive mutual funds or such is exactly this: you might be not utilizing the funds within the subsequent 5, 10 or 20 years, and so the price to you of getting a smoother portfolio trajectory makes much less sense. What you need is returns over many years — in observe which means till you retire. Even accounting for monetary media’s incessant complaints about value volatility appears to make only a few dents within the monetary case for this asset. Bitcoin’s Sharpe ratio, i.e., its returns in relation to its volatility, routinely outperforms most different belongings:

“Riskadjusted returns is calculated utilizing Sharpe ratio over a 4-year HODL interval,” courtesy of Willy Woo

“Riskadjusted returns is calculated utilizing Sharpe ratio over a 4-year HODL interval,” courtesy of Willy Woo

That’s to say, even ignoring its obscure early days, a number of years’ HODLing of bitcoin greater than sufficient paid for its short-term value dangers.

How To Make Sense Of All This?

It is essential to keep in mind that all of those guidelines are generic and never catered to your monetary scenario. In equity, accountable asset advisors couldn’t publicly give far more particular steerage in interviews which are learn by hundreds of thousands, i.e., converse to the monetary circumstances of whom they know little or no. To provide blanket statements of two% or 5% or 10% of your financial savings is totally indifferent from three essential parts of your life:

- Timing: when are you going to make use of or want the funds? Are you retiring at 40? Or are you retiring at a extra common retirement age? Are you buying a pristine, infinitely-lived asset to go on to your heirs?

- Threat Tolerance: how snug are you with seeing investments go up and down in worth over quick or medium timeframes? Should you can’t sleep at evening due to strikes within the value of some asset, that is a transparent signal you’re overexposed. Some persons are blasé about this, stacking untouched via 50%+ drawdowns; others are skittish as frightened cats. Dimension your positions accordingly.

- Revenue Safety: different monetary commitments matter, similar to “How a lot do you earn?” “How a lot does your partner earn?” “What are your expenditures?” Until you’re holding BTC as a Hail Mary gamble in opposition to what looks as if an amazing world (through which case I counsel you to first get your own home so as, metaphorically talking), I wouldn’t advise somebody with nothing to their names to purchase bitcoin with their lunch, or hire, cash. Don’t max your second bank card to go all in on bitcoin if it means your loved ones or children can’t eat.

These standards will look completely different for all of us, and data and understanding of how bitcoin works — in addition to how the incumbent financial and monetary system surrounds all of those standards. Usually, the deeper you go down the rabbit gap, the extra convicted you turn out to be of bitcoin’s long-term value potential, and subsequently the extra snug you turn out to be with a better allocation share of belongings.

The allocation problem is much more difficult than a single quantity. Within the restrict, you may not even take into account BTC a part of the remainder of your funding portfolio, however a free-floating unbiased asset to which you have got full uninterruptible possession.

This can be a visitor submit by Joakim E book. Opinions expressed are totally their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.