Okay, so the market

Okay, so the market is shrugging off some actually robust earnings outcomes.

We need to see the same old response to robust earnings, however that doesn’t appear to be forthcoming.

Alternatively, the Fed stays supportive and inflation stays a slight optimistic for the market, though it may very well be pinching our pockets.

The massive query is, ought to we be involved about what’s occurring? Ought to we avoid the market?

Clearly, for development traders, you’re able to take some danger, however you’re in search of outsized returns. In any other case, it doesn’t make sense.

And should you’re a price investor, you actually don’t need to get into shares which are mainly simply benefiting from the bottom impact (pandemic-related softness final 12 months) to generate robust development. You’re in search of firms with actual prospects which are going low cost as a result of they might have been missed by traders.

The explanation the query of development or worth is a bit difficult proper now’s the availability chain. For one motive or different, a lot of industries are seeing very robust demand that they’re unable to cater to as a result of there are specific provide constraints. And extra importantly, we don’t actually know when the state of affairs goes to enhance though we now have hints that it’s enhancing. This uncertainty is preserving traders on the sidelines. Which is comprehensible.

However you’ve received to do not forget that regardless of these uncertainties, firms are overwhelmingly reporting income and earnings beats and likewise offering robust steering. And resultantly, earnings estimates are transferring up.

Additionally, U.S. GDP for the second quarter has moved past pre-pandemic ranges.

Which means we’re on a optimistic trajectory for actual earnings development. However as a result of traders are incrementally cautious, valuations on many shares aren’t excessive. Which makes it a very good time to purchase.

With that in thoughts, I’ve picked 5 shares that you could be need to take into account, regardless of whether or not you might be basically a price or a development investor. As a result of these shares have issues going for them though they may very well be quickly boxed in by the stock state of affairs.

Two of those are auto sellers that I’ve really useful earlier than as effectively. This business has efficiently raised costs on its restricted inventories, impacted as they’ve been by the chip scarcity. So, within the close to time period, they’re benefiting from greater costs. And in the long run, we’re now listening to that the chip state of affairs continues to enhance, though some constraints could persist into the center of 2022. Which means the availability constraints will steadily alleviate, driving up inventories. So this can be a good place to be in, if the valuation permits. And the Zacks business rank displays the prospects: the business is on the high 2% of Zacks-ranked industries.

First up is Asbury Automotive Group, Inc. ABG, which has a Worth Rating A, a Progress Rating C (we all know the place that’s coming from) and a Momentum Rating B for a internet VGM Rating of A.

The Zacks Rank #1 (Sturdy Purchase) firm’s June quarter earnings topped the Zacks Consensus Estimate by 47%. Estimates have been steadily trending up over the past three months. And because it reported, the 2021 and 2022 estimates are up 62 cents and 69 cents, respectively.

So far as valuation is worried, the shares are buying and selling at a ahead P/E of 8.9X and P/S of 0.4X. The P/E is actually low in comparison with the common of round 16X in our universe, in addition to the 23.2X for the S&P 500. And a P/S valuation that’s beneath 1 is all the time low cost, as a result of the share worth is undervaluing the corporate’s gross sales.

After which we now have AutoNation, Inc. AN, which additionally has the identical #1 rank, however will get an A for Worth, Progress in addition to Momentum.

After beating June quarter estimates by 70%, the corporate’s 2021 and 2022 earnings estimates rose 33% and 24%. This simply isn’t attainable with out notable enchancment in prospects.

After which once more, the valuation nonetheless appears very first rate at 8.9X P/E and 0.4X P/S.

The Metal – Speciality business is within the high 2% of Zacks-classified industries, and for good motive. Metal is a mandatory part of all types of infrastructure, whether or not its public transport programs, automobiles, instruments, implements, equipment, or dwelling development and white items (and a number of different issues). So naturally, this market is actually sizzling for the time being.

And what may very well be a more sensible choice than Voestalpine AG VLPNY, which has publicity to many of those segments. So this inventory has a Zacks Rank #1 with Worth and Progress Scores of A.

We don’t have estimates for the historic interval, so there’s no shock historical past. However we will see that the 2022 and 2023 (fiscal 12 months ending March) estimates have moved up over the previous month by 13% and 23%, respectively.

Moreover, the shares are valued at 7.6X P/E and 0.6X gross sales (actually low cost).

The Leisure and Recreation Merchandise business (high 12%) is in fact very enticing presently due to the good reopening and the truth that shoppers have obtainable money.

Lazydays Holdings LAZY gives a number of the RVs and on-site campgrounds that individuals can be in search of. With each Worth and Progress Scores of A, this #1 ranked inventory appears set to develop strongly this 12 months.

The corporate will report its June quarter earnings subsequent week. From the numbers obtainable, I’m seeing a 20% enhance within the 2021 estimate over the previous month. The 2022 estimate is up 32%.

What’s extra, the shares are at present buying and selling at 9.5X P/E and 0.3X gross sales, which suggests it’s a very good time to leap in.

One in every of my favourite industries within the present setting is Transportation – Truck (ranked within the high 15% by Zacks). That’s as a result of all of the power in demand in the end represents hundreds to be delivered to the producer or shopper, whether or not the transaction is accomplished on-line or in any other case. And vans take time to fabricate and ship, particularly in an setting the place we don’t have sufficient chips. And once they’re delivered, there’s a query of hiring and retaining drivers. What this boils right down to is restricted capability and due to this fact, greater charges. Which may solely be a very good factor for this group.

I’ve picked #1 ranked Covenant Logistics Group, Inc. CVLG right this moment, primarily due to its worth (VGM Rating A) though development also needs to in the end develop into an element (Progress Rating C).

After beating June quarter earnings estimates by 50%, the 2021 and 2022 estimates moved up a respective 22% and 15%.

Nevertheless, valuation stays low cost at a P/E of simply 6.6X and a P/S of 0.4X.

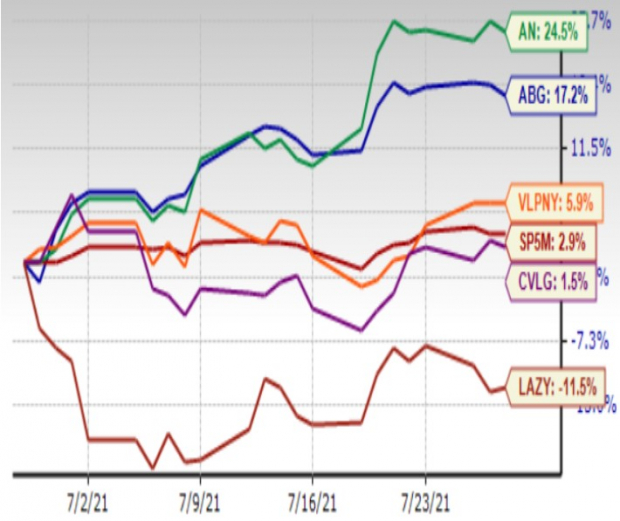

One-Month Value Efficiency

Picture Supply: Zacks Funding Analysis

5 Shares Set to Double

Every was hand-picked by a Zacks knowledgeable because the #1 favourite inventory to realize +100% or extra in 2021. Every comes from a distinct sector and has distinctive qualities and catalysts that might gas distinctive development. Many of the shares on this report are flying beneath Wall Avenue radar, which gives an important alternative to get in on the bottom flooring.

Right now, See These 5 Potential Residence Runs >>

Click on to get this free report

AutoNation, Inc. (AN): Free Inventory Evaluation Report

Asbury Automotive Group, Inc. (ABG): Free Inventory Evaluation Report

Voestalpine AG (VLPNY): Free Inventory Evaluation Report

LAZYDAYS HOLDINGS, INC. (LAZY): Free Inventory Evaluation Report

Covenant Logistics Group, Inc. (CVLG): Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.